Product

What Is DropsTab? The Beginner's Guide

DropsTab isn’t another price list — it’s a market-intelligence layer that shows how money actually moves. This guide explains how to use DropsTab to trade with context, not guesses.

Quick Overview

- DropsTab turns noise into structure — revealing real signals behind price.

- Tabs let you build scanners for VWAP gaps, accumulation, unlock risk, or investor strength.

- Accumulation Phase shows quiet buyer activity before breakouts.

- Vesting tools map upcoming unlocks so you avoid predictable sell pressure.

- Fundraising + Investors expose VC entry levels and narrative clusters.

- Public Portfolios + Activities add a social and opportunity layer for tracking strategies and airdrop events.

- 1. DropsTab Is What Traders Use When “Price” Isn’t Enough

- 2. How to Use the Tabs Tool on DropsTab

- 3. DropsTab’s Accumulation Phase Metric

- 4. How to Read Vesting and Token Unlocks on DropsTab

- 5. Using the Fundraising and Investors Tabs

- 6. Early-Radar for Airdrops and Sales on DropsTab Activities

- 7. What is the DropsTab Public Portfolios Tool

- 8. Conclusion

DropsTab Is What Traders Use When “Price” Isn’t Enough

Most people still open CoinMarketCap or CoinGecko, glance at a number, and call it “analysis.” It’s like trying to trade with a pair of sunglasses on indoors — you see shapes, not signals. DropsTab sits in a different category entirely. It’s a market-intelligence layer built to surface what big wallets, funds, and early insiders are doing long before the noise hits Reddit or Telegram.

And here’s the part newcomers always miss: the platform doesn’t drown you in endless meme listings. Instead, it pulls together the data that actually moves markets — vesting calendars that show where VCs might exit, accumulation streaks where whales quietly load up, and the pre-market pipelines that power 2025’s points-and-airdrop meta.

If you read this guide properly, you stop being another “price refesher” and start acting like someone who understands how money flows… and why it moves the way it does.

