Crypto

Machi Big Brother One of the Most Watched On-Chain Traders

Machi Big Brother, aka Jeffrey Huang, is a polarizing force in crypto—NFT whale, DeFi pioneer, and controversy magnet. From multi-million dollar trades to legal showdowns, his every move shakes markets and stirs debate.

Quick Overview

- Taiwanese-American rapper turned crypto whale, known for bold bets and big losses

- Founder of Mithril and Cream Finance; major NFT trader and Blur airdrop recipient

- Famously clashed with ZachXBT over embezzlement claims (later settled)

- Accused of market manipulation via massive NFT dumps and token farming

- Lost millions on $FRIEND and $PUMP, yet continues doubling down

- His wallet activity influences DeFi and NFT markets, tracked by top analysts

- Fans see him as a visionary; critics call him reckless — either way, he's watched closely

Table of Contents

- 1. Who Is Machi Big Brother

- 2. Key Projects and Achievements in Crypto

- 3. Public Appearances, Initiatives, and Controversies

- 4. Community Perception of Machi Big Brother

- 5. Market Influence

- 6. How to Track Machi Big Brother’s Transactions (via Drops Bot)

- 7. Why Machi Big Brother Matters — And Whether You Should Track Him

Who Is Machi Big Brother

Machi Big Brother (real name – Jeffrey Huang) is a Taiwanese-American music producer and entrepreneur who became known in crypto circles under this pseudonym. In the 1990s, Huang rose to fame as a member of the hip-hop group L.A. Boyz, later founding his own entertainment business in Taiwan.

The pseudonym “Machi Big Brother” (translated from Chinese “麻吉大哥” – “Big Brother Machi”) refers to his stage persona and the “Machi” brand. Since 2017, Jeffrey Huang has actively shifted his focus to cryptocurrencies and decentralized finance, where he assumed a new role as a crypto influencer and investor.

Key Projects and Achievements in Crypto

Machi Big Brother has established himself as a pioneer in DeFi and a notable player in the NFT market. Below are the key projects and initiatives associated with Huang:

Mithril (MITH)

A blockchain-based social media platform (launched in 2017) that rewarded content creators with its native token, MITH. The project’s launch was one of the most successful in 2017, but interest in it significantly declined over time.

Cream (CREAM)

A DeFi lending protocol launched in 2020 as an “open financial system” built on smart contracts. It incorporated ideas from Compound, Balancer, Curve, and other platforms, and collaborated with Andre Cronje (Yearn Finance). Despite a strong start, the protocol faced multiple exploits in 2021–2022 but made a notable contribution to the evolution of DeFi.

