Analytics

Major Crypto Token Unlocks in July 2025

July 2025 brings a wave of significant token unlocks for five crypto projects — Solv Protocol, deBridge, LayerZero, Avail, and Sign — each releasing tokens worth over 10% of their current market capitalization.

⚡TL;DR

- Solv Protocol (SOLV) unlocks ~$15M in tokens (≈22% of its market cap) on July 17, 2025. These come mainly from its DAO treasury and private/team allocations after a one-year cliff, boosting circulating supply by ~20%.

- deBridge (DBR) releases ~$12–13M of DBR (≈35% of market cap) on July 17, 2025. This event marks the first post-TGE vesting for core contributors, strategic investors, and validators, unleashing ~590 million tokens (5.9% of total supply) – roughly one-third of the current circulation.

- LayerZero (ZRO) unlocks ~$45.9M in ZRO (≈22% of market cap) on July 20, 2025. With only ~11% of ZRO supply circulating pre-unlock, this 25.7M token release (23% of circulating supply) is significant. It’s the second monthly unlock in a series continuing through May 2027, mainly for team and early backers.

- Avail (AVAIL) unlocks ~$23.6M in AVAIL (≈39% of market cap) on July 23, 2025. Around 972 million tokens (9.24% of total supply) will hit the market – a 55% increase to the current circulating supply – as core contributors and investors see their 12-month cliffs end.

- Sign (SIGN) unlocks ~$12.3M in SIGN (≈15.8% of market cap) on July 28, 2025. This 189 million token release (1.89% of total supply) is the project’s first major post-IDO unlock, likely involving early investor (“backer”) allocations and foundation/ecosystem tokens after its April 2025 launch.