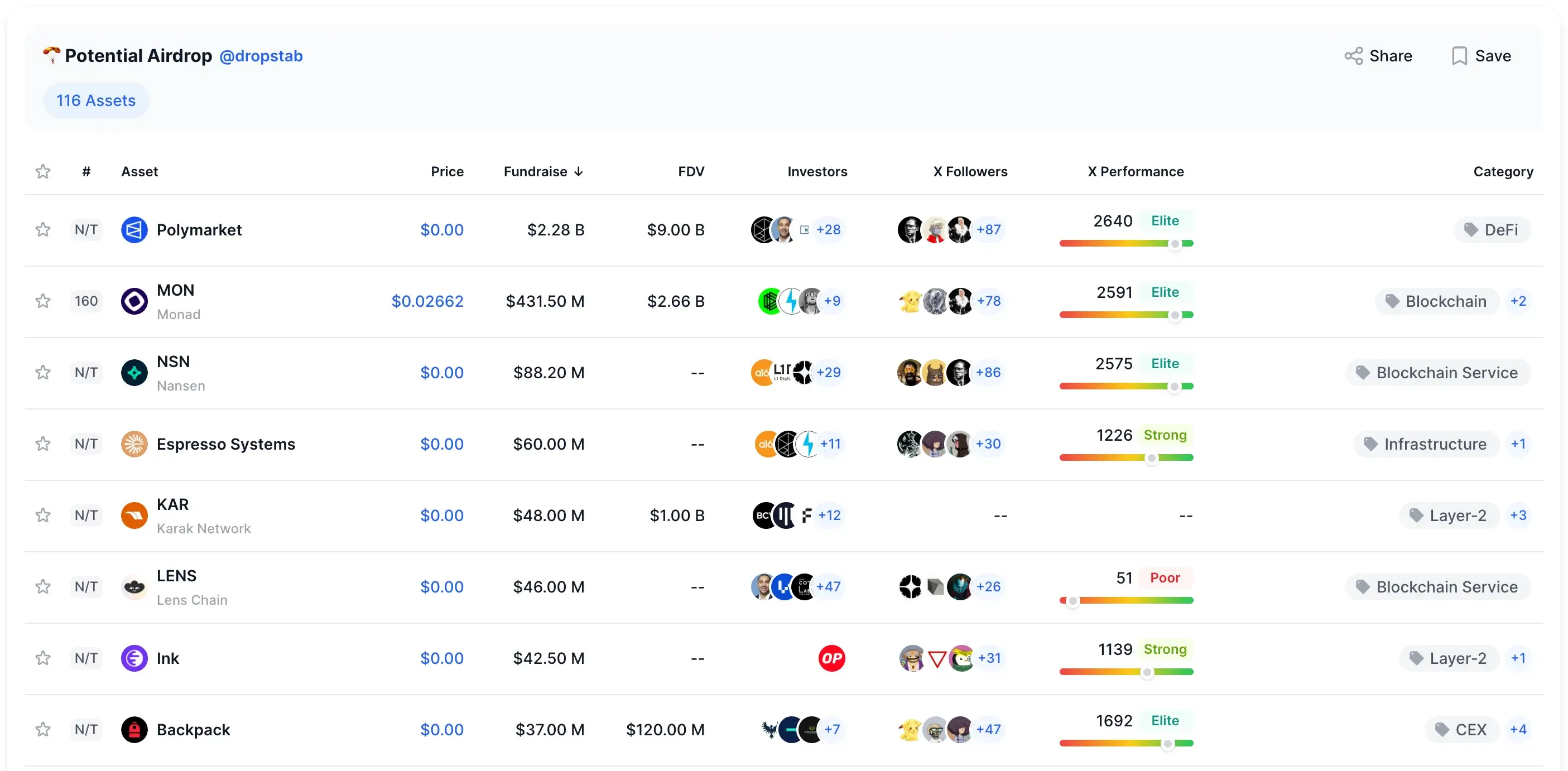

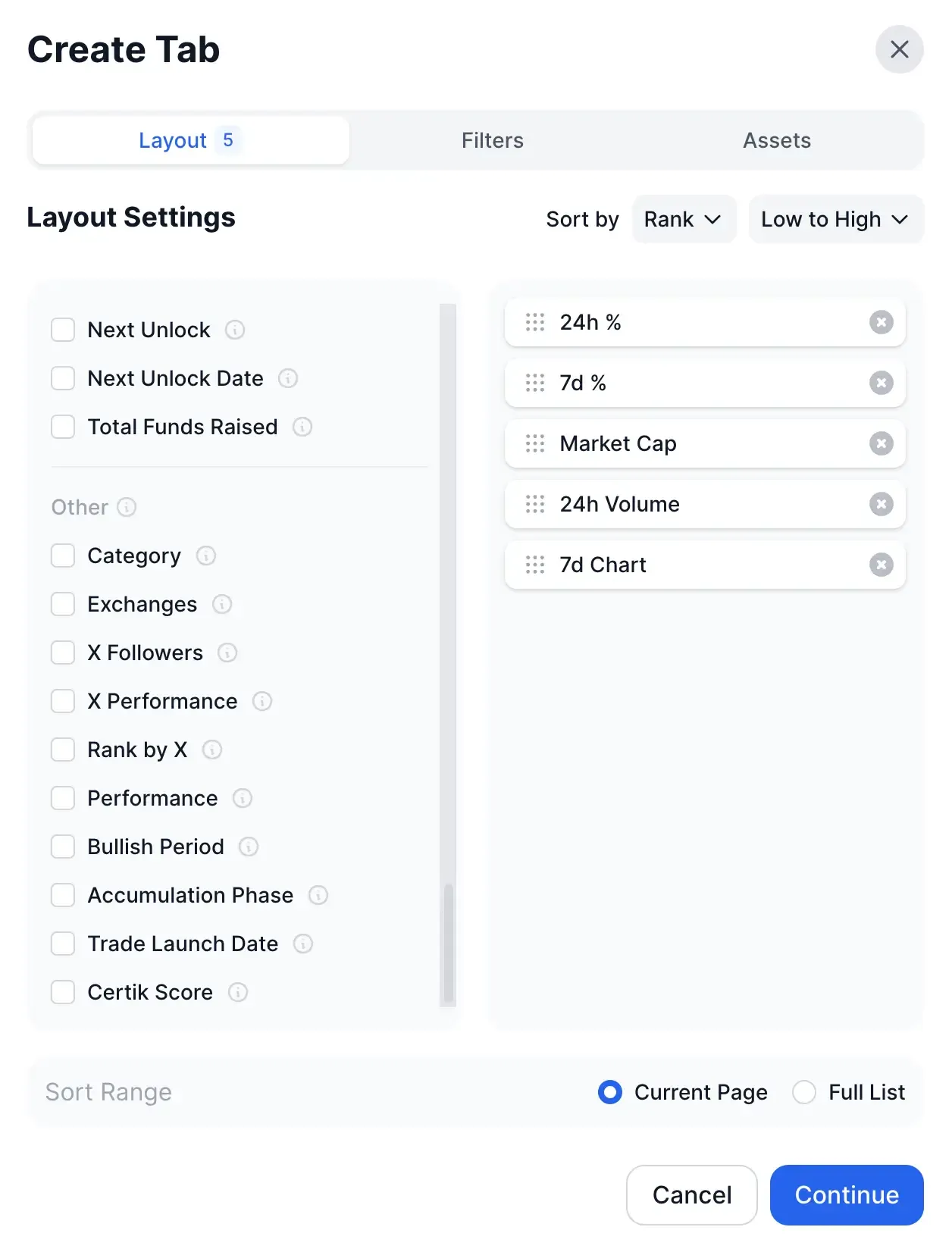

How to Use the Tabs Tool on DropsTab

For the most part, traders browse markets the way everyone else does — scrolling endless lists and hoping something stands out. Tabs flips that completely. It lets you build your own market scanner, one that highlights only the signals you actually trade: liquidity spikes, undervalued VWAP setups, early investor backing, accumulation streaks, unlock risk, social momentum… all in one table, updating in real time.

You pull in whatever columns matter — 24h volume, FDV, 7d VWAP, Investors, Bullish Period, Unlock Progress, Accumulation Phase — and suddenly the noise disappears. What’s left is a structured view of the market that would normally take five tools and 20 browser tabs to replicate.

That’s why the community-made layouts in feel so sharp:

- Token Buybacks shows assets where teams are actively absorbing supply.

- VWAP Radar isolates tokens trading far from fair value.

- PERP DEXes compares competing protocols at a glance.

- Waiting ETF tracks institutional narratives.

- Potential Airdrop turns deal flow into a sortable watchlist.

Each layout is basically a different definition of alpha — created simply by mixing the right filters. Sort by VWAP to find reversion plays. Filter by Investors + low FDV for undervalued VC bets. Toggle Accumulation to see stealth buying. It’s flexible enough that you can hunt for almost any market behavior you care about.