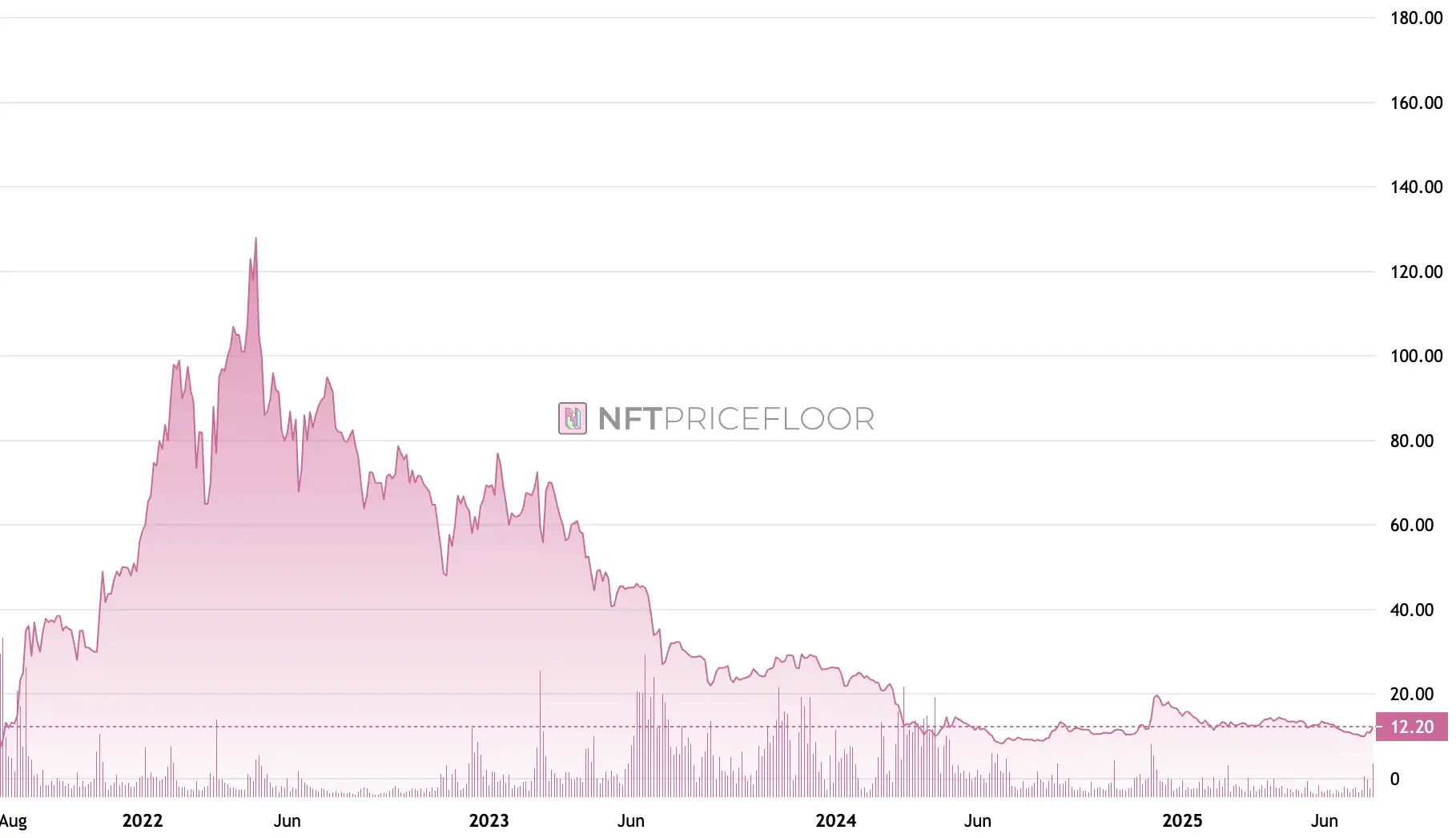

NFT Collections and Trading

One of the largest collectors of Bored Ape Yacht Club and other top-tier NFTs. In February 2023, Huang received a large Blur token airdrop due to his trading activity and sold 1,010 NFTs within 48 hours — reportedly the “largest NFT sell-off in history.” He actively used the Blur Blend platform for NFT-backed lending, becoming its largest lender with 58 loans totaling 1,180 ETH.

BobaOppa (BOBAOPPA)

A meme token on Solana, launched in March 2024. It raised approximately $40 million in SOL during its presale, but its price fell by ~74% immediately after launch — turning a $10,000 investment into $129. Machi referred to it as a “dump-and-pump” token, hinting at a rebound strategy following the initial crash. The project sparked serious controversy and criticism.

More recently, other Solana meme tokens have seen renewed liquidity and market interest—especially following Pump.fun’s $1.7M injection via the Glass Full Foundation, which deployed capital transparently across ten tokens to strengthen the broader ecosystem.

Machi Project (MACHI)

A new initiative launched at the end of 2024 — the release of the MACHI token on the Blast blockchain. The project proposes a “fair” liquidity raise of $5 million through a Baseline Value event instead of a traditional token sale. Special terms were offered to holders of Ape NFTs and other collections. The initiative immediately attracted large investors with a declared capital of up to $125 million and is positioned as a long-term project. However, the community remains cautious due to Machi’s past record.

Other Activities

In addition to the projects mentioned above, Machi Big Brother experimented with an algorithmic stablecoin (Mithril Cash, 2020), launched mobile apps for crypto enthusiasts, and continues to actively invest in various tokens. His financial means have enabled significant personal acquisitions — for example, Huang reportedly purchased a mansion in Los Angeles for $25 million, underscoring his status as a major capitalist in the crypto world.

Public Appearances, Initiatives, and Controversies

Social Media Activity

Machi Big Brother regularly maintains an account on the X platform under the handle @machibigbrother. He has around 170,000 followers and often shares his market views, announces new projects, and posts the results of his own trades.

For example, Huang publicly discussed the decline in the Blur token price in a community chat, expressing dissatisfaction with the price drop, and also humorously introduced the BobaOppa character through cartoon videos. His direct communication style and active engagement make him a prominent figure on “crypto Twitter.”

Conflict with Investigator ZachXBT

One of the most high-profile episodes was the clash between Machi Big Brother and independent crypto sleuth ZachXBT. In June 2022, ZachXBT published an exposé titled “22,000 ETH Embezzled and Over Ten Projects Failed: The Story of Machi Big Brother,” alleging that Huang had embezzled 22,000 ETH (~$37M) from the Formosa Financial project (ICO in 2018) and was connected to several failed crypto ventures.

Machi vehemently denied the allegations. In summer 2023, Huang filed a defamation lawsuit against ZachXBT in a Texas state court, calling the article deliberately false. The lawsuit triggered a mixed reaction from the community: many viewed it as an attempt to silence a critic. Leading industry figures rallied in support of ZachXBT — more than $1 million in donations for his legal defense were raised in under 24 hours, including contributions from Binance CEO Changpeng Zhao and Kraken co-founder Jesse Powell.

Eventually, in August 2023, both parties announced an amicable resolution. ZachXBT edited the article to include Huang’s responses, and Machi Big Brother withdrew his lawsuit. Huang publicly acknowledged that taking the legal route was “a misstep,” while also recognizing ZachXBT’s contribution to the community. Despite the formal reconciliation, the incident damaged Machi Big Brother’s reputation and reignited doubts about his past projects.

It’s important to note that ZachXBT’s allegations were never proven in court, and the most serious claims were later removed from the article.

Other Controversial Episodes

Within the NFT community, Huang has also been discussed in the context of market manipulation. His mass sell-off of BAYC tokens in February 2023, according to some analysts, triggered a drop in the Bored Ape Yacht Club floor price amid his attempts to farm Blur tokens.

In addition, Machi actively promotes his own initiatives (such as Boba Oppa or the MACHI token), which are sometimes viewed with skepticism. For instance, the launch of Boba Oppa was accompanied by accusations that Machi was profiting off meme-coin hype while retail investors suffered losses. Huang has responded by saying that his approach is “different” and focused on long-term strategy, though discontent among part of the audience remains.

Volatile tokens like Boba Oppa are part of a broader Solana pattern, where SOL frequently decouples from ETH around key market events — a trend explored in Solana–Ethereum correlation volatility research that traders like Machi look to exploit.