Solv Protocol (SOLV) Unlock Overview

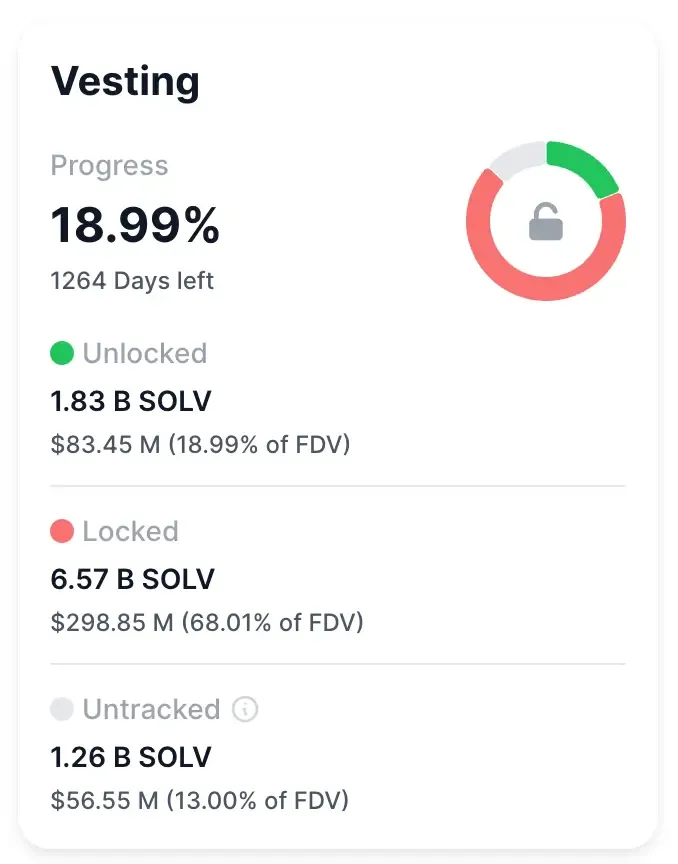

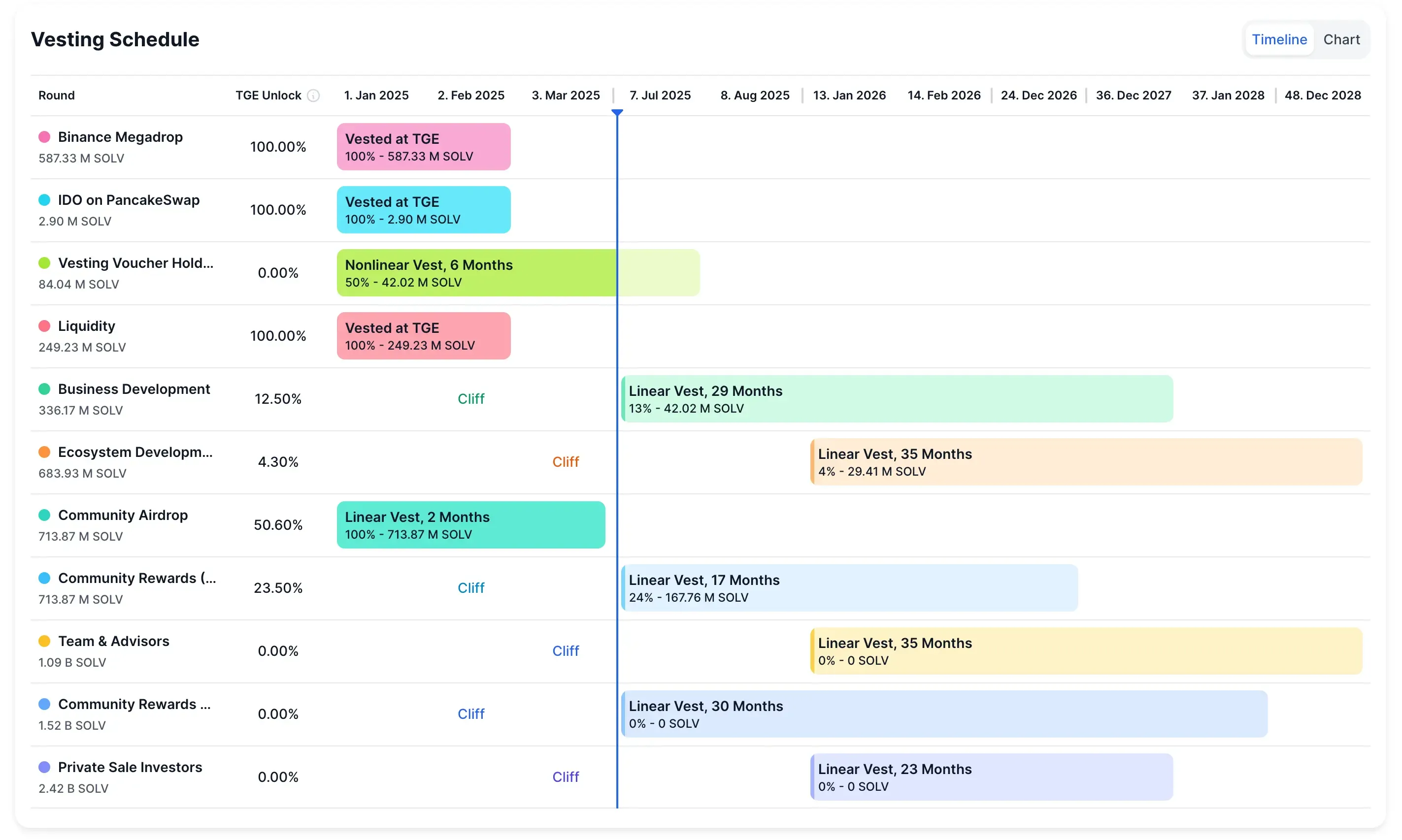

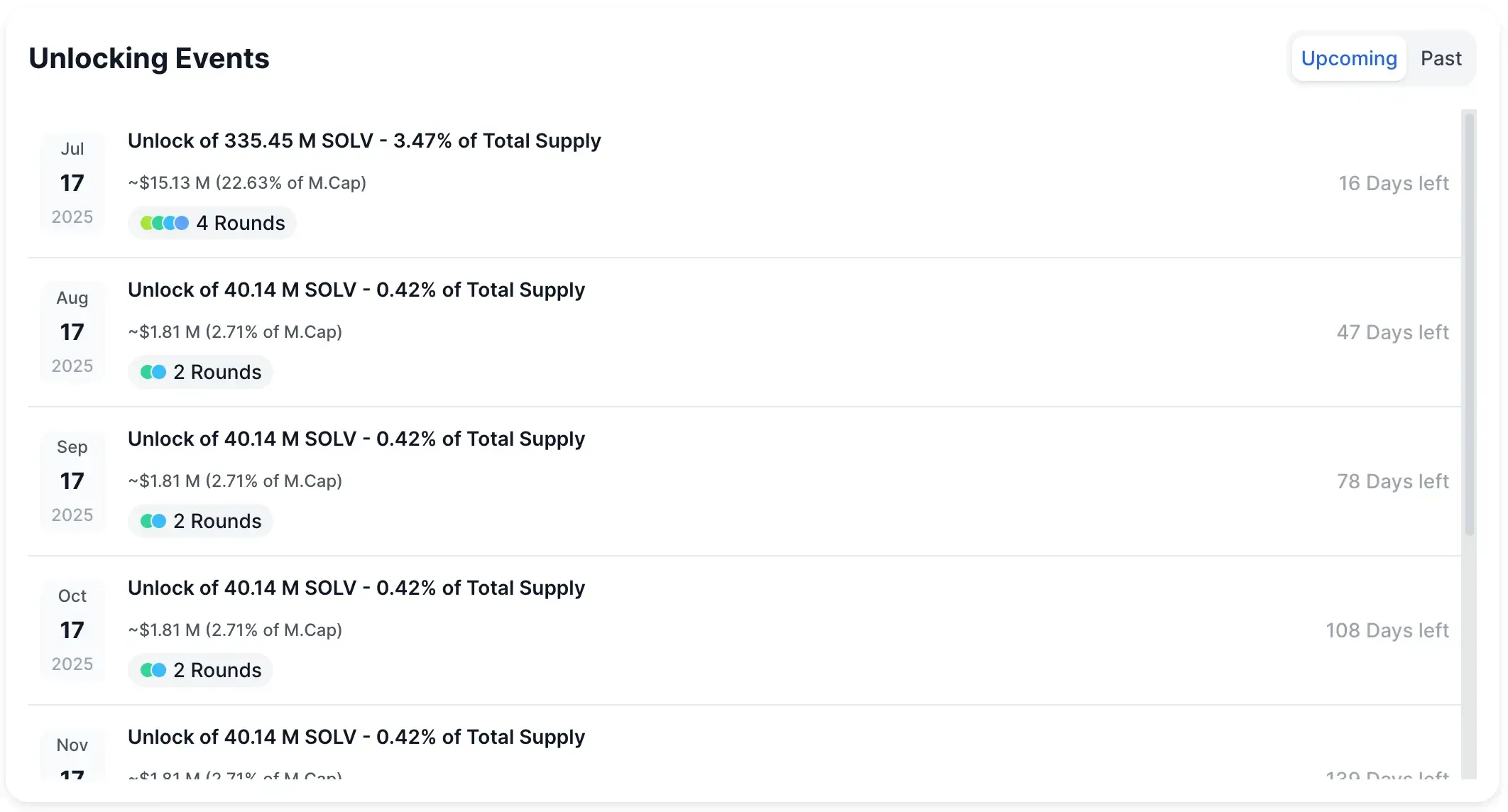

Solv Protocol will unlock 296.23 million SOLV on July 17, 2025 (worth ~$15.1M, about 22.6% of its market cap). This represents 3.53% of SOLV’s 9.66 billion max supply.

The event combines four vesting tranches unlocking simultaneously, substantially increasing the ~1.5 billion SOLV currently circulating by roughly 20%.

Vesting sources

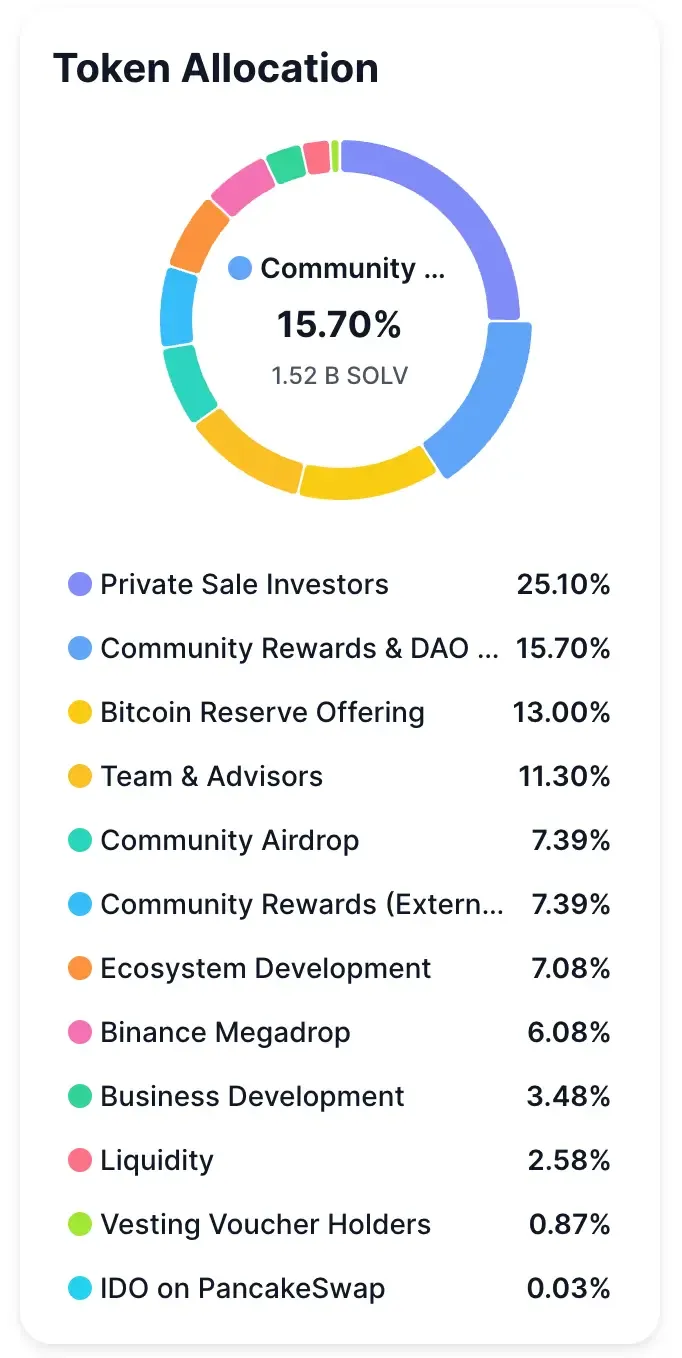

The July unlock corresponds to the first scheduled releases for several major allocations: notably the project’s Community Rewards & DAO Treasury and Team & Advisors. According to Solv’s tokenomics, the 1.512 billion SOLV earmarked for the community DAO begins vesting in six-month intervals starting July 2025.

Likewise, the core team and advisors had a one-year lockup from launch, after which their tokens vest over 3 years. Early private sale investors also faced a one-year cliff followed by a two-year linear vesting. In other words, July 2025 marks the end of the initial lockup period for both the Solv team and seed investors, as well as the first disbursement to the community treasury.

Supply impact

With Solv’s circulating supply previously only ~15–19% of the total, this unlock is a sizable influx. ~296M new SOLV entering circulation in one day will swell the float by about one-fifth. Absent a proportional rise in demand, such a supply jolt can exert selling pressure, especially given that these tokens originate from early stakeholders who might seek liquidity.

For context, Solv’s market cap before the event was ~$68M. Releasing $15M of tokens (22% of that value) is non-trivial, though it’s worth noting these tokens are long-vested allocations (team, treasury, etc.), not a surprise dilution.

On-chain and community signals

The unlocked SOLV will likely be distributed from known vesting contracts or multisig wallets. For example, Solv’s DAO treasury and team allocations have been held out of circulation – their movements can be tracked on-chain once released. The community has been aware of this timeline; Solv’s documentation explicitly laid out the semiannual unlock schedule.

Thus, some of the impact may be “priced in.” Still, traders often watch for tell-tale on-chain moves like transfers from the Solv team’s multisig or investor wallets to exchanges as bearish signals.