Tabs isn’t just a feature; it’s a framework. Once you’ve used it properly, default rankings feel useless. You stop “looking at coins” and start designing the way you see the market.

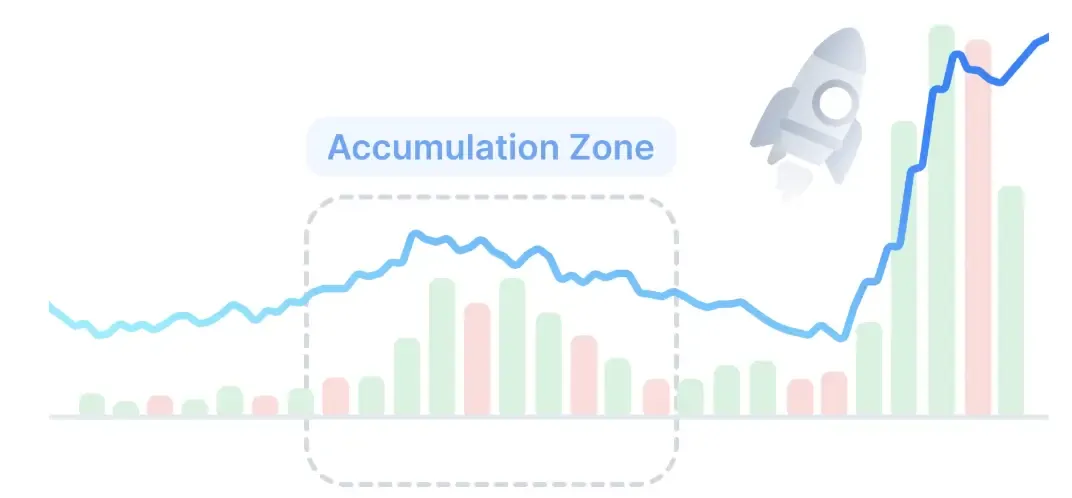

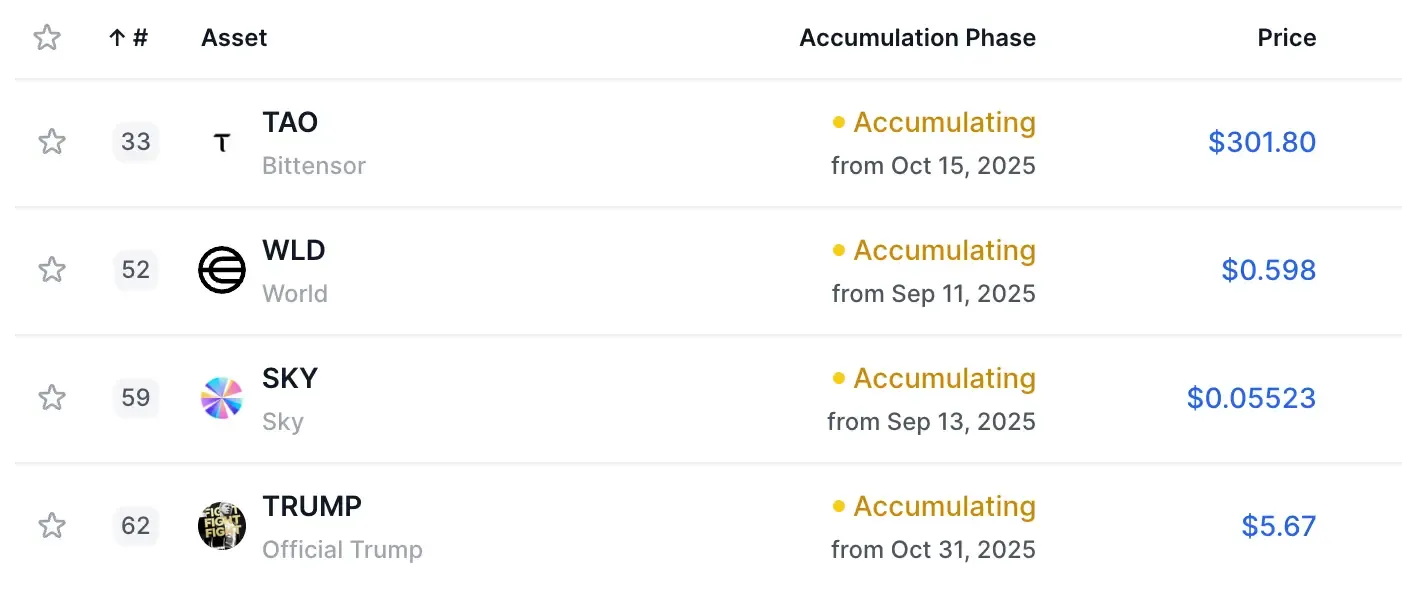

DropsTab’s Accumulation Phase Metric

Every trader has that moment where a coin suddenly explodes and they’re left wondering:

“Who the hell was buying this for the last three weeks?”

DropsTab’s accumulation phase metric answers that question — sometimes uncomfortably clearly. It’s the platform’s most predictive signal for swing setups because it spots the quiet buying long before the chart turns green and social feeds wake up.

The idea is simple enough: when price moves sideways, yet volume behaves like someone’s steadily absorbing every dip, something unusual is happening. A fund building a position. A whale refilling. Sometimes just one stubborn wallet that refuses to let the chart slide. When those patterns persist, the metric flags the asset as being “in accumulation.”

How to Read It

Open the filter and you’ll see lines like “Accumulating for 8 days” or “Accumulating from Oct 31, 2025.” That timestamp alone tells a story — nobody accumulates for weeks unless they expect a future catalyst.

Under the Hood

The trigger kicks in when trading volume starts expanding while price barely moves. Add in a series of failed breakdowns — those annoying candles where the asset dips, immediately gets bought back, and closes flat — and you’ve got the classic footprint of someone filling size without wanting to advertise it.