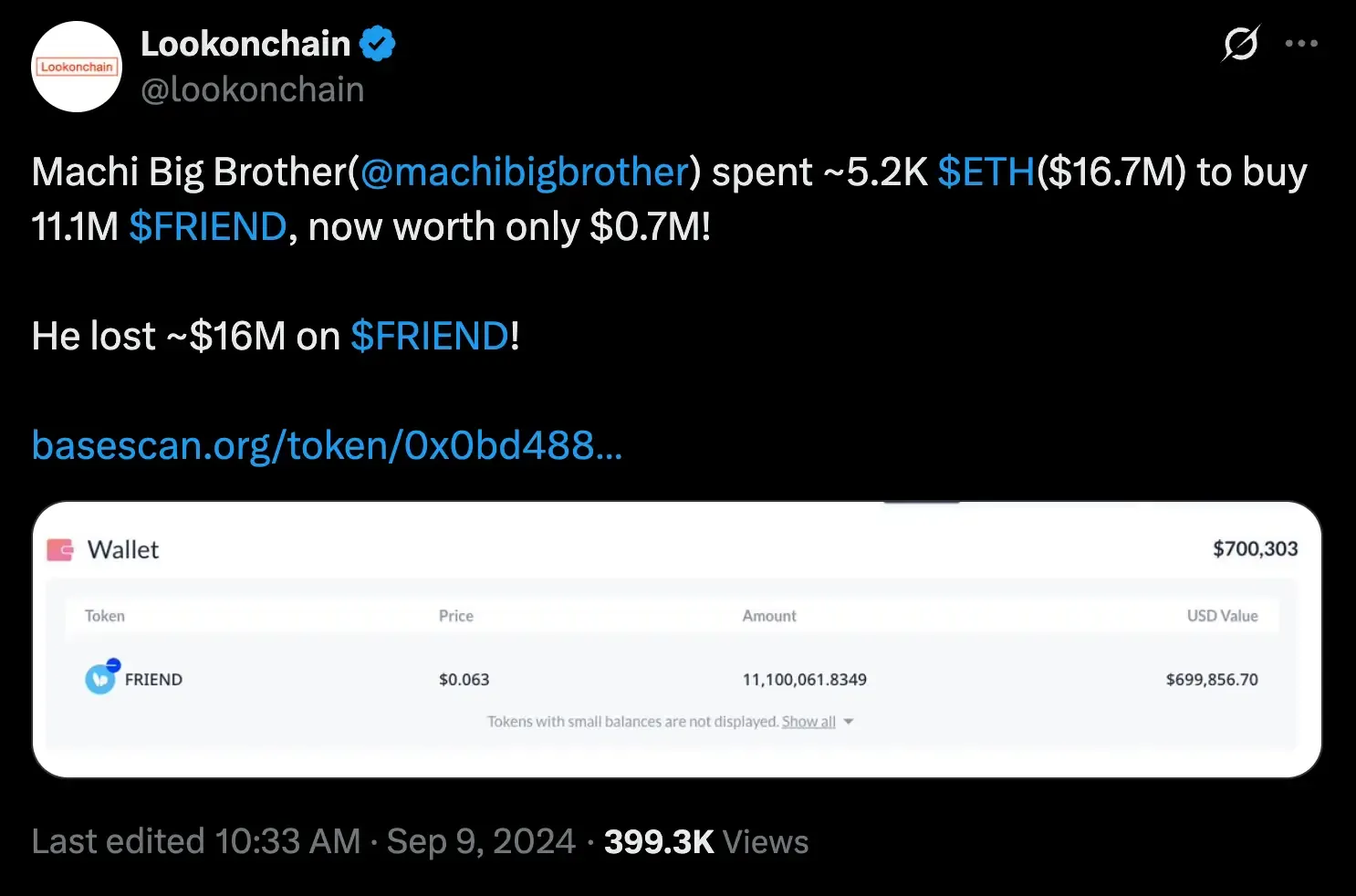

Another major example of alleged manipulation was the collapse of the Web3 social network Friend.tech in 2024, with Machi Big Brother being the largest holder of the $FRIEND token.

As noted by @lookonchain, Machi Big Brother spent approximately 5.2k ETH ($16.7M) to acquire 11.1 million $FRIEND, which is now worth only $0.7M — resulting in a ~$16M loss on $FRIEND.