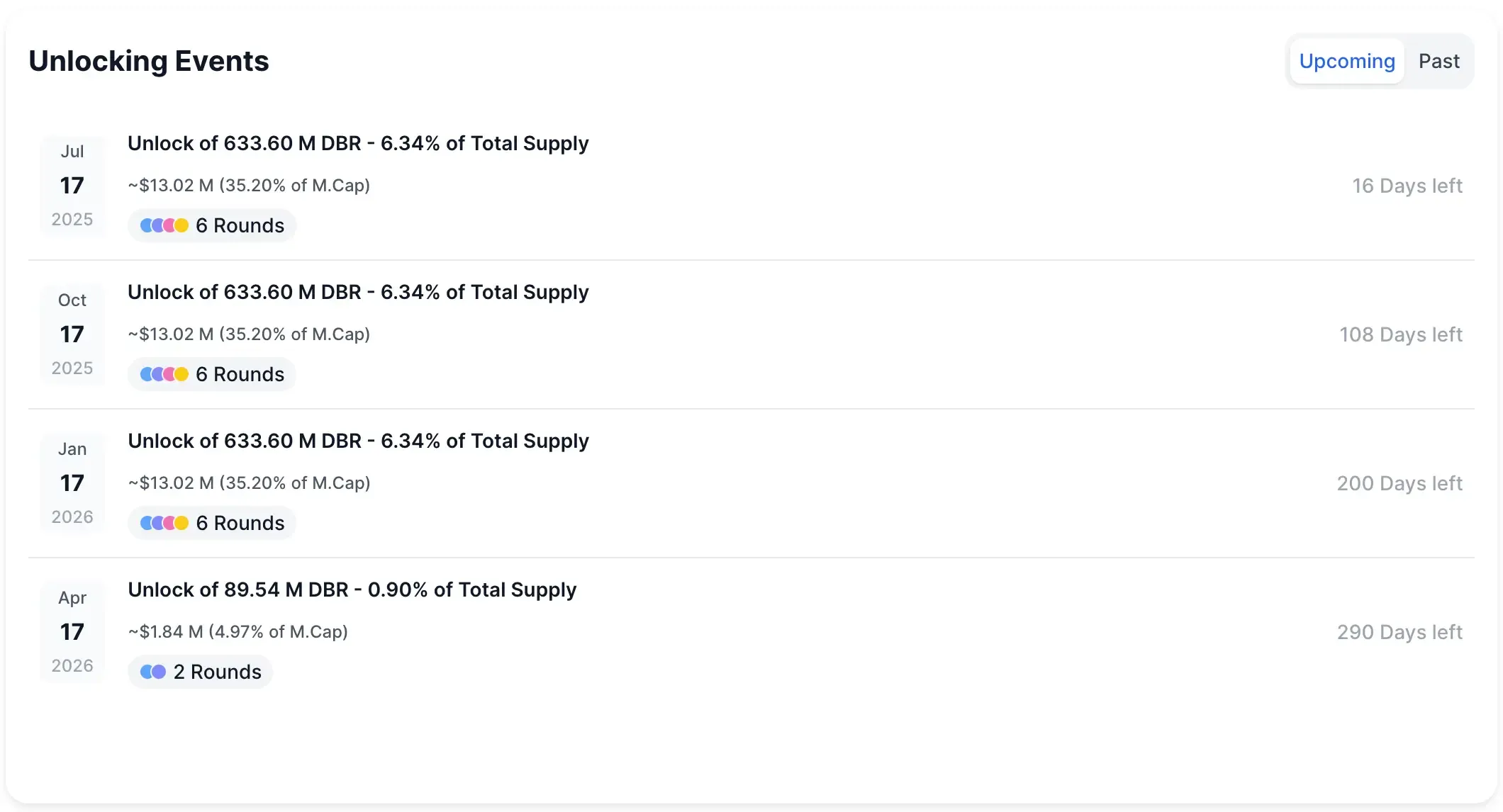

deBridge (DBR) Unlock Overview

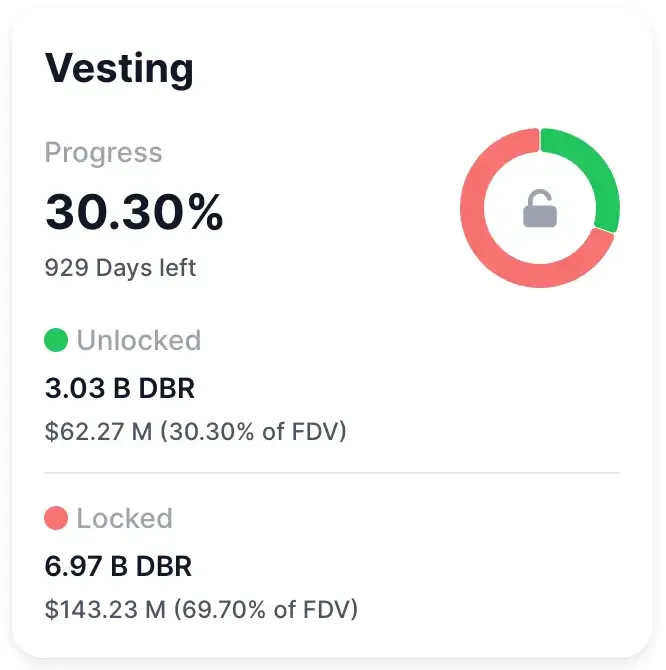

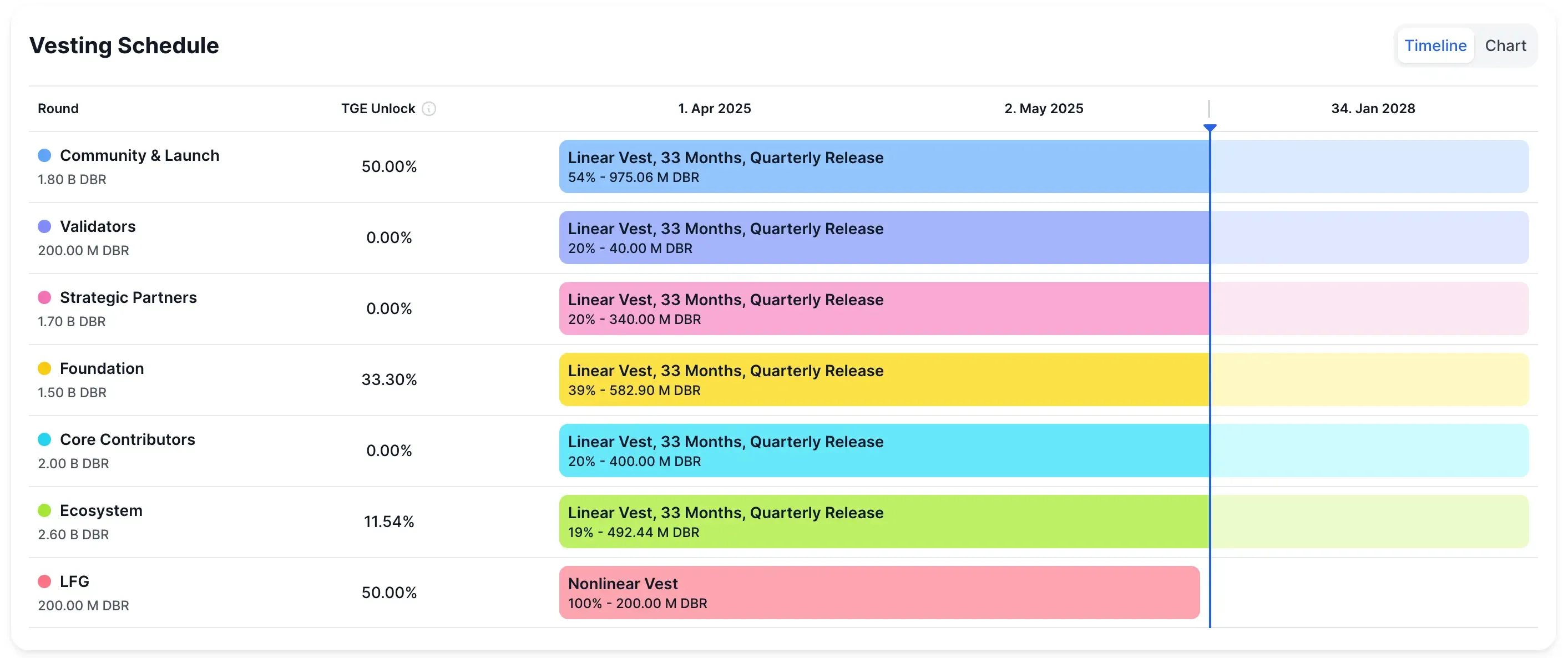

deBridge is scheduled to unlock 590.78 million DBR on July 17, 2025. This tranche is valued around $12–13 million (pegged to recent prices) and equals about 5.9% of DBR’s 10B total supply.

Notably, that sum is roughly 20–35% of DBR’s market cap (the exact percentage varying with market conditions – at a $35M cap it’s ~35%).

In circulating supply terms, ~590M tokens boost the float by roughly one-third overnight (DBR’s circulation before unlock was ~1.8B tokens).

Vesting sources

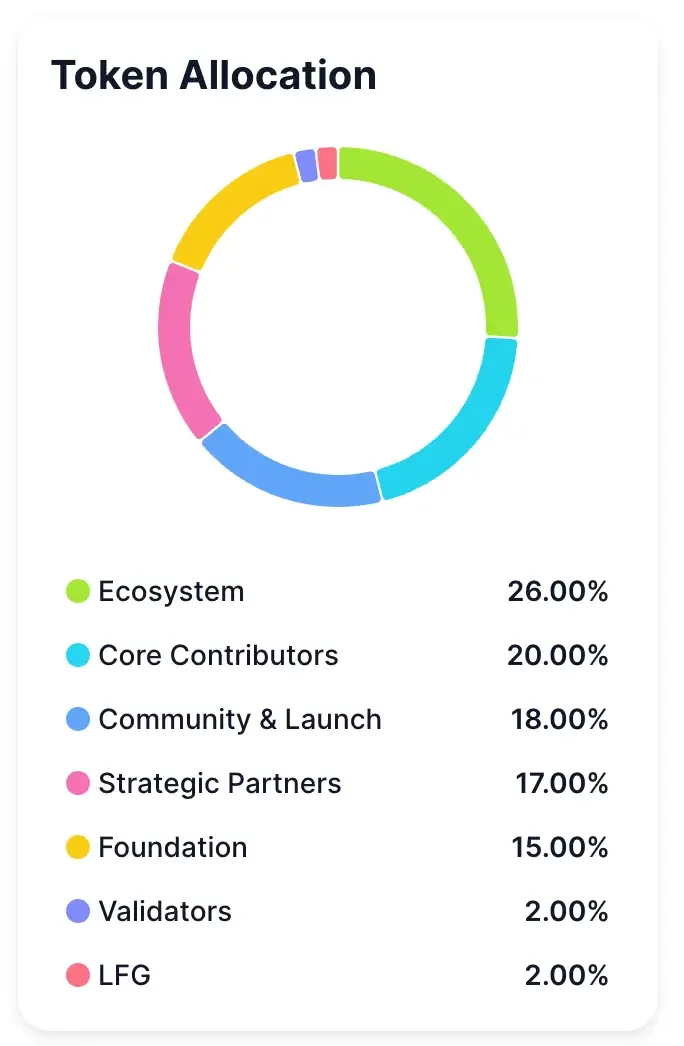

This event marks the first big post-TGE unlock for multiple deBridge stakeholder groups. deBridge’s tokenomics ensure a balanced distribution between core contributors, strategic partners (investors), and the community.

At launch (TGE), certain portions were immediately unlocked (e.g. 10% of supply for community incentives and 5% to the foundation treasury). The remainder were locked with cliffs and quarterly vesting schedules.

Specifically:

- Core contributors had 0% at TGE, then 4% of the supply unlocked after a 6-month cliff (400M DBR).

- Strategic investors likewise had a 6-month cliff with 3.4% unlocking at that point (340M DBR).

- Validators (node operators) had 0.4% unlocked after 6 months.

The foundation’s remaining tokens and the ecosystem fund are also on 3-year quarterly vesting starting 6 months after TGE.

In sum, the July unlock aggregates six “rounds” of vesting – core team, strategic partners, validators, foundation, ecosystem, and possibly community incentives – all hitting their first scheduled release roughly half a year after DBR’s token launch.

Supply impact

The infusion of ~590M DBR will expand the circulating supply (previously ~18% of total) to roughly 24%. That’s a significant dilution in a short span. Early investors and team members who have waited through cliffs now gain the ability to sell portions of their holdings.

Because the unlock includes multiple stakeholder categories at once, the supply shock is compounded. For example, the deBridge Foundation’s unlocked tokens (intended for liquidity and ecosystem growth) can enter circulation alongside team and investor tokens.

However, it’s worth noting these tokens vest quarterly over 3 years, not all at once. The ~590M in July represents the first quarterly release; subsequent quarters will continue to release tokens on a schedule.