If the metric shows a multi-day accumulation streak, many traders start planning entries there, not on the candle that finally moves. It’s counterintuitive, but the best runs often start right after weeks of “nothing happening” — except the data showing someone patiently loading up.

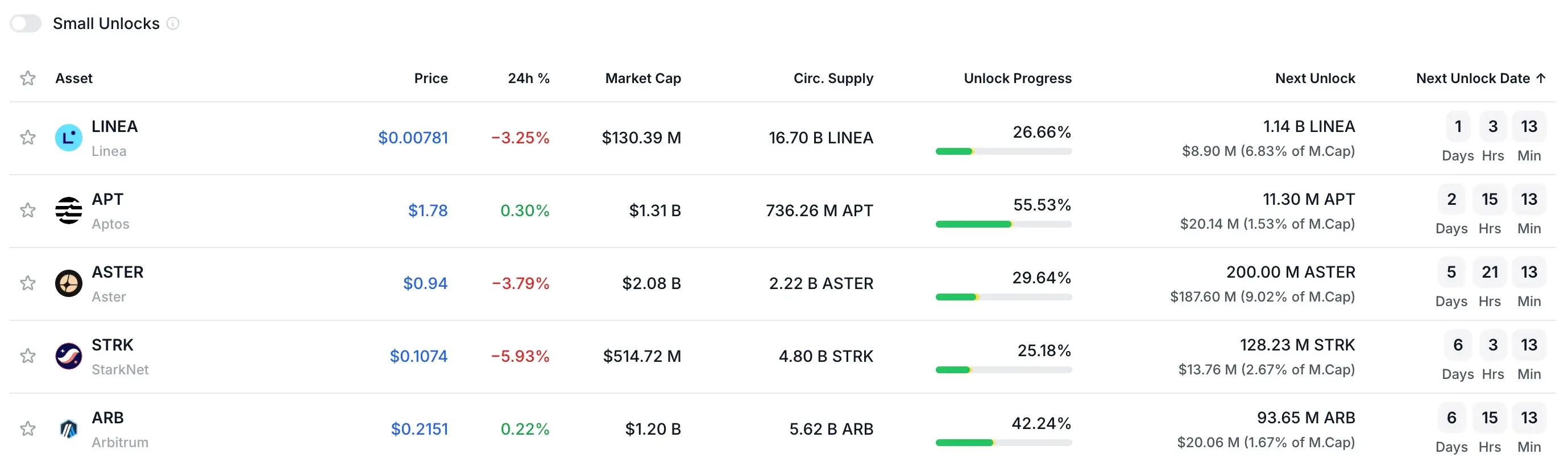

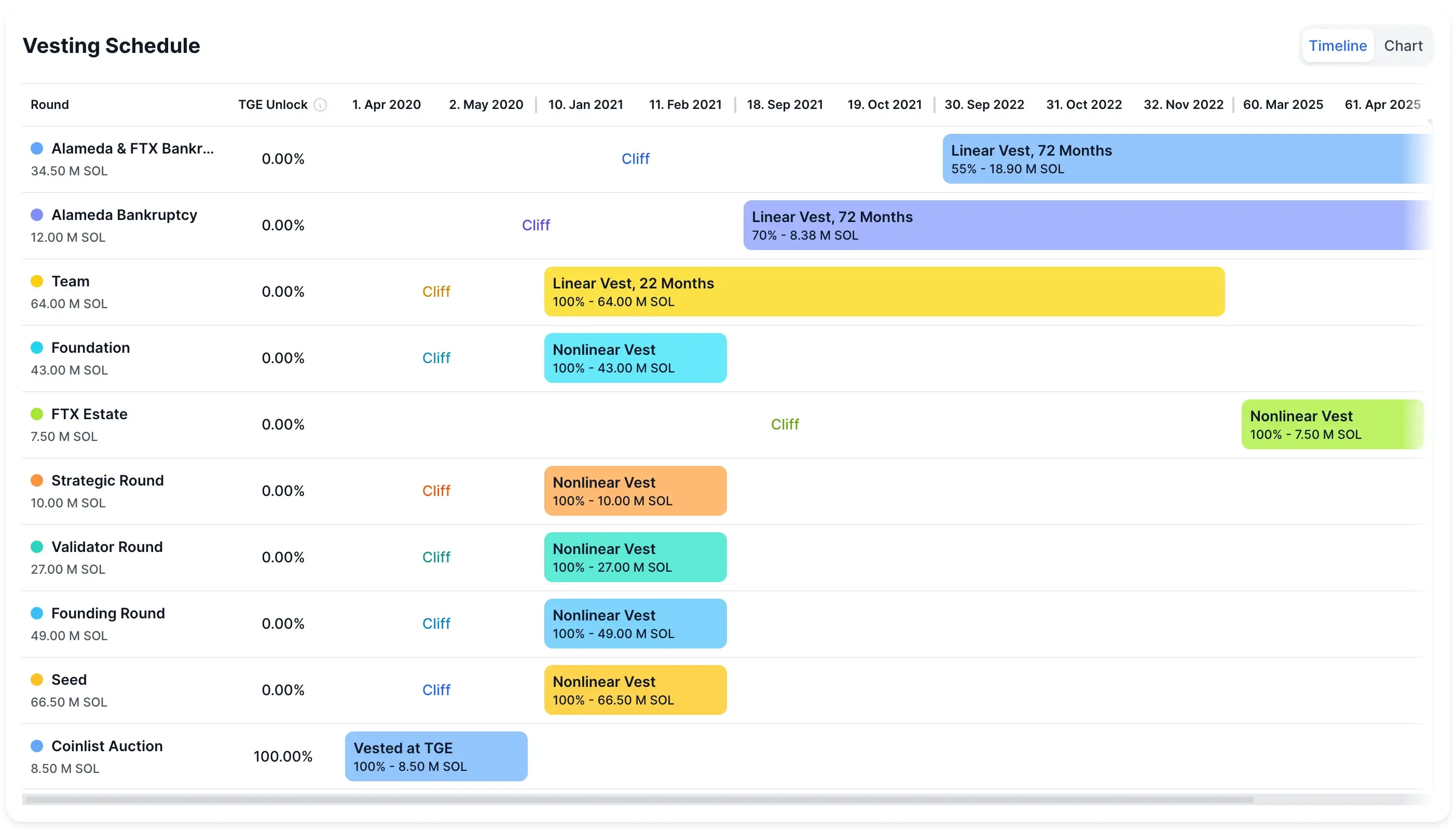

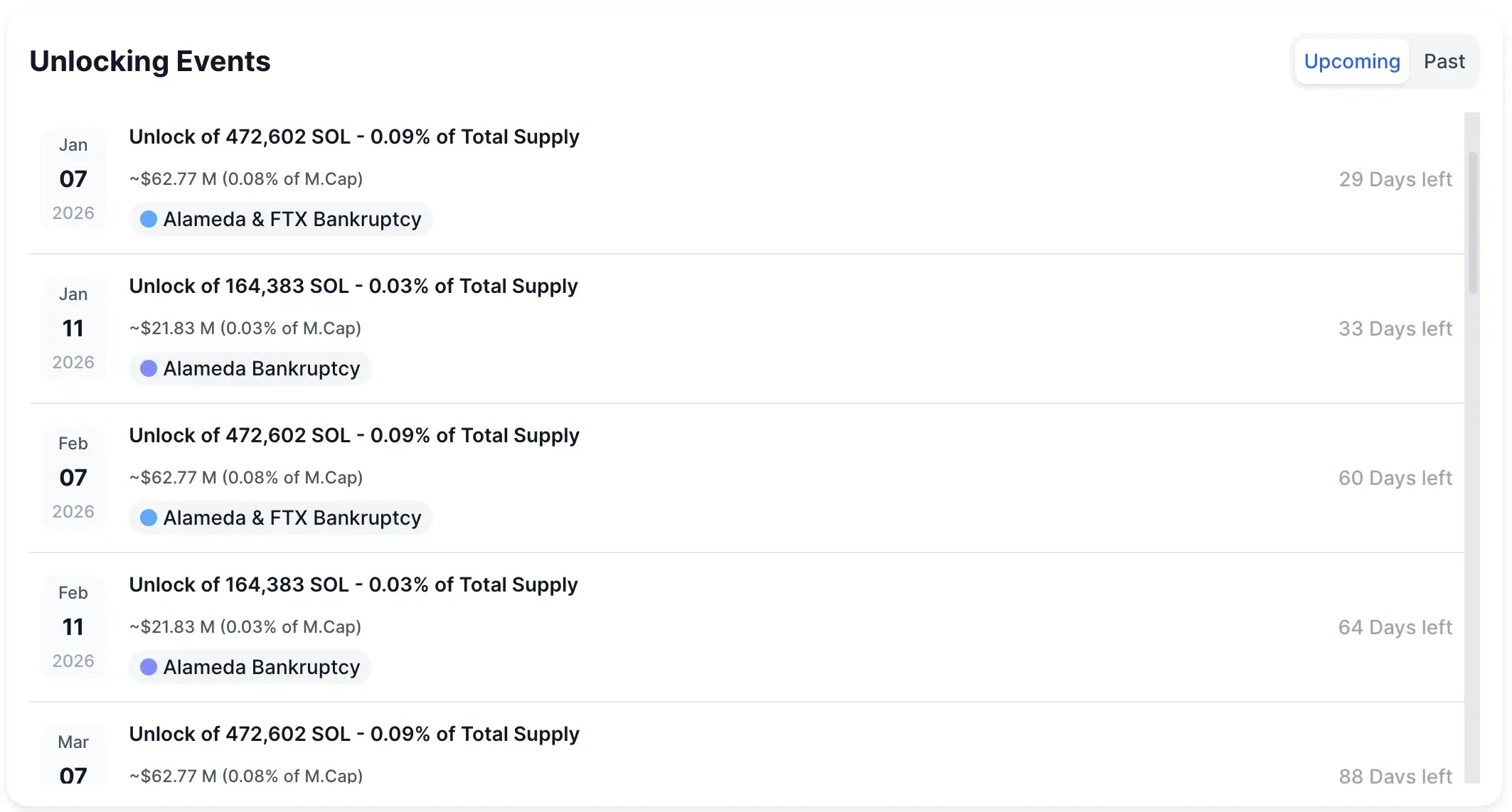

How to Read Vesting and Token Unlocks on DropsTab

Every bear-market veteran has lived this nightmare at least once — you buy a token that looks stable, maybe even promising, only to watch it crater because a giant tranche of investor tokens hit the market the next morning. It’s not bad luck. It’s vesting. And it’s one of the easiest traps to avoid once you know where to look.

DropsTab’s vesting section is built for this exact problem. The dashboard shows how much supply is still locked, when it unlocks, and how violent those unlock windows might be.

Vesting Chart Bars

Scroll down on any token page and you’ll find a vesting chart with a thick blocks. That’s the portion of the supply still held back — investor allocations, team tokens, ecosystem grants, whatever hasn’t hit circulation yet. If that bars are huge, it tells you the project still has a long supply runway ahead.

How traders actually use this

If the platform shows a major unlock coming in three days, you simply don’t enter. Or you size tiny. Most wait for the unlock, let the market absorb the sell pressure, and only then reconsider the position. It sounds boring, but skipping one badly timed entry can save months of drawdown — and DropsTab hands you that timing data upfront.