Community Perception of Machi Big Brother

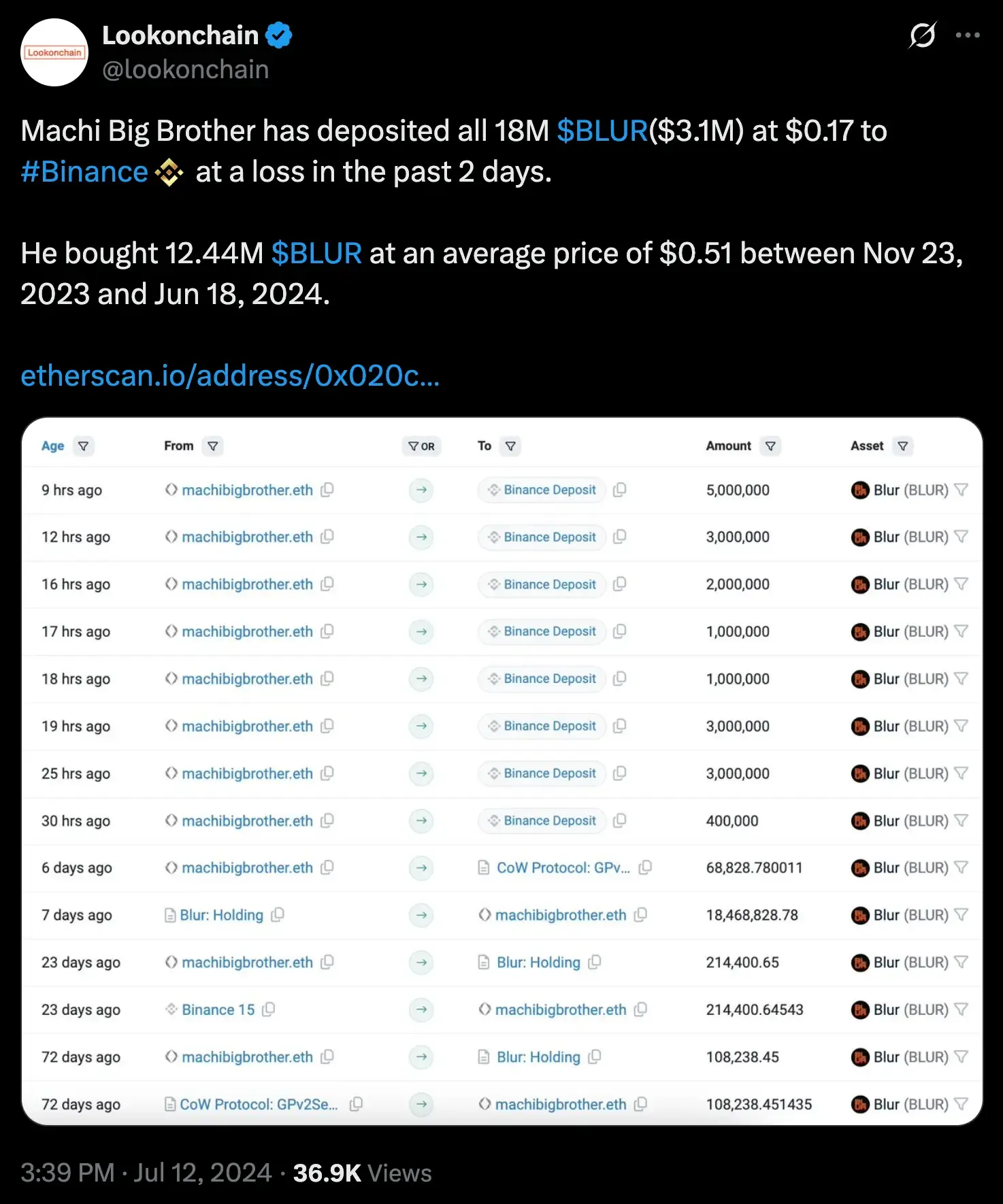

Within the crypto community, Huang is recognized as a major whale investor: his trades are closely tracked by on-chain analysts and often make headlines. For example, in July 2024, media reported that Machi’s wallet transferred 18.4 million BLUR tokens (~$3.13M) to Binance, causing the BLUR price to drop by 7%.

As noted by @lookonchain, Machi Big Brother deposited all 18 million $BLUR tokens ($3.1M) to Binance at a price of $0.17, resulting in losses. From November 23, 2023, to June 18, 2024, he had acquired 12.44 million $BLUR at an average price of $0.51.

Such large-scale movements lead traders to monitor Machi’s actions closely. His participation in the NFT sector is another influential factor: Huang’s major NFT purchases or sales can swing the collectibles market (e.g., the aforementioned sale of 1,010 NFTs, which flooded the market with new supply).

On the other hand, reputational risks and criticism continue to follow Machi Big Brother. Following ZachXBT’s exposé, many began to view Huang with caution. Crypto Twitter frequently features skeptical remarks that reference the missing 22k ETH or failed projects associated with him.

The name Machi Big Brother has become associated with a “serial founder” launching numerous projects with varying levels of success. Nevertheless, Machi retains a base of supporters — particularly among those who value his contributions to DeFi (Cream Finance) or share his enthusiasm for NFTs. As a former music celebrity, he also has loyal fans in the Asian region who defend him in online debates. However, within the English-speaking crypto sphere, Machi is often seen as a wealthy speculator: tracking his moves is interesting and useful for gauging market sentiment, but few regard him as a role model or reliable source of financial guidance.

Market Influence

Machi Big Brother can rightly be considered a market indicator in certain crypto niches. His actions — whether opening a major position, selling an NFT collection, or launching a new token — are often accompanied by significant price movements and widespread discussion.

“Even Machi Big Brother loses money in this market,” said X user @ai_9684xtpa. “In the past hour, Machi Big Brother closed at 1,229 ETH and lost $80,000. His remaining long positions in $ETH/$PUMP/$HYPE still carry a floating loss of $8.711M.”

