Crypto

How Did Machi Big Brother Lose $71M on Hyperliquid? A 2026 Forensic Analysis

The era of the omnipotent whale is over. Jeffrey Huang, known as Machi Big Brother, now faces a severe liquidity crisis following $71M in realized losses on the Hyperliquid DEX. This report conducts a forensic analysis of his degradation from market mover to yield source, dissecting his net worth, the Formosa Financial allegations, and the "gambler's ruin" psychology driving his 2026 collapse.

Key Points

- Liquid crypto assets have compressed to $50M–$80M (Feb 2026), a steep decline from his >$150M peak, driven by aggressive leverage decay.

- Huang realized $71M in losses during Q4 2025/Q1 2026, including 262 individual liquidations in January alone as his "Martingale" strategy failed.

- On-chain forensics confirm a 22,000 ETH treasury withdrawal (June 2018) to wallets linked to Huang, an allegation left unchallenged after he withdrew his lawsuit against ZachXBT.

- The BOBAOPPA token trades at $0.000064, down ~98% from ATH, while his once-legendary BAYC portfolio has been largely liquidated to service margin debt.

- Huang's losses have effectively subsidized the Hyperliquid HLP vault, turning his trading activity into a primary yield source for the protocol's liquidity providers.

- 1. The Catalyst: When Whales Become Yield

- 2. 2026 Portfolio Composition: A Forensic Audit

- 3. The Hyperliquid Meltdown: Anatomy of a $71M Loss

- 4. Historical Controversies: The Pattern of Extraction

- 5. Strategic Verdict: The End of the Whale Era

- 6. How to Track Machi Big Brother’s Transactions (via Drops Bot)

The Catalyst: When Whales Become Yield

‘The market can remain irrational longer than you can remain solvent.’ It is the oldest cliché in finance, yet in early 2026, it has claimed one of the crypto industry's most visible titans.

For years, the "whale" was the predator—an entity capable of moving markets through the sheer gravity of capital. If they bought, the floor rose; if they sold, the retail cohort panicked. Jeffrey Huang, universally known as "Machi Big Brother," was the archetype of this era: a prolific collector of Bored Apes and a brute-force farmer of DeFi yields whose wallet movements were treated as gospel by copy-traders.

But looking through the macro lens of 2026, a structural inversion has occurred. The whale is no longer the hunter; in the high-velocity, transparent arena of decentralized perpetuals (perp DEXs), they have become the prey.

Huang’s recent financial hemorrhage—a realized loss of $71 million on Hyperliquid—is not merely a personal misfortune. It is a signal event. It marks the transition from an era of "smart money" accumulation to an era of "capital toxicity," where large, on-chain positions are ruthlessly hunted by algorithmic liquidity providers. The data is undeniable: Huang has transitioned from being a market mover to becoming a primary source of yield for the protocols he trades on.

This report is a forensic autopsy of that transition. By dissecting the collapse of his "Martingale" strategy, the decay of his asset base, and the lingering shadows of the Formosa Financial controversy, we build a case that Machi Big Brother is currently facing a liquidity crisis that threatens to erase his standing in the digital asset hierarchy.

2026 Portfolio Composition: A Forensic Audit

As of February 9, 2026, the on-chain reality contradicts the social media persona. While centralized exchange balances remain inherently obfuscated, a rigorous analysis of known wallet clusters (specifically 0x020...872 and 0x021...382) suggests a liquid crypto net worth in the $50 million to $80 million range.

This represents a precipitous contraction from his 2022 peak, estimated at over $150 million. The portfolio has degraded not just in value, but in quality—shifting from "blue-chip" spot assets to high-beta, leveraged directional bets.