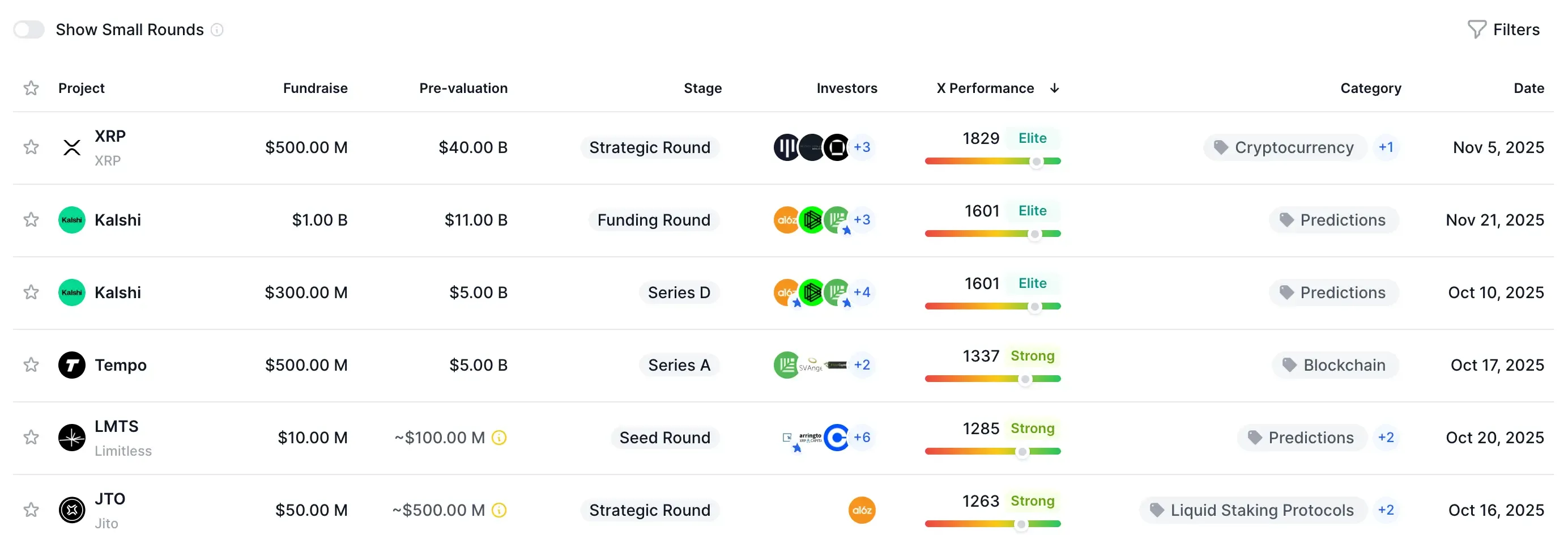

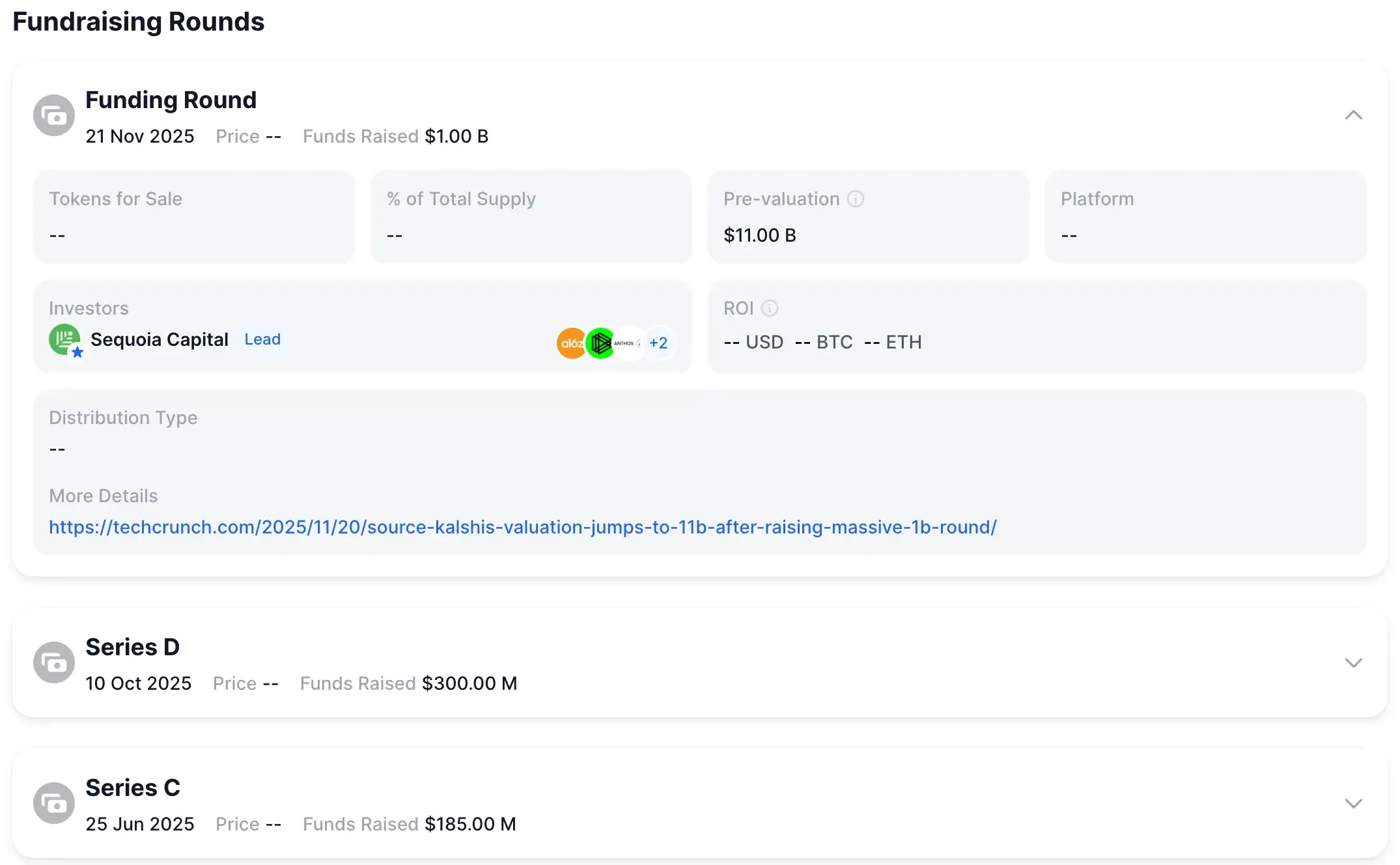

Using the Fundraising and Investors Tabs

Crypto moves in stories — and those stories often start on a cap table long before they show up on a chart. DropsTab gives you that view in one click. You can see who funded a project, what they paid, and how far in profit (or pain) those early buyers sit right now. It’s like getting a peek at the sheet music before the orchestra starts playing.

Fundraising — The Price No One Talks About on Twitter

Inside the Fundraising tab you’ll find something traders quietly obsess over: the seed and series prices. If a token is trading 100× above its seed, early investors are holding monstrous unrealized gains. That’s not inherently bearish, but it does tell you there’s a ceiling somewhere — whales might be waiting for liquidity to unload.

Flip it around: when a token hovers near 2× the seed price, you’re basically standing where venture money entered. Sometimes that means the market wiped out excessive hype… sometimes it means insiders know something the public hasn’t caught yet. Either way, you’re no longer guessing blind.

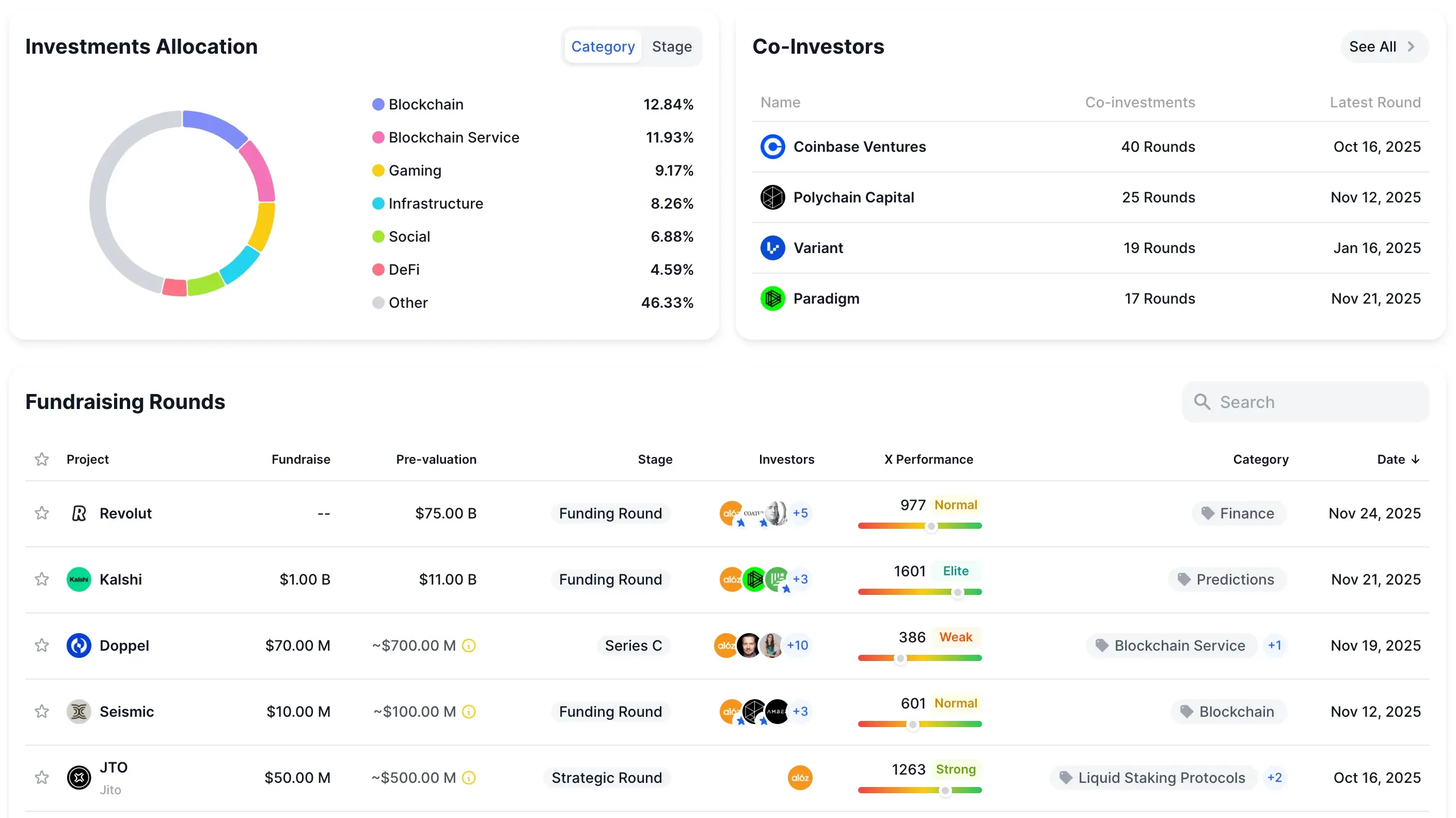

Investors — The Map of Narrative Clusters

Open the Investors tab and click on a fund — say, a16z. Suddenly you’re staring at their entire portfolio: gaming, modular chains, AI agents, L2s. Patterns jump out fast. When a top-tier VC quietly buys four or five projects in the same theme, that’s usually the seed of a narrative rotation. These clusters don’t guarantee returns, but they do reveal where smart money is leaning months before the sector becomes a hashtag.

Taken together, Fundraising + Investors form something close to a compass. Not perfect. But enough to stop walking into charts without understanding who’s already inside the trade — and what incentives they carry.