This predictable, staggered release could help the market absorb new supply over time – but the initial unlock often has an outsized psychological impact.

On-chain and community signals

On-chain, deBridge’s smart contract releases are something the community is tracking closely. Governance multisig wallets hold large allocations (for instance, the 26% ecosystem reserve is custodied by a DAO multisig).

A key thing to watch is whether newly vested tokens stay in those treasury wallets or move out. If the foundation or team retains tokens (or stakes them for governance), it signals confidence and may reassure investors.

Conversely, any large transfers to exchanges or OTC desks by early backers (some of whom got in during 2021–2022 seed rounds) would indicate potential selling.

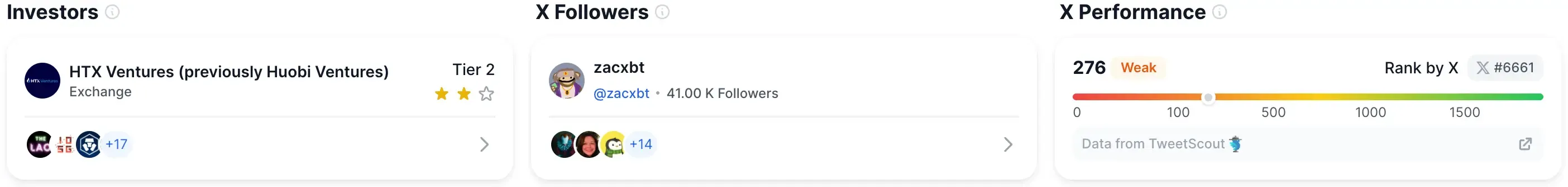

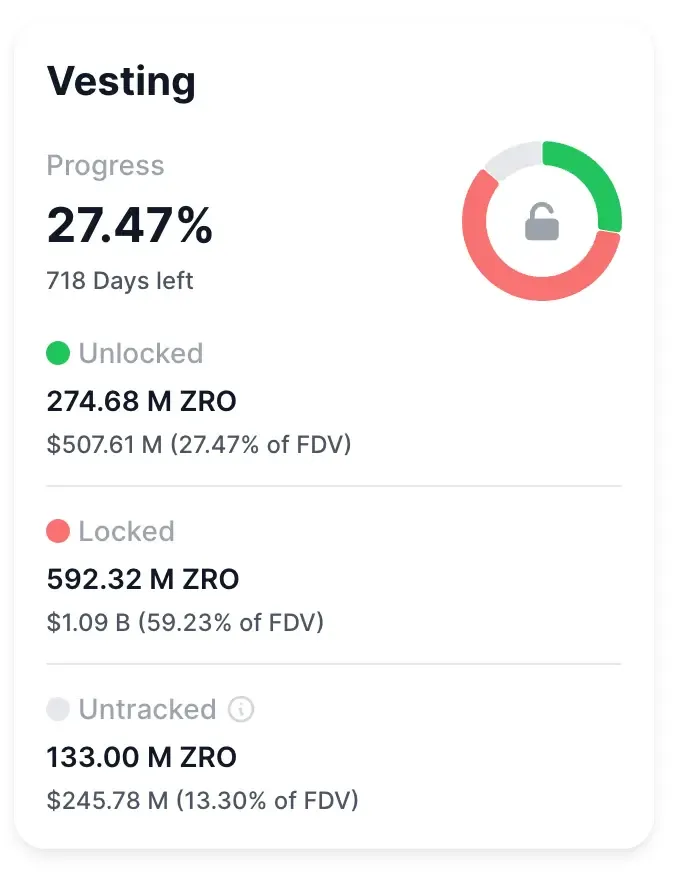

LayerZero (ZRO) Unlock Overview

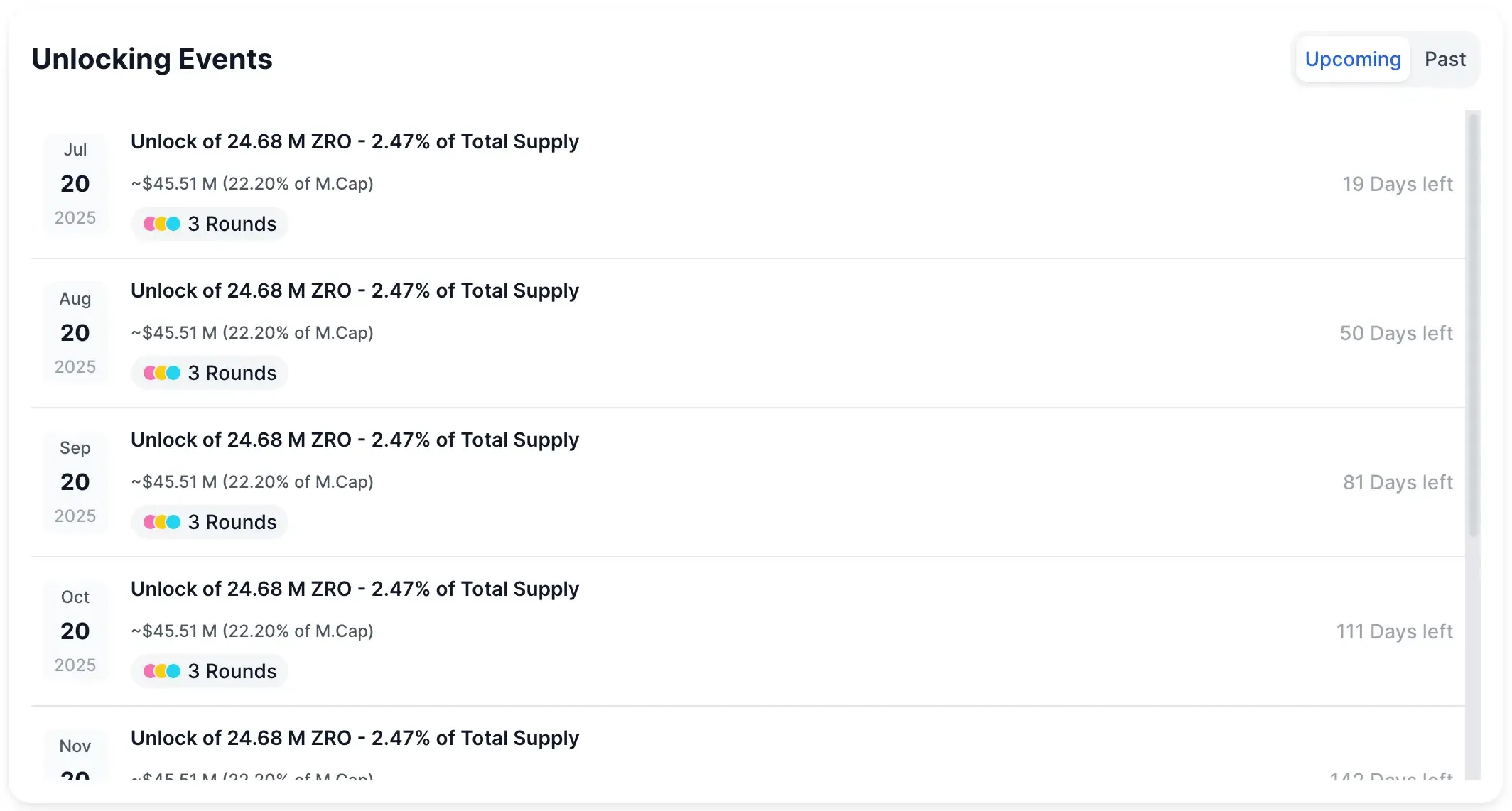

LayerZero Labs faces a 25.71 million ZRO token unlock on July 20, 2025, following on the heels of a similar-sized release in June.

The July tranche (~2.47% of the 1B total supply) is valued around $45–46 million, or about 22% of ZRO’s market capitalization.

This is part of a monthly unlock schedule that will run until May 2027. Each month, roughly ~25M ZRO are unlocked, dramatically increasing supply over time.

The July event alone will boost the circulating supply (~111M before unlock) by over 23%.