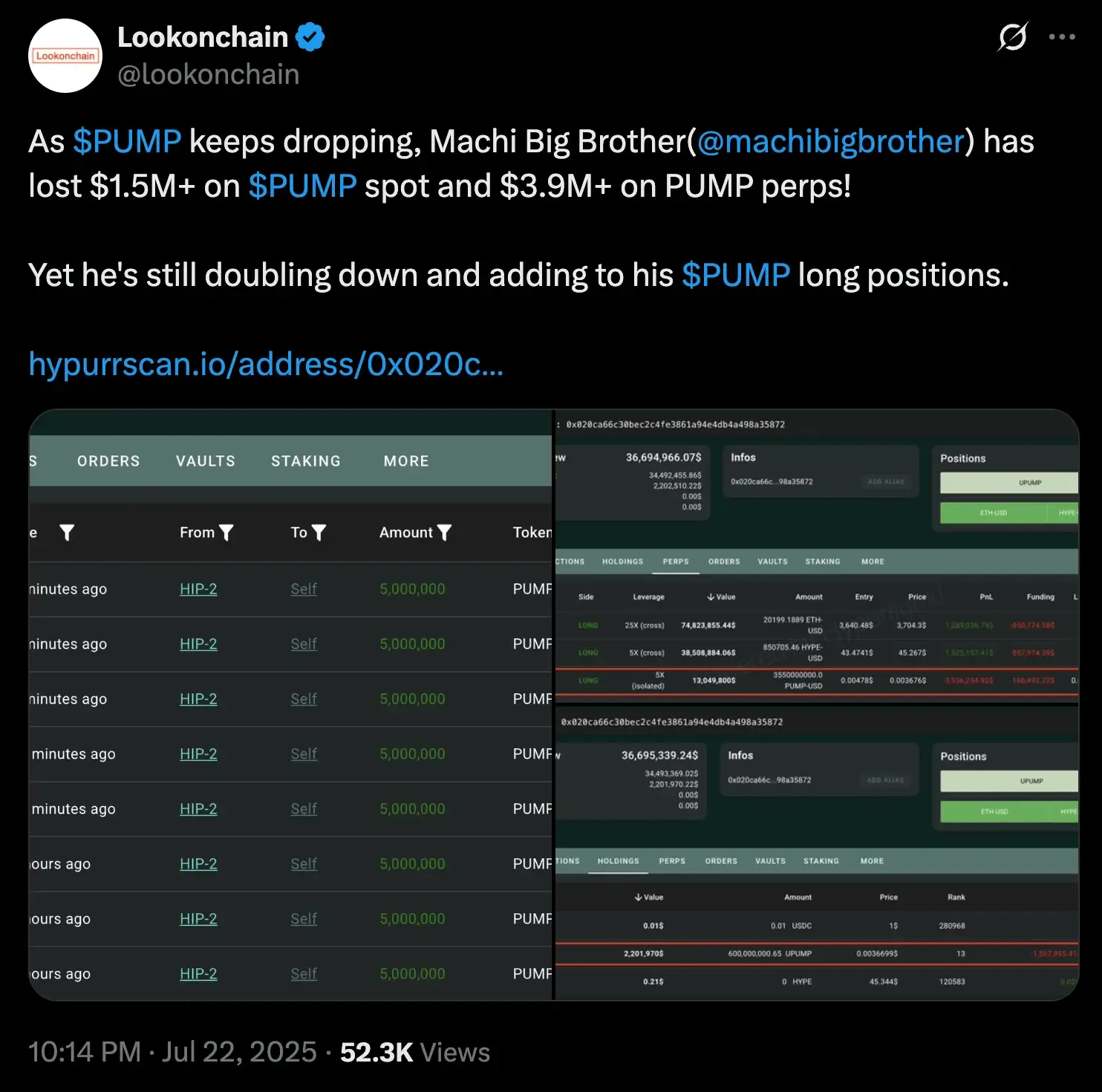

For instance, Huang is known for aggressive trading in illiquid tokens: in 2025, he held multi-million dollar leveraged long positions on the PUMP token despite floating losses exceeding $6 million.

His behavior reflects a growing trend among DeFi-native traders moving toward Perpetual DEX platforms, which offer CEX-like speed with full on-chain control. His wallet activity can be tracked on HypurrScan.

“As $PUMP continues to fall, Machi Big Brother (@machibigbrother) has lost over $1.5M on spot $PUMP and more than $3.9M on derivatives! Nevertheless, he continues to double down and increase his long positions in $PUMP,” shared @lookonchain on X.

These bold bets inspire a mix of admiration and criticism: some users see Machi as a risk-taker who believes in his investments, while others point to recklessness and the “whale effect” that can destabilize markets. Indeed, Machi’s BLUR sell-off in summer 2024 coincided with a price dip, while his NFT dump in 2023 corresponded with a drop in floor prices of top collections.

Thus, Huang has the capacity to influence market liquidity and sentiment, making his moves relevant even to those who don’t personally follow his guidance.

If you want to receive real-time alerts, use the free bot: https://dropstab.com/products/drops-bot

How to Track Machi Big Brother’s Transactions (via Drops Bot)

If you want to monitor the activity of well-known crypto traders like Machi Big Brother, the most convenient tool is the Drops Bot on Telegram. Below is a step-by-step guide to setting up tracking.

Step-by-Step Guide

Launch Drops Bot on Telegram

Go to the link @drops_bot and click Start.

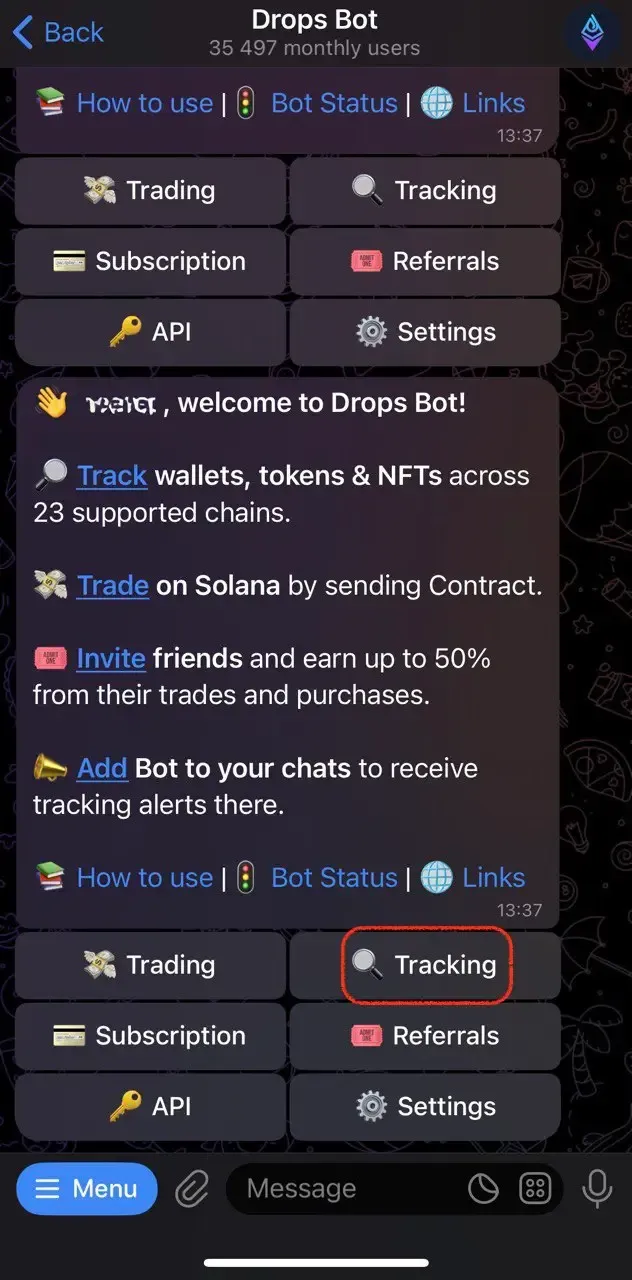

Select the “Tracking” Section

In the main menu, select Tracking — this is the section for monitoring wallet activity.