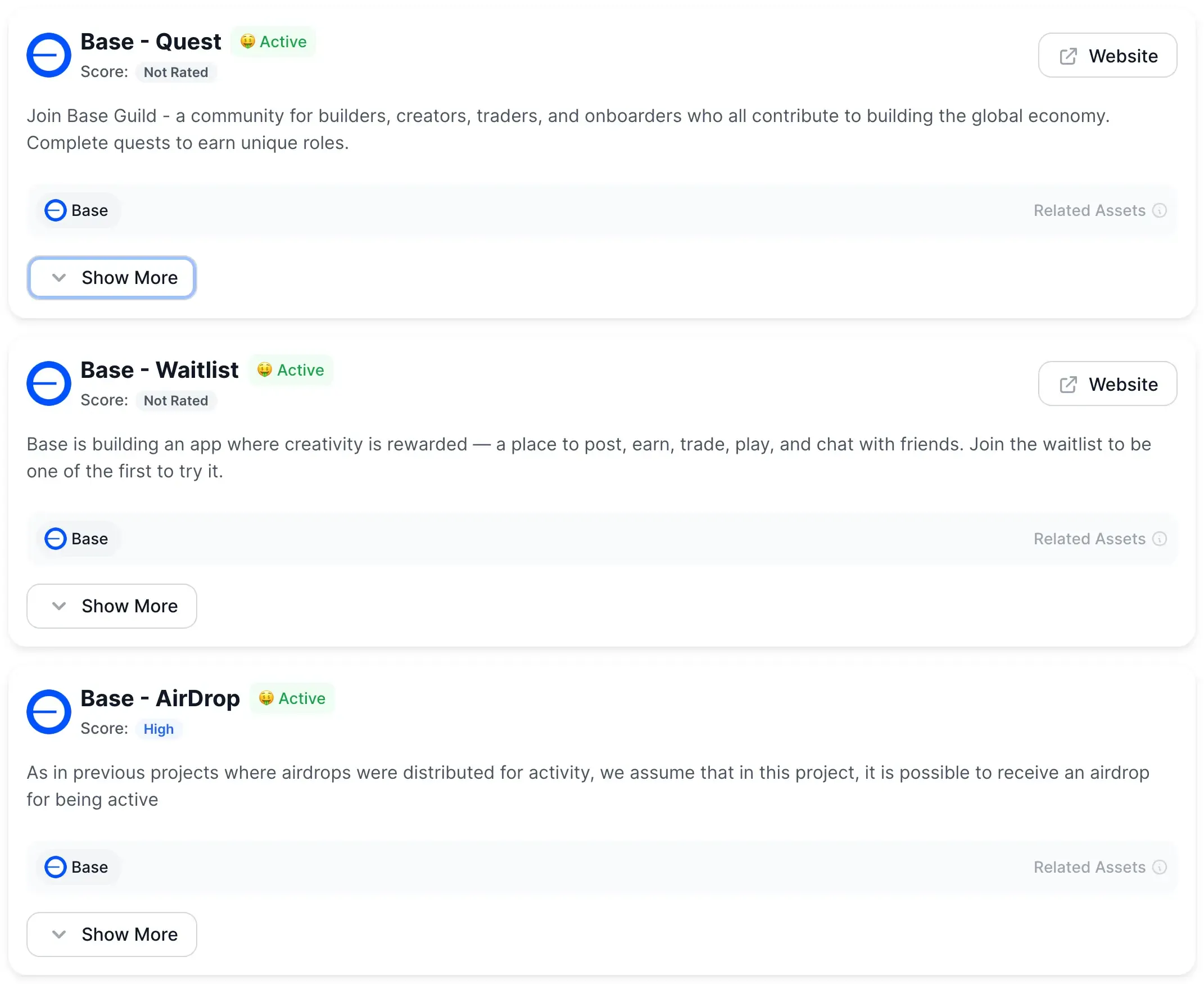

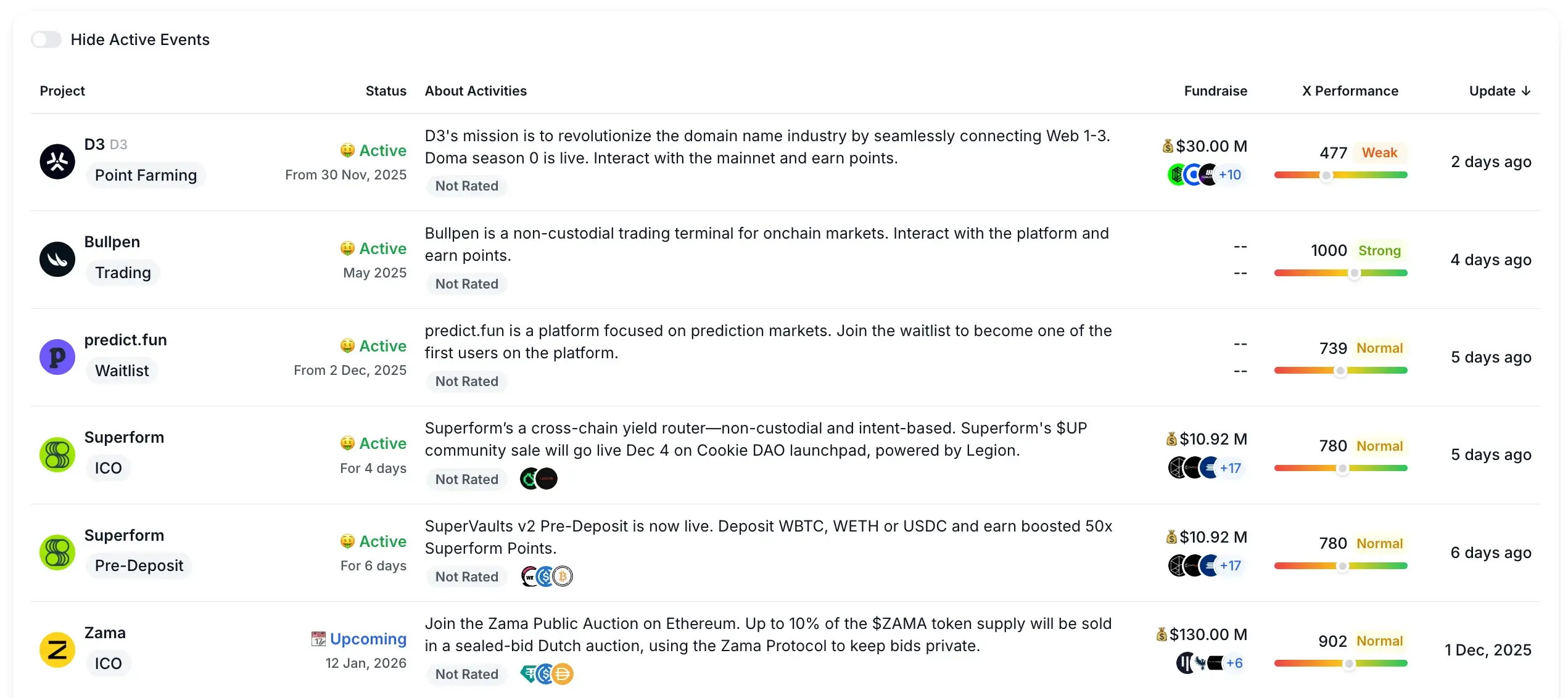

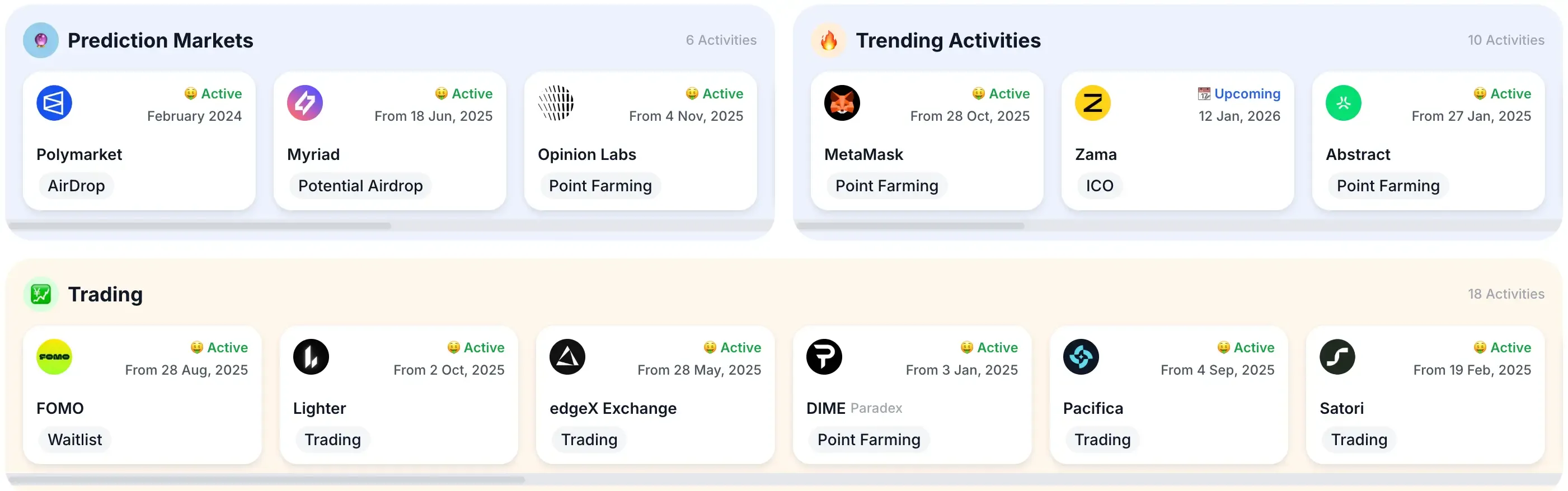

Early-Radar for Airdrops and Sales on DropsTab Activities

Most people spot opportunities when they’re already crowded. DropsTab’s crypto activities flips that timeline by pulling every live or upcoming event — airdrop programs, point campaigns, ICO sales, waitlists, pre-deposits — into one clean feed. It’s basically an early-warning system for anything that might reward you for showing up before everyone else does.