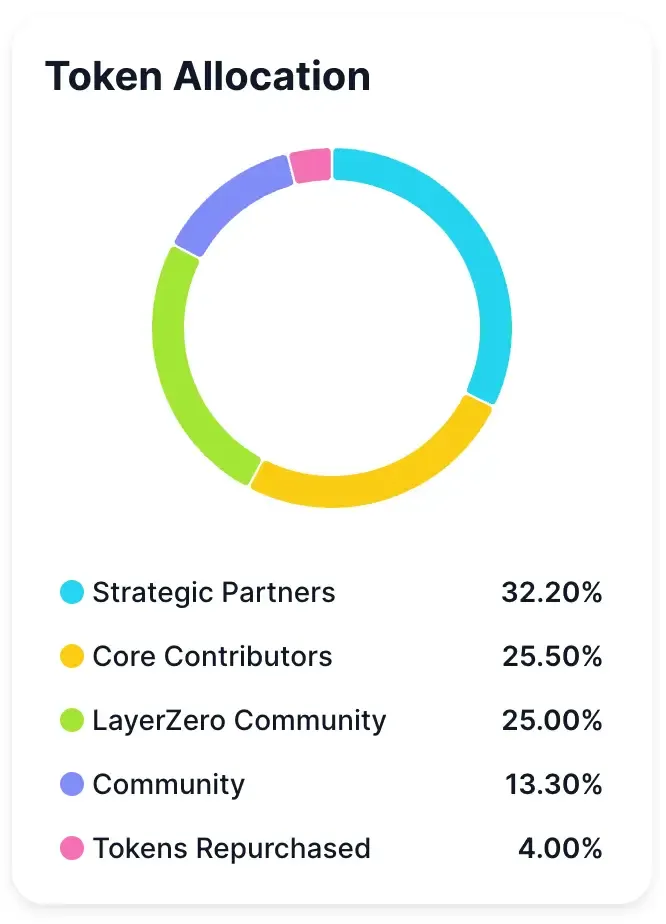

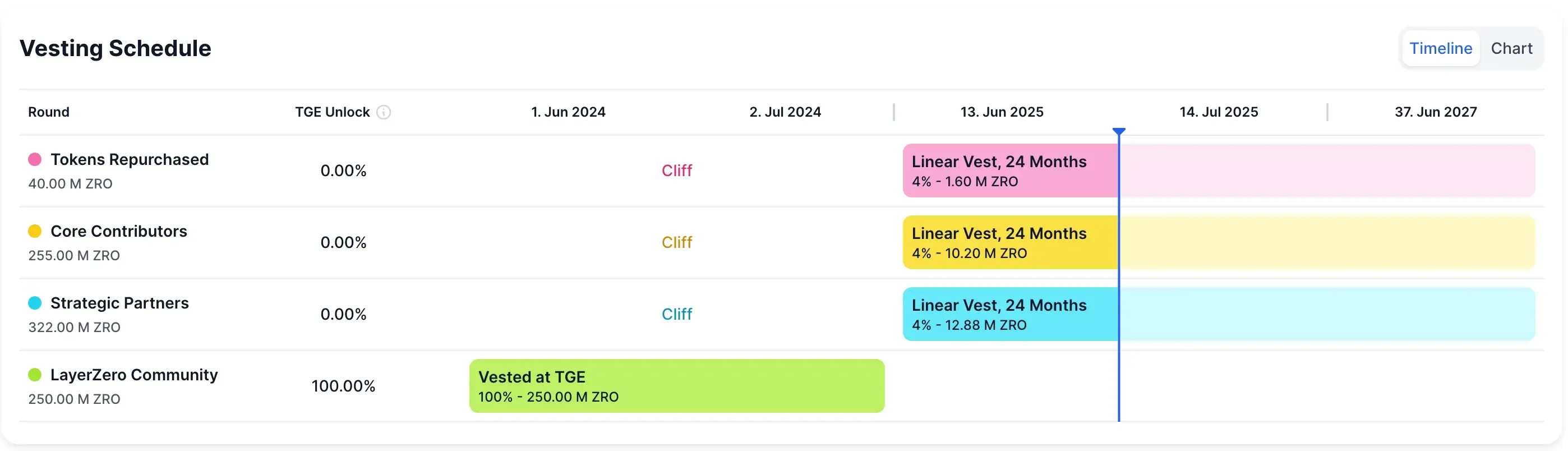

Vesting sources

The LayerZero unlocks primarily stem from investor and team allocations becoming liquid after the protocol’s launch. Per LayerZero’s tokenomics, Strategic Partners (investors and advisors) were granted 32.2% of the supply, locked for 1 year, then vesting monthly over 2 years. Similarly, Core Contributors (team) hold 25.5% of supply with a 1-year lock and 2-year monthly vesting thereafter.

Both groups had their cliffs end on June 20, 2025 – kicking off the first wave of unlocks. The July 20 release is the second monthly installment for these groups.

Notably, LayerZero’s Community allocation of 38.3% was largely distributed at TGE via airdrops and community programs, so the community portion isn’t a factor in ongoing unlocks. The remaining smaller buckets – like 4% “Tokens Repurchased” and 9.5% “Ecosystem & Growth” – are controlled by the foundation and unlock on different schedules or as needed.

In essence, the July unlock is dominated by early private investors and core team members finally receiving tokens each month after supporting LayerZero through its development phases.

Supply impact

LayerZero’s situation is striking: prior to unlocks, only ~11% of the 1B supply was circulating (around 110M ZRO). That low float is now steadily rising by ~2.5% of total supply each month.

The July batch (25.7M tokens) adds roughly 23% more tokens to circulation in one go. June’s initial unlock already injected $47M of ZRO, and combined with July’s, the circulating supply will have effectively doubled within two months.

Such a rapid inflow of supply is akin to a “supply surge” that, without commensurate demand growth, can depress price. Indeed, ZRO’s price has been in a short-term downtrend leading into these events.

The project’s fully diluted valuation (FDV) remains high ($1.8B), so investors are keenly aware that a lot more ZRO is yet to come.

On-chain and community signals

The LayerZero community and analysts have been vocal about these unlocks. Messari highlighted the 23% circulating supply jump and continuous monthly unlocks as a major headwind.

Leading into the first unlock, technical analysis turned bearish – ZRO broke critical support around $1.77 as the unlock approached, and trading volumes dropped ~30%, indicating lower demand in the face of new supply.

On-chain, one can monitor the vesting smart contracts (likely controlled by the LayerZero Foundation) that disburse tokens monthly. Spikes in exchange deposits were observed around the June 20 unlock, suggesting some early holders did sell immediately.

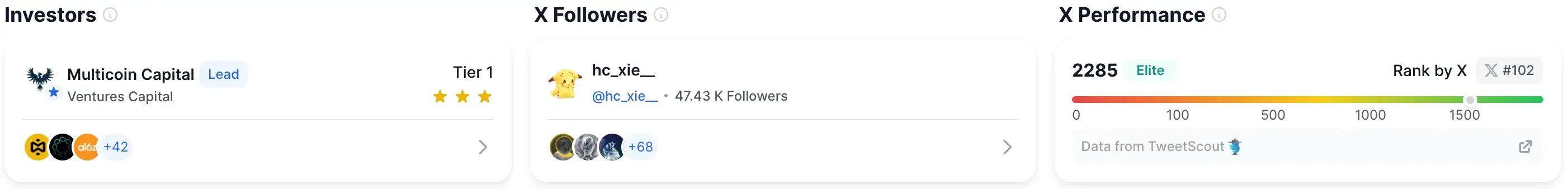

However, not all investors will rush for the exit; some may hold if they believe in LayerZero’s long-term value (especially given LayerZero’s prominent role in cross-chain infrastructure and the fact that investors like a16z, Sequoia, etc., backed it at much higher valuations).

Key addresses to watch include the LayerZero Labs team wallet and venture fund wallets. If large transfers from those appear on-chain heading to exchanges, it will likely intensify short-term bearish sentiment.