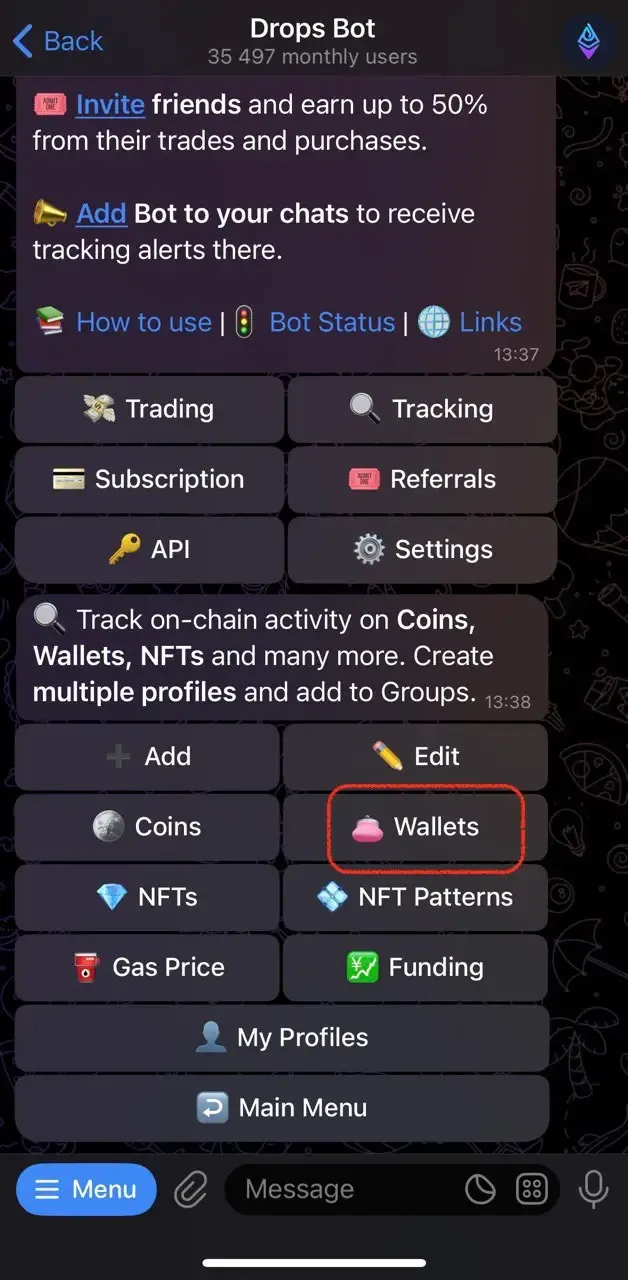

Go to “Wallets”

Next, choose Wallets to manage the addresses you’re tracking.

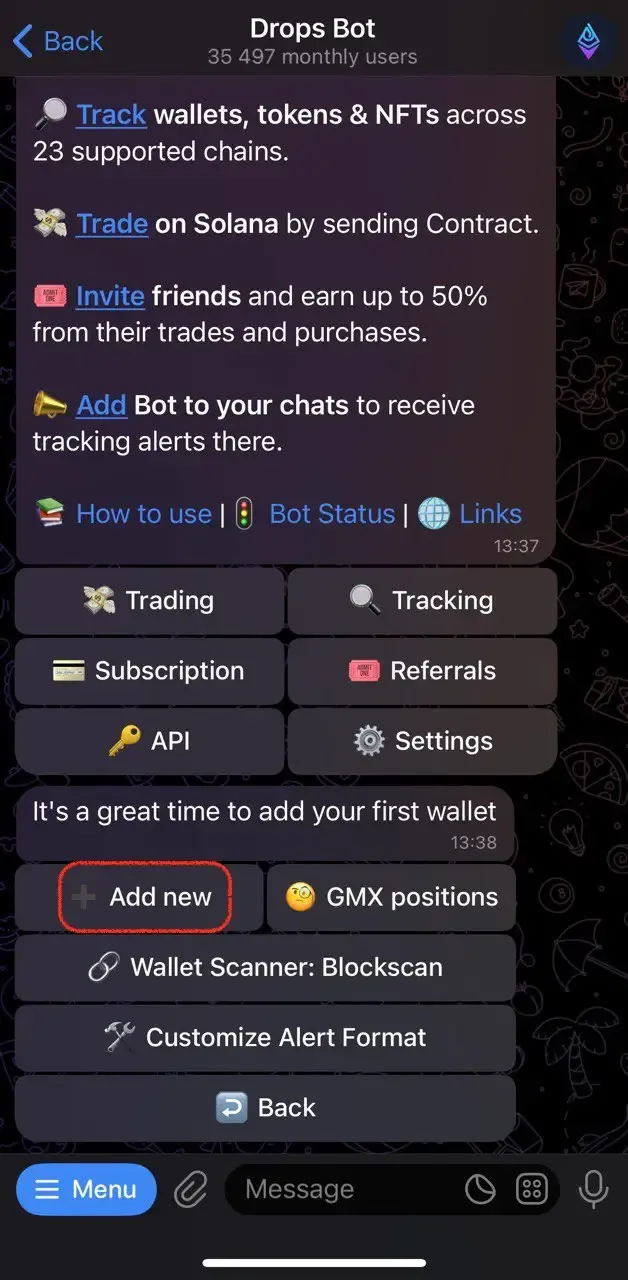

Click “Add new”

The bot will offer to add a new wallet — click the Add new button.