Each activity card tells you what matters upfront: status, start date, fundraise size, X performance, related assets, and a short description of what you actually need to do. If you click in, you get full manuals: how to participate, eligibility rules, snapshot dates, token claim details — the stuff that usually takes 20 tweets and a Discord scroll to piece together.

You can browse by category — Point Farming, Trading, Airdrops, ICO, Waitlist — or just follow trending campaigns like Superform, MetaMask points, Zama’s sealed-bid auction, Bullpen’s trading program, Abstract’s farming missions, and prediction-market plays like Polymarket or predict.fun.

Activities let you treat crypto opportunities like a watchlist, not a guessing game. Whether you’re hunting yield, trying to qualify for a community sale, or stacking points for a future TGE — this page keeps everything in one place, with actual instructions, not rumors.

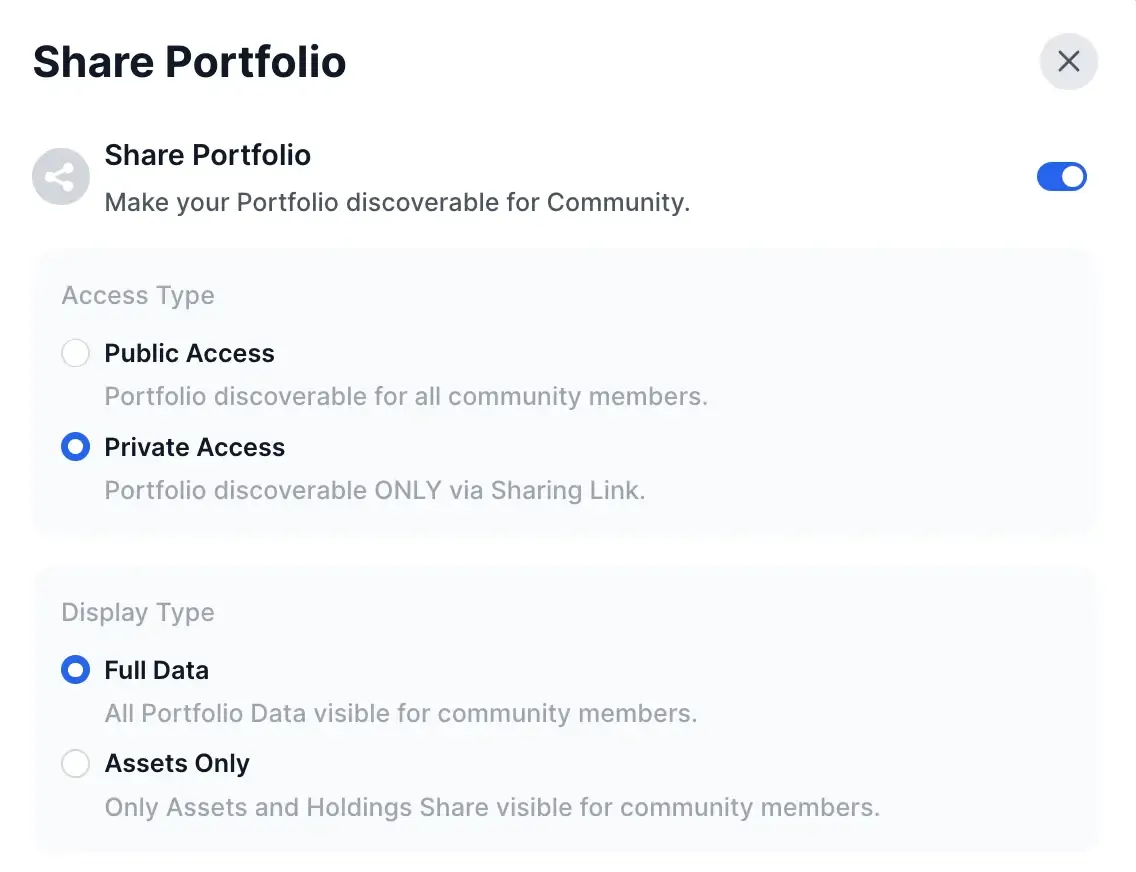

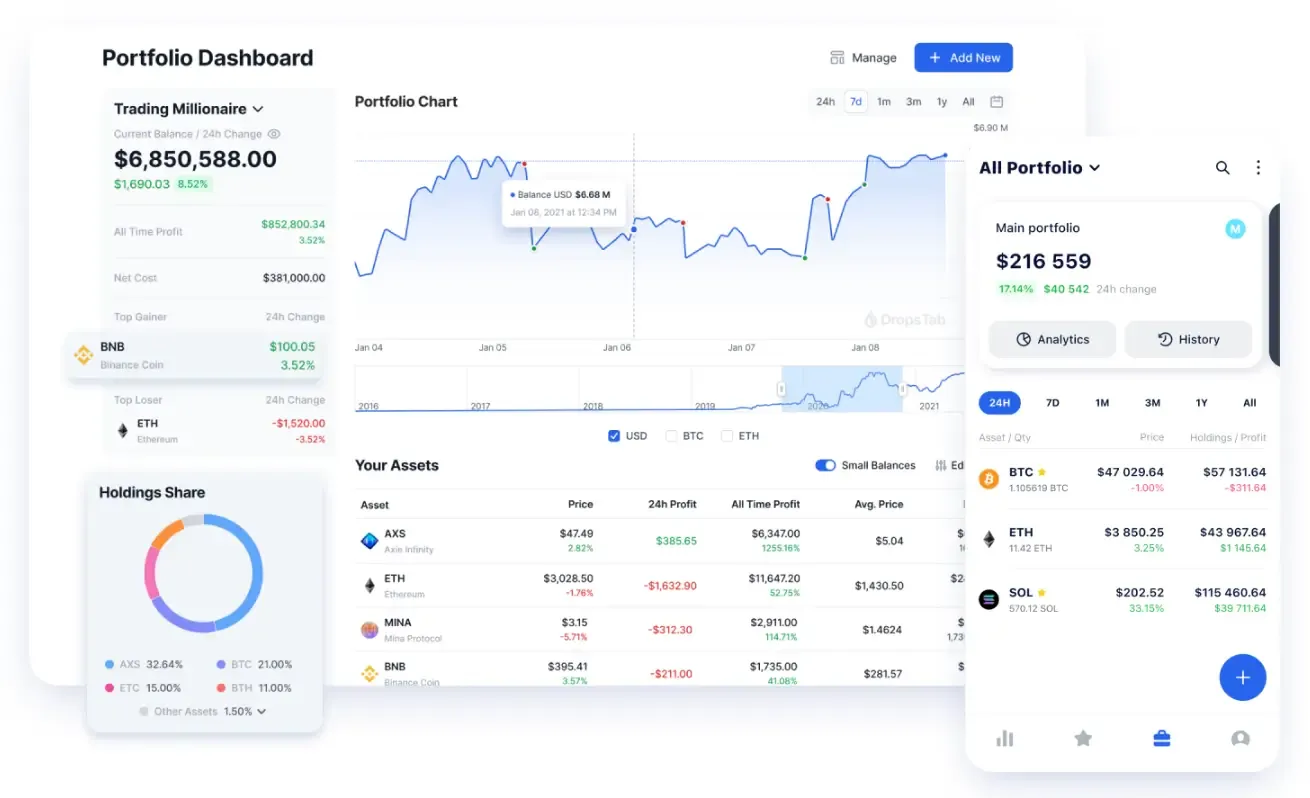

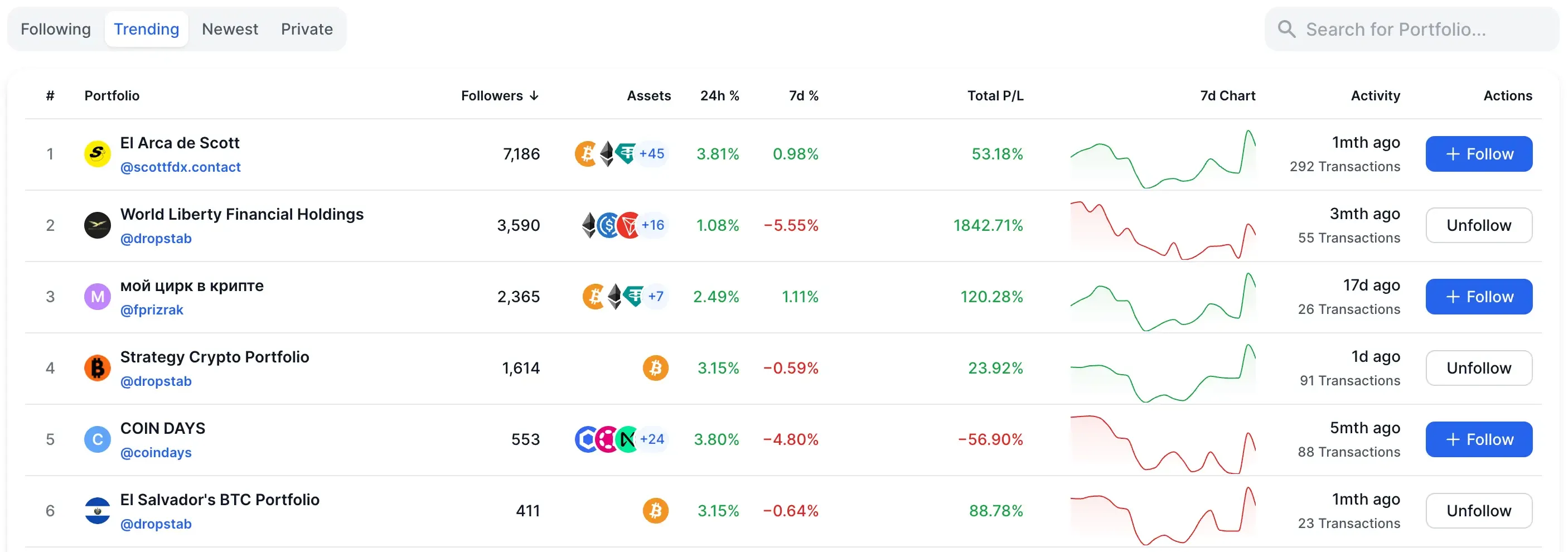

What is the DropsTab Public Portfolios Tool

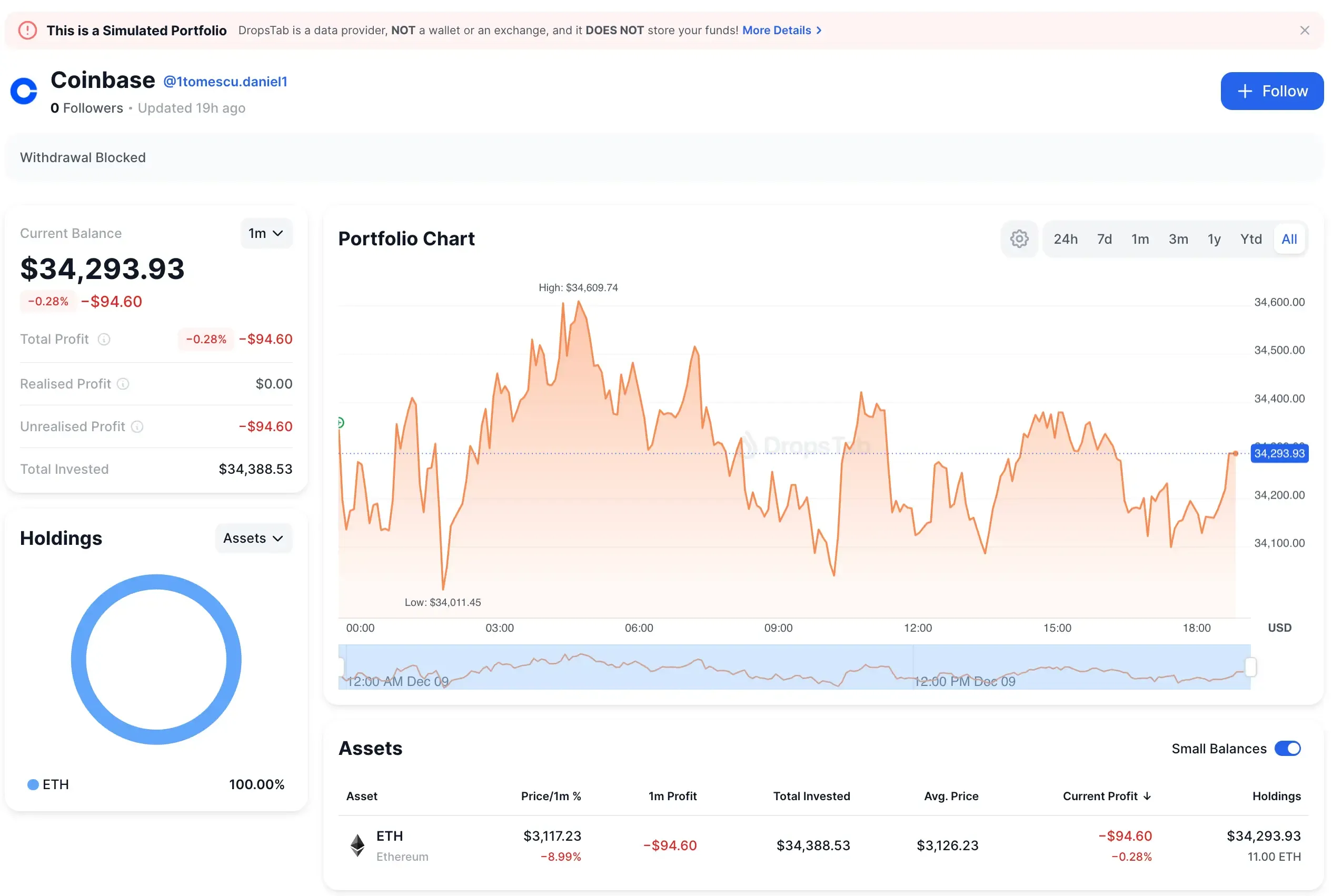

Most “portfolio trackers” feel frozen — static charts, delayed pricing, awkward transaction logs. DropsTab’s public portfolios live on an entirely different layer. Everything updates in real time: balances, P/L, allocation charts, upcoming events, even toggles that let you choose what’s visible when you share it.

The personal portfolio view is surprisingly deep. One click shows your performance (Realised vs Unrealised), average entry, total invested, and the exact profit generated by each asset. The chart isn’t just a generic line — it highlights the high/low range, your deposits, market phases, everything. It’s flexible enough that most traders end up using it as their main dashboard.

But the real magic unlocks when you step into public portfolios.