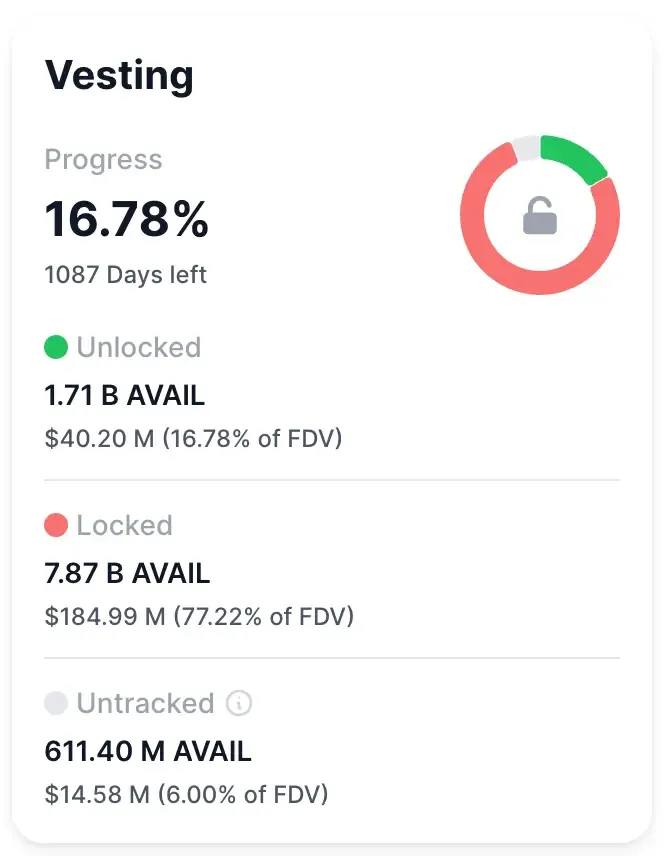

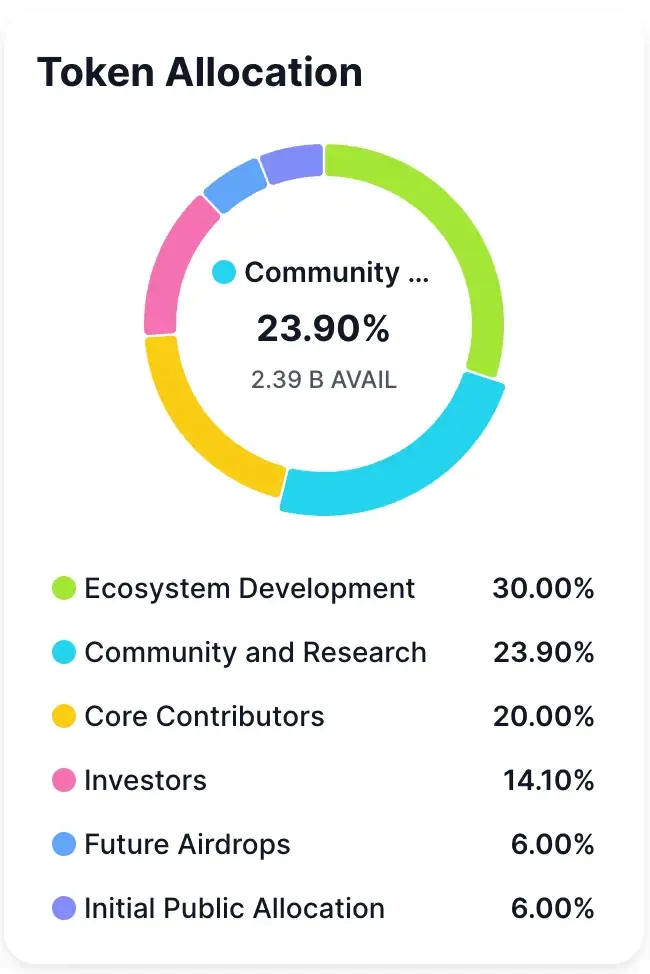

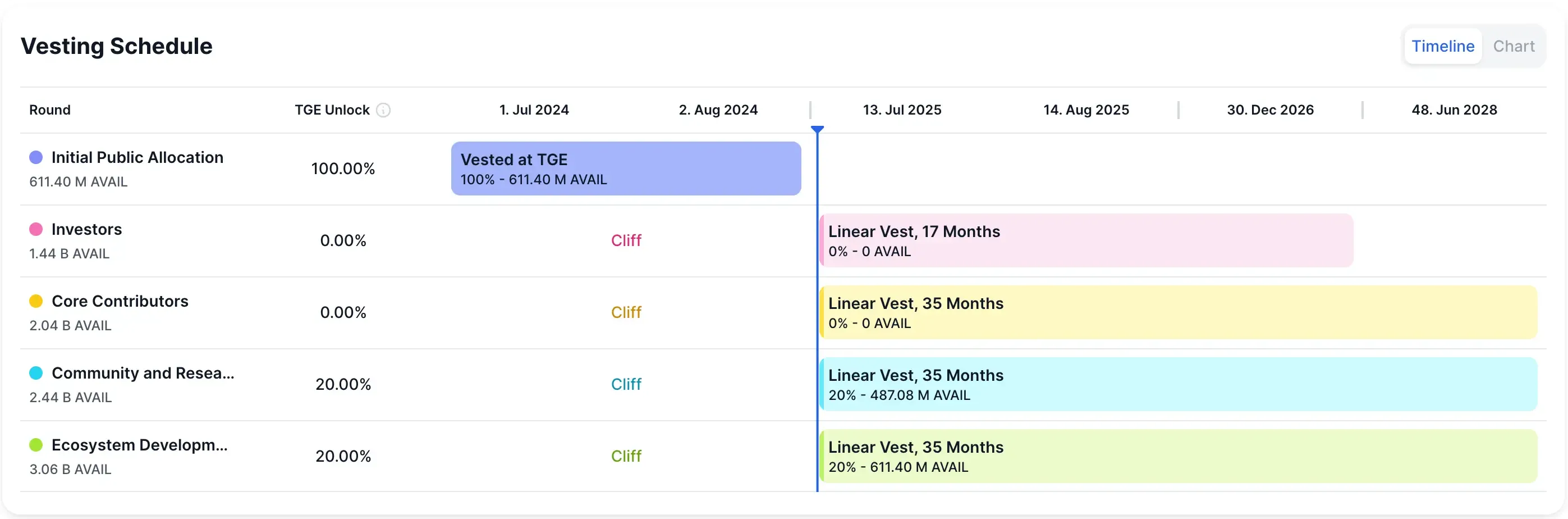

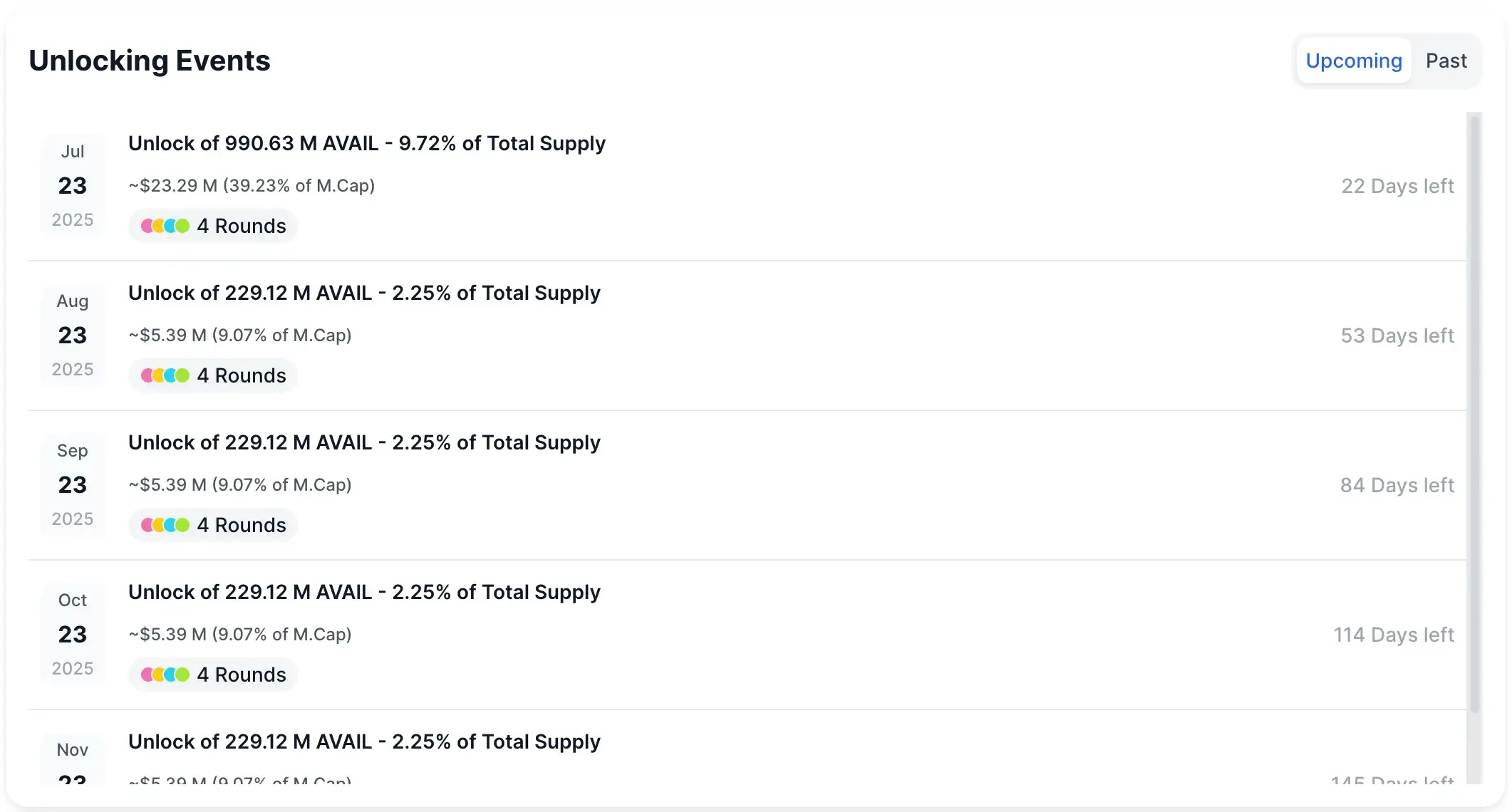

Avail (AVAIL) Unlock Overview

On July 23, 2025, Avail will unlock 972,000,000 AVAIL tokens. At recent prices (~$0.024 each), that’s about $23.6 million in value or 39% of Avail’s market cap.

The token count constitutes 9.24% of Avail’s 10.5B total supply. Crucially, because Avail’s circulating supply so far has been relatively small, this one-time unlock will increase the circulating amount by roughly 55–56%.

It’s one of the most dramatic supply jumps among July’s unlocks.

Vesting sources

This event aligns with Avail’s one-year post-TGE cliffs for major stakeholders. Avail’s network launched and held its public token generation event in July 2024 (the token’s all-time high occurred on July 23, 2024). Thus, July 2025 marks 12 months since TGE, when core contributors (team) and early investors likely see their first vesting release.

According to allocation data, 20% of supply was allocated to Core Contributors and ~14.1% to Investors, with initial cliffs of 1 year. Indeed, none of the team or investor tokens have been unlocked to date (0% unlocked so far in those buckets), implying the first tranches unlock now.

In addition, a portion of Ecosystem Development (30% supply) and Community & Research (23.9% supply) allocations may also be vesting. Avail’s tokenomics suggest these categories had small percents unlocked at TGE and the rest vesting over time (the public sale initial float was 6% of supply).

The July 23 unlock is described as “4 rounds” unlocking, indicating multiple allocation categories releasing tokens together. It’s reasonable to infer those rounds include team tokens, investor tokens, and perhaps portions of the ecosystem and community allocations that were scheduled at the one-year mark.

Supply impact

Prior to this event, only about 20–25% of AVAIL’s supply was circulating (approx 2.1–2.5B out of 10.5B). The 972M unlocked will push circulating supply well above 3 billion, a ~55% jump. In terms of circulating market cap, that’s dilutive unless demand expands correspondingly.

One silver lining is that these tokens are earmarked for productive uses (development, research, etc.) – not all are purely investor profit. Some could be used to incentivize network activity or fund ecosystem grants. Nonetheless, the immediate effect is a large increase in available supply.

Traders will be watching liquidity closely: Avail is still a relatively small-cap project (ranked ~500 by market cap before unlock), so an additional $23M of potential sell-pressure could be significant. It’s also notable that Avail’s unlock schedule continues past July – for example, another unlock is expected in late 2025, meaning the token will experience periodic inflation beyond this initial spike.