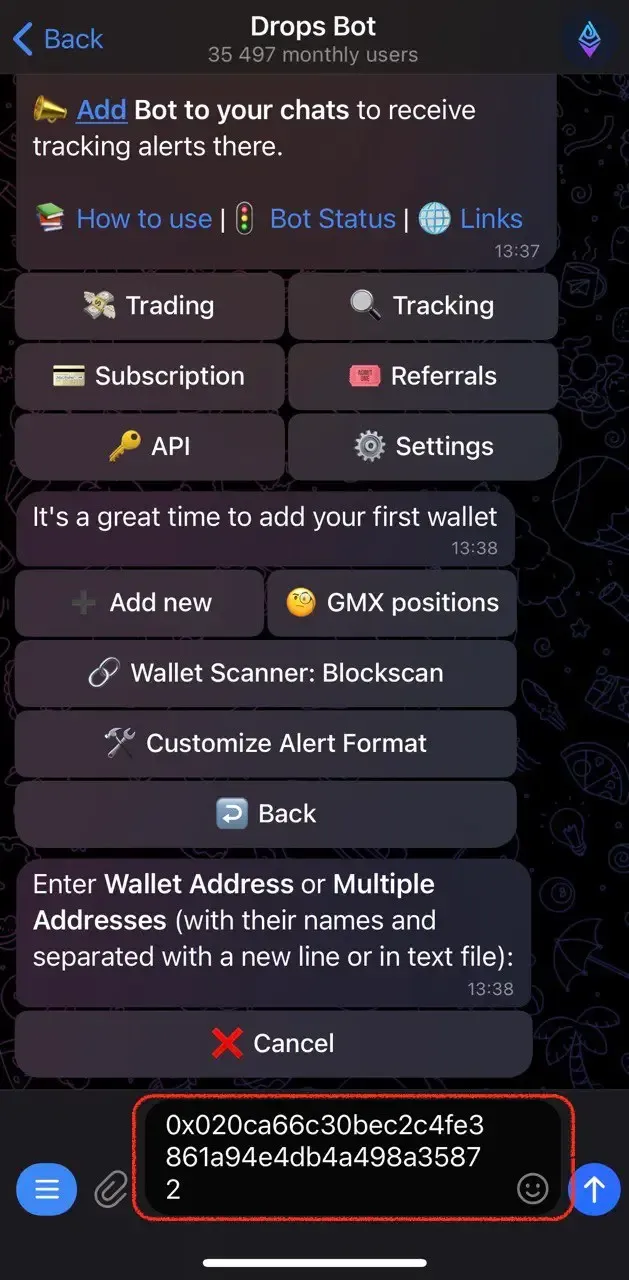

Enter the Wallet Address

Paste Machi Big Brother’s wallet address into the input field:

0x020ca66c30bec2c4fe3861a94e4db4a498a35872

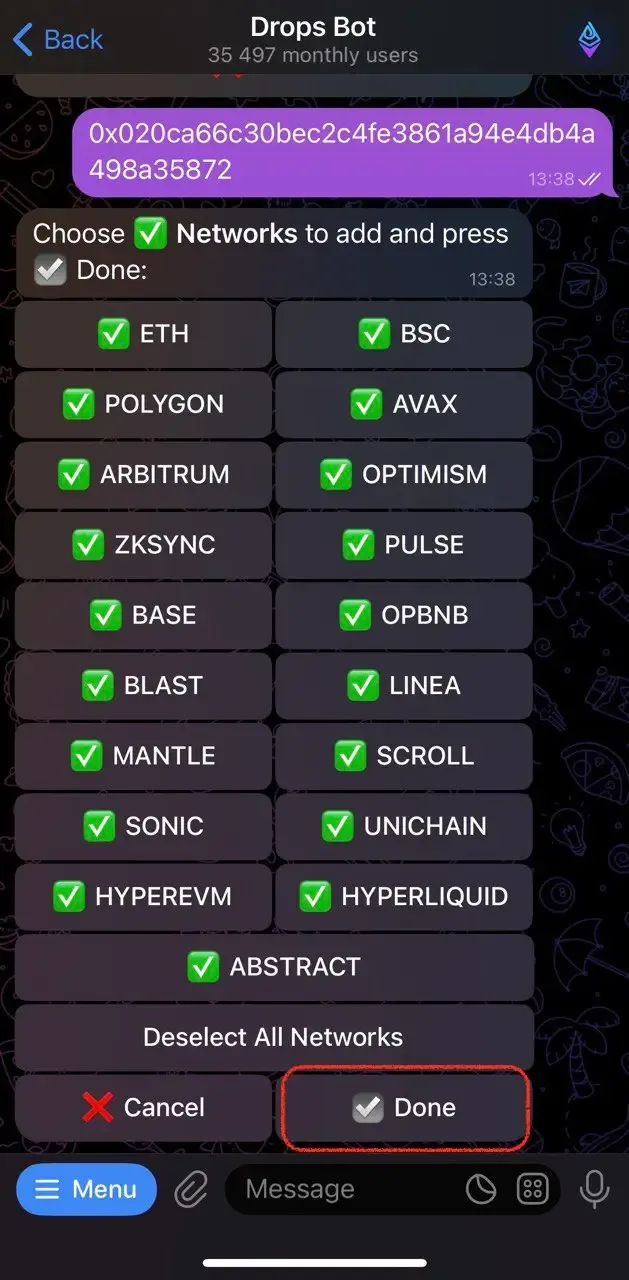

Choose Networks to Track

The bot will show a list of networks — you can leave the default settings and press Done.