Here you can browse portfolios shared by the community — fully transparent, updated second by second, sortable by P/L, 7d performance, activity, asset mix, or whatever metric you care about. Some users treat them like strategy journals. Others build narrative-themed portfolios (World Liberty Financial holdings, Strategy crypto portfolio, El Salvador's BTC portfolio). And you can follow them just like you’d follow an analyst, watching their allocations shift over time.

This transforms DropsTab into something crypto never had: a social layer built on actual data, not screenshots or anonymous claims. No guessing, no “trust me bro.” If someone is outperforming, you see the transactions that got them there.

Note on Safety: The “Dormant Account” Scam

As Public Portfolios grew, scammers predictably tried to piggyback on the visibility. The most common attempt is the fake “dormant balance” message — someone pretending DropsTab is holding money for you and demanding a fee to unlock it. Impossible. DropsTab never holds funds; it only tracks your existing wallets.

Another variant: fake “support agents” messaging or calling you. They’ll ask for screenshots — or worse, your seed phrase. Real support never does that, and official channels exist only on the site and verified Telegram spaces.

If a stranger claims they can “restore” or “unlock” anything for you, close the chat. They’re after your wallet, not helping your portfolio. Stay safe.

Conclusion

If there’s a single thread running through every part of DropsTab, it’s this: the platform keeps pulling you away from guessing and toward seeing. Not perfectly — nothing in crypto is — but enough that the market stops feeling like chaos and starts behaving like a system you can actually read. Accumulation streaks don’t look random anymore. Unlock cliffs stop blindsiding you. Fundraising prices explain half the candles you used to chalk up to “volatility.” Activities hand you opportunities before they’re noisy. Public Portfolios show you how other traders really operate.

And that’s the real shift. DropsTab doesn’t make you smarter — it just removes the blindfold. Once you trade with the full picture, it’s very hard to go back to watching a single price ticker and pretending that’s analysis.