On-chain and community signals

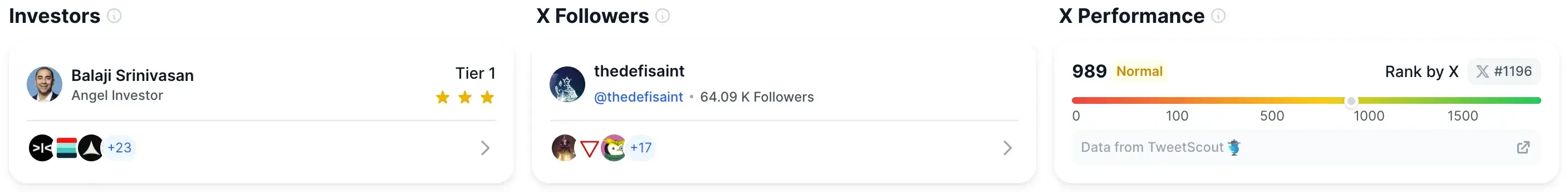

Avail is a modular blockchain network incubated by Polygon, and its community is highly attuned to token economics. Many Avail holders have likely anticipated this event, given public token unlock calendars have listed the date. The key question is how those unlocked tokens will be handled.

If core contributors hold a significant portion, their distribution strategy matters – a coordinated sell-off would erode community trust, while a measured approach (or recommitment of tokens to long-term locks or staking) could reassure investors. Similarly, investor tokens coming online (from seed/strategic rounds) may head to exchange order books.

On-chain, watchers will look at addresses associated with Avail’s foundation and investor wallets. Any movements of large AVAIL sums into known exchange wallets (or to Polygon’s bridges, if investors move tokens cross-chain for sale) will be seen as bearish. Conversely, announcements of those tokens being used for ecosystem growth (e.g., liquidity programs, or vested to new validators as stake) could offset negativity.

Sign (SIGN) Unlock Overview

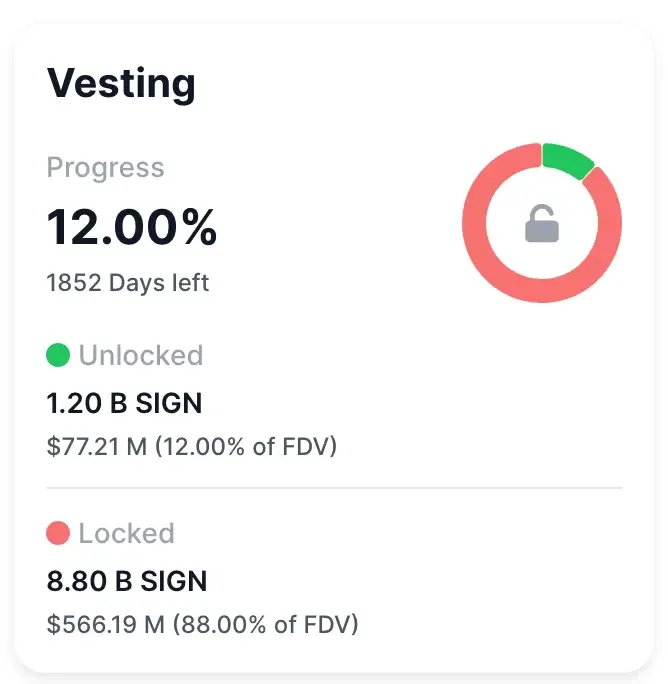

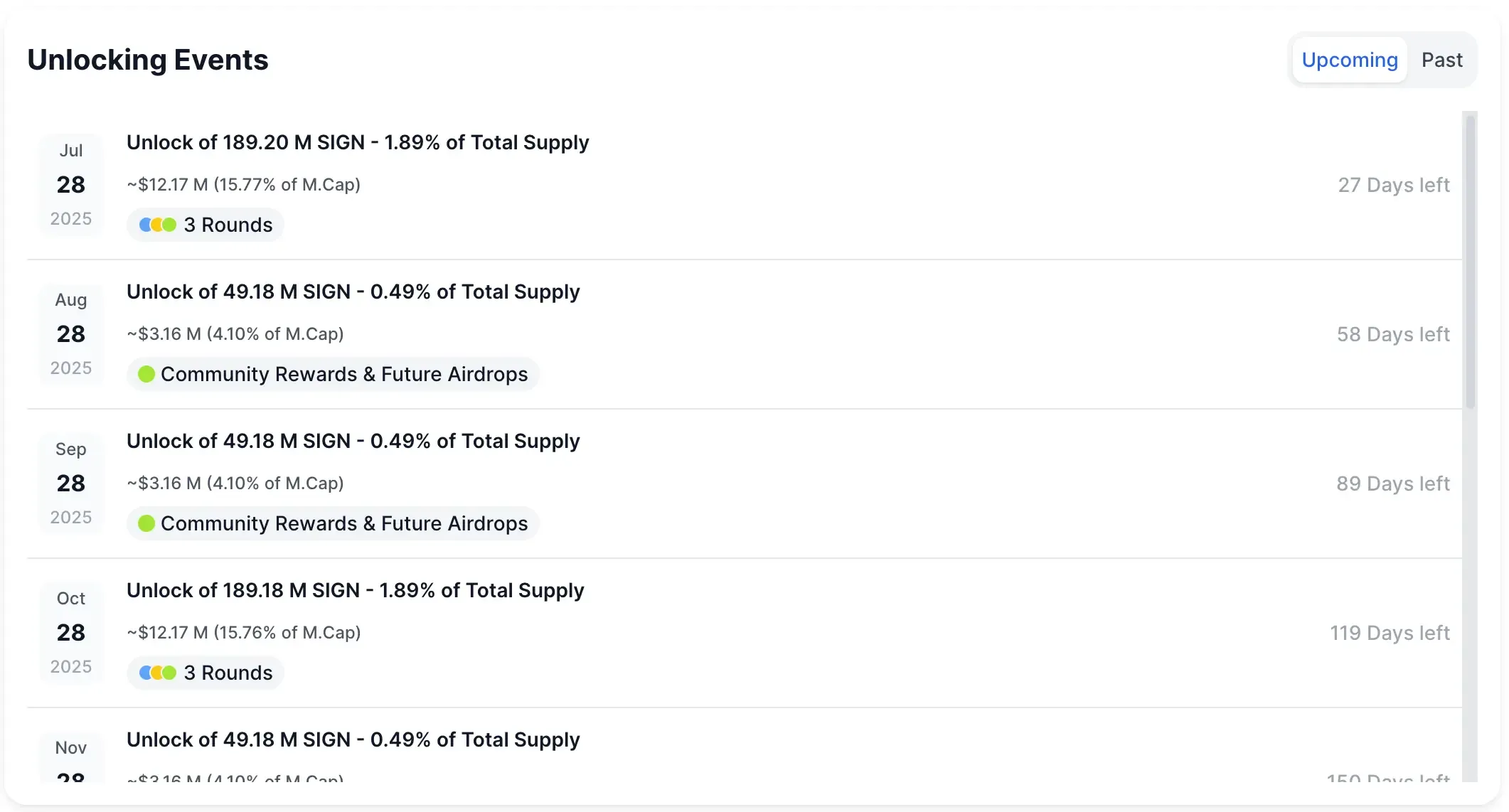

Sign will have its first major token unlock on July 28, 2025, releasing 189.17 million SIGN tokens. That’s roughly $12.3 million in value at recent prices (~$0.065) and equals 15.8% of Sign’s market cap. The unlocked amount is 1.89% of Sign’s 10B max supply.

While 1.89% may sound small, remember that Sign launched just in April 2025 with only 12% of tokens initially circulating – this unlock adds about 16% more to the tradable supply (increasing it from 1.2B to ~1.39B tokens).

Vesting sources

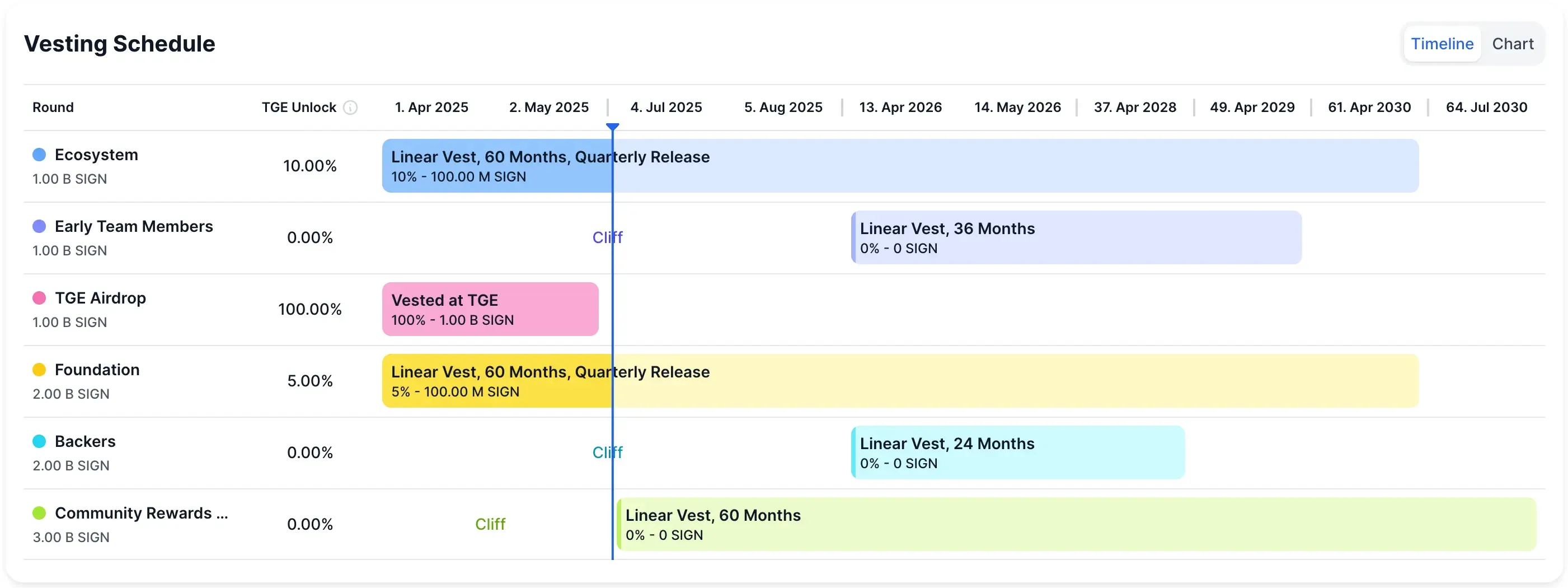

The July unlock likely involves private sale “Backers” and possibly Foundation/Ecosystem allocations hitting their first vesting milestones.