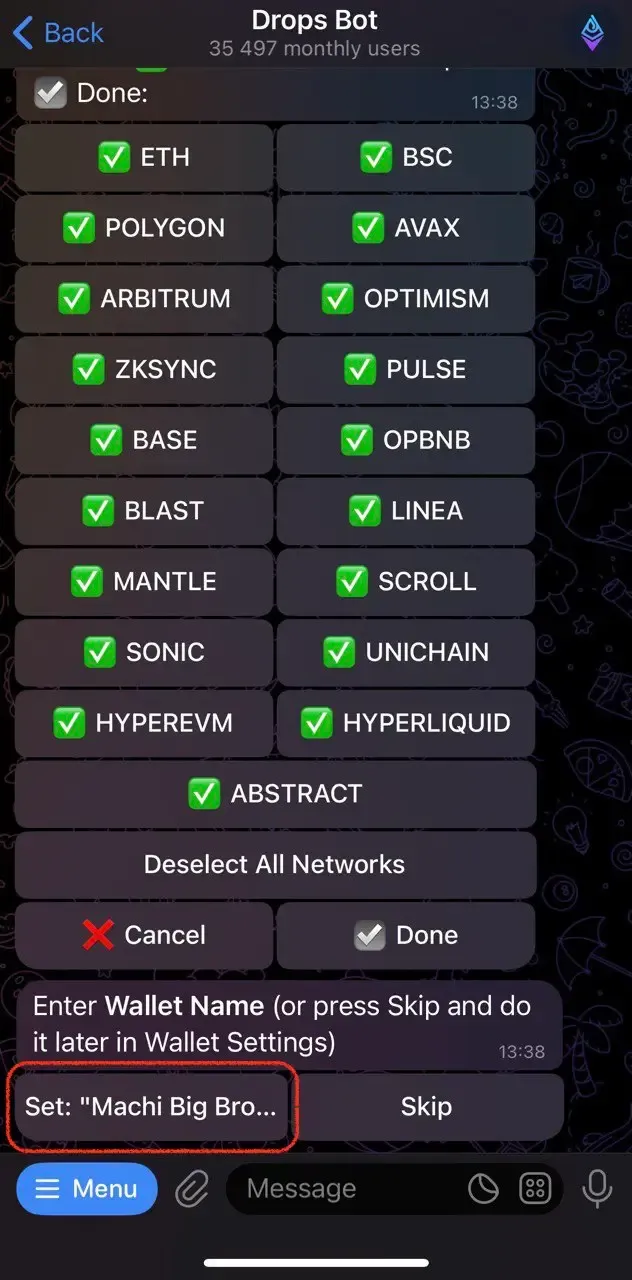

Assign a Wallet Name

Since Machi’s wallet is already known to the system, the bot will suggest the name Machi Big Brother. You can use it or assign your own — the name can be changed anytime in the settings.

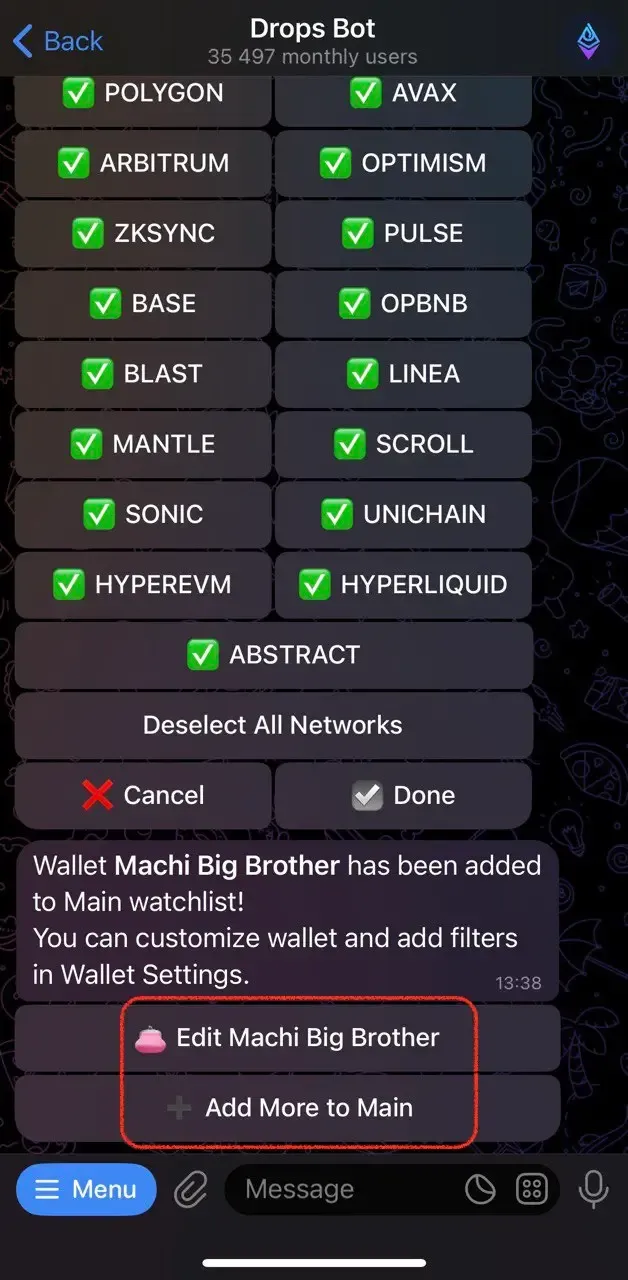

Done!

The bot will confirm that the wallet has been successfully added. You will now receive notifications about all activities from this address: purchases, sales, transfers, and DeFi interactions.

If needed, you can add other wallets, adjust notification settings, or disable tracking anytime through the bot’s menu.

Why Machi Big Brother Matters — And Whether You Should Track Him

By influence and experience, Machi Big Brother is a notable figure in the crypto world, especially at the intersection of DeFi and NFTs. But should the average investor or analyst follow his activity?

From a practical standpoint, tracking Machi can be useful. His large trades and investment moves often signal upcoming market shifts — whether it’s a sharp price movement or the rise of a new trend (such as the hype around Blur, in which Machi played an active role). Subscribing to his account on X and monitoring Machi’s wallets gives you access to “whale behavior” insights. Many analytics services even automatically flag transactions from machibigbrother.eth as significant for the NFT or emerging token markets.

However, blindly following the investment advice or behavior of Machi Big Brother is not recommended. His history shows that even with resources and insider knowledge, he is not immune to mistakes: major losses from farming, failed tokens, and legal controversies are proof of that.

Ultimately, the figure of Machi Big Brother is a reminder that the crypto world often elevates highly unconventional characters — and that the ability to filter information, separating fact from noise, remains a key skill for anyone aiming to navigate this space successfully.

Follow his public portfolio on DropsTab to uncover trends shaped by one of DeFi’s most watched traders — https://dropstab.com/p/machi-big-brother-gh4g2ksb97