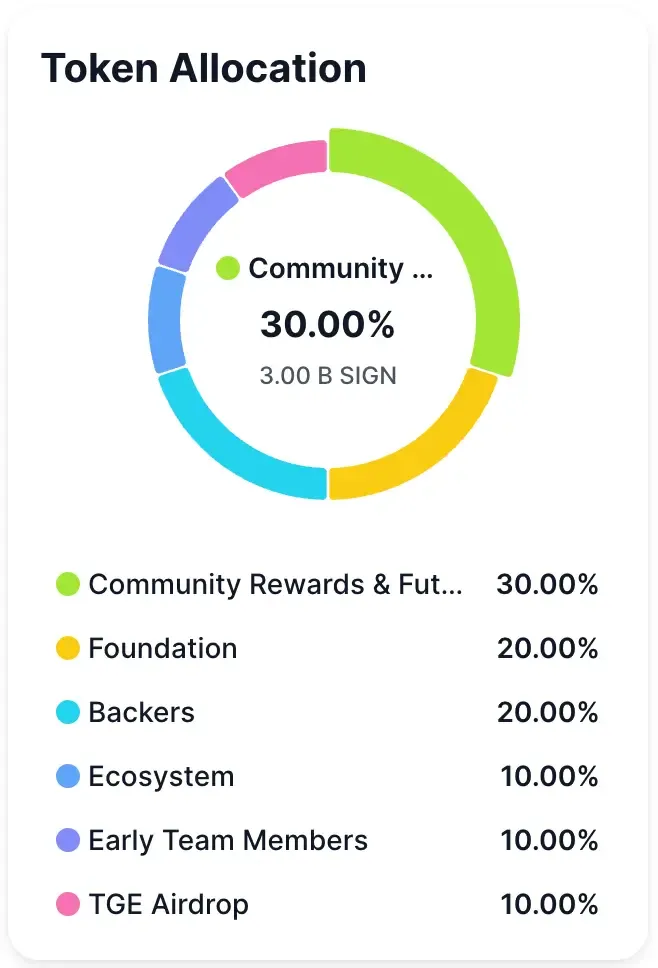

Sign’s token allocation includes 20% to Backers (investors), 20% to the Foundation, 10% to Early Team, 10% to Ecosystem, and 30% to Community Rewards/Airdrops.

At TGE (Token Generation Event on Apr 28 , 2025), Sign had a relatively high initial circulation (12%) due to a large airdrop (10% of supply) distributed immediately. Additionally, small portions of Foundation and Ecosystem tokens (around 1% of supply each) were unlocked at launch for liquidity and initial operations.

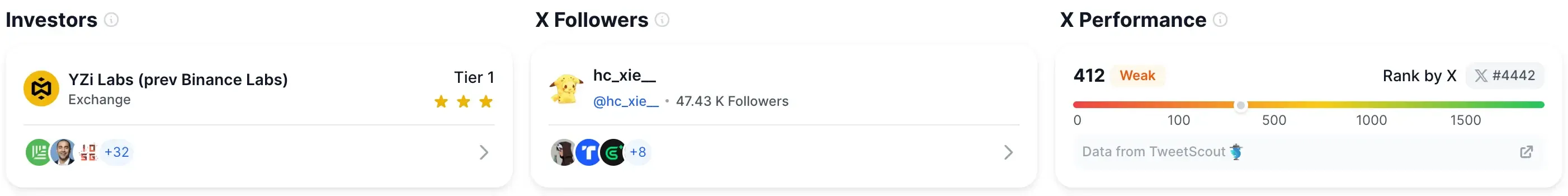

However, backer (investor) tokens and team tokens were fully locked at TGE. Given typical vesting, many projects give investors a short cliff (3–6 months) before a partial unlock. It appears Sign’s private-round investors (which include big names like Sequoia Capital and Binance Labs’ YZi fund) may have a 3-month cliff, allowing a first portion of their 20% allocation to vest in late July 2025.

The foundation and ecosystem tokens might also have periodic unlocks; the fact that 1% was unlocked at TGE suggests a linear or staged release thereafter (possibly quarterly). The Sign team (Early Contributors) likely has a longer lock (often 1 year), so the Early Team’s 10% is probably still fully locked until 2026 – meaning July’s unlock should not include team tokens, focusing instead on investor and ecosystem distributions.

The data calling this “Unlock 3 rounds” hints that three categories are unlocking:

- Foundation treasury

- Ecosystem fund

- Backer (investor) tokens

Supply impact

Sign’s circulating supply will rise from 1.2B to ~1.39B tokens, about a 15% increase in one go.

The project’s fully diluted value (FDV) is large ($650M), but its actual market cap is around $80M pre-unlock. A $12M unlock relative to an $80M cap is considerable.

The situation is somewhat similar to LayerZero’s: a new token with a relatively low initial float sees its first injection of investor-held coins.

One mitigating factor is that Sign’s initial float (12%) was higher than many projects’, so liquidity is not extremely thin. Also, Sign’s token has utility in its ecosystem – for credential verification services and on-chain governance in the Sign network.

If the foundation uses some unlocked tokens to grow the network (e.g., incentive programs on their TokenTable platform or rewards for “Orange Dynasty” community members), those tokens might not directly hit exchanges.

Still, the first investor unlock is often when early backers secure profits. Some backers bought in as early as 2021–2022 (seed round: $12M raised in March 2022), likely at a fraction of today’s price. Even a partial unlock could yield hefty ROI for them (Sign’s listing price was $0.0629, and it’s modestly above that now).

Thus, one should expect some of this supply to seek an exit.

On-chain and community signals

Because Sign is a multichain token, tracking on-chain flows might be a bit complex. However, Binance Research helpfully published the wallet addresses for major token buckets at TGE.

For example:

- the Private Investors allocation was held at Ethereum address

0x5a09Da2877b8ADd7aBf15155675a5d173e1ed6B5 - the Foundation at

0x5050D06e2C9Ee6d2F27c2AF97e0b45cc9b1e0cBD

Watching those addresses around late July can provide early warning if tokens move (e.g., large outbound transfers to exchange deposit addresses or to other wallets).

The Sign community, branded as the “Orange Dynasty,” has a strong long-term ethos (the project touts real-world adoption and significant revenue in 2024). Many are aligned with the project’s vision and might buy dips caused by unlock selling. That said, sentiment acknowledges the unlock: community discussions revolve around whether Binance Labs (now YZi Labs) or other VCs will take profit or hold.

The Sign team might try to soften the impact by, say, announcing new partnerships or product launches around the time of unlock (good news can help absorb selling). They’ve also emphasized that they generated $15M revenue last year – signaling fundamental strength.

For traders, the prudent approach is to monitor liquidity pools and order books in the days around July 28. Any sudden supply influx could temporarily push SIGN’s price down.

Key Takeaways

Token unlocks are a double-edged sword

They are known events (often scheduled from genesis), so markets have time to price them in. However, the actual moment of unlock still introduces a surge of liquidity that can depress prices if not met by equal demand. In July 2025’s cases, each of these five projects is seeing a supply increase of 15% to nearly 60% of the circulating amount – a significant dilution that puts downward pressure on price in the short term if holders sell immediately.

Vesting sources matter

Understanding who is getting these newly unlocked tokens is key. Team and foundation unlocks might be less immediately harmful if those tokens are used for ecosystem growth or held long-term.

In contrast, early private investors often seek ROI, so unlocks from investor rounds (like LayerZero’s VCs or Sign’s backers) are more likely to hit the market.

For instance, LayerZero’s monthly unlocks are largely investor/team tokens, and indeed we saw selling pressure right as the first unlock occurred. By contrast, an unlock allocated to a DAO treasury or community fund could even be positive if used to incentivize network activity (though it still increases liquid supply).

On-chain analytics provide early warning

Many in the crypto community track token unlocks through dashboards and will be watching whale wallets and vesting contracts as D-day approaches.

Spikes in exchange inflows of these tokens, or movements from project treasury wallets, can signal impending sell pressure. All five projects discussed have known allocation wallets (often multisigs) – their activity around the unlock dates will be scrutinized. Projects that communicate and even pre-announce what will happen with unlocked tokens tend to fare better in maintaining investor confidence.

Market impact is context-dependent

The broader market conditions of July 2025 will influence how these unlocks play out. If we’re in a strong bullish trend, new supply might be easily absorbed (or even eagerly bought by new investors). Conversely, in a weak or sideways market, these unlocks can become catalysts for price drops as traders front-run anticipated selling.

Long-term vs. short-term holders

Finally, token unlocks test the conviction of long-term holders. Projects with strong fundamentals and community (and tokens with real utility) can recover after an unlock-induced dip as believers accumulate cheap tokens.

All five projects here have credible use-cases – Solv in DeFi asset management, deBridge in cross-chain infrastructure, LayerZero in omnichain messaging, Avail in modular blockchain scaling, and Sign in decentralized identity and token distribution.

Long-term value investors will be watching for overreactions to these unlocks as potential entry points. Meanwhile, short-term traders may play the volatility.

As always, transparency and communication from the project teams around these events can help stabilize their token’s performance. Investors should stay informed via official channels and independent data trackers to navigate the influx of supply in July 2025.

👉 Always fresh info on vesting schedules: https://dropstab.com/vesting