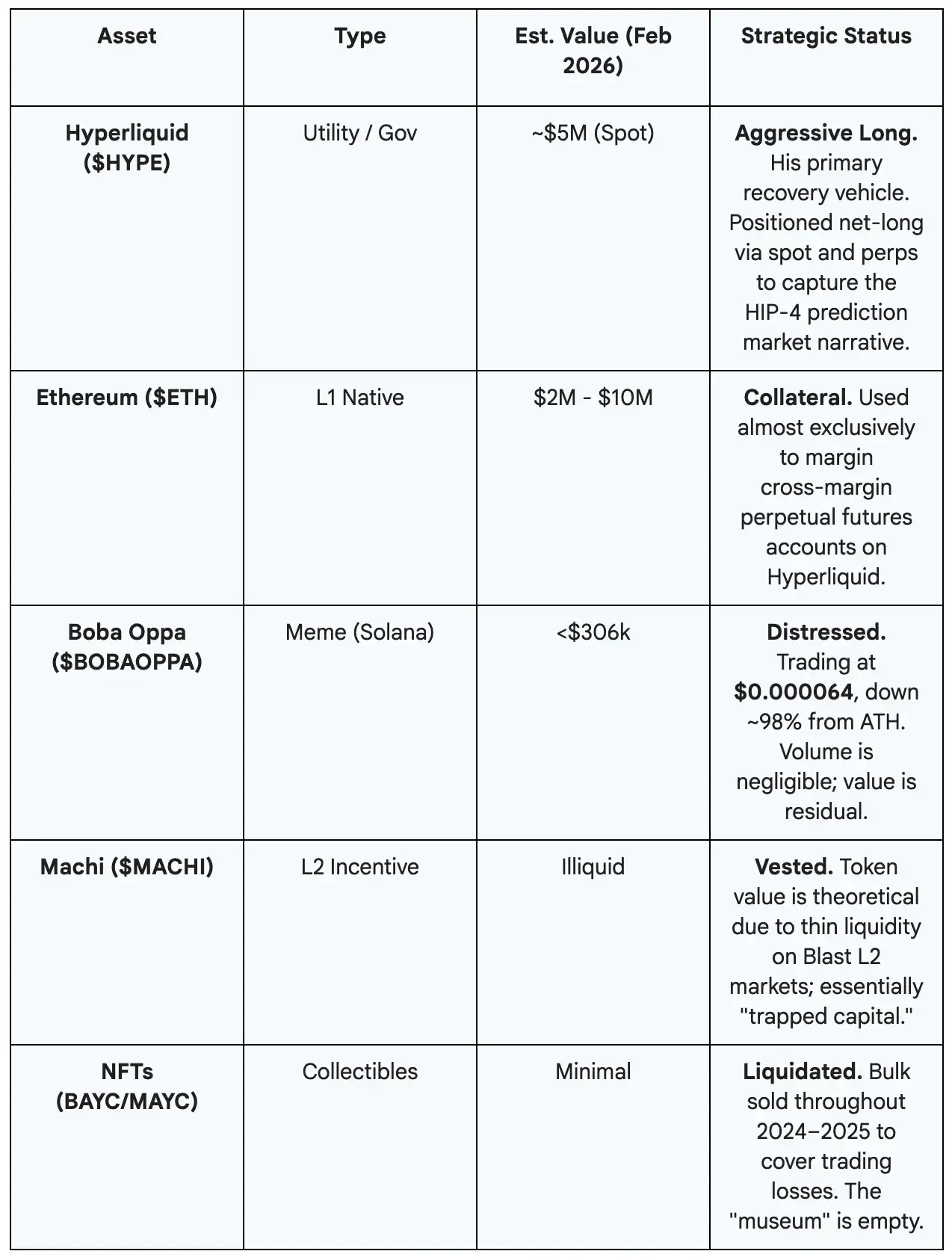

The Asset Matrix: From Blue Chips to Dust

The composition of Huang’s holdings reveals a desperate pivot. The "anchor" assets that once provided stability—hundreds of BAYC and MAYC NFTs—have been systematically liquidated. In their place, we find a portfolio clutter of distressed meme tokens and highly leveraged derivative positions.

The Liquidity Trap

The degradation of Boba Oppa ($BOBAOPPA) serves as a microcosm for Huang’s waning influence. Launched in 2024 with a $40 million presale that capitalized on peak meme mania, the token has suffered near-total capital destruction. With a market cap shrinking to approximately $305,000, the project has become a "zombie chain" asset. For presale participants, this is a catastrophe; for Huang, it is a loss of social capital that makes future fundraising exponentially more difficult.

Furthermore, his $MACHI holdings on the Blast L2 face a liquidity cliff. With the Blast ($BLAST) unlock looming in late February 2026, the liquidity required to exit these positions without crashing the market simply does not exist. Huang is effectively "rich" in tokens he cannot sell.

The Hyperliquid Meltdown: Anatomy of a $71M Loss

If 2024 was the year of NFT capitulation, late 2025 and early 2026 defined Huang’s degradation through derivatives. The primary engine of his net worth erosion is a catastrophic series of failures on the Hyperliquid decentralized exchange.

Forensic analysis of wallet 0x021...382 reveals a trading psychology defined by the "Martingale" fallacy—the practice of doubling down on losing positions in a desperate attempt to lower the average entry price and recover capital.

The Liquidation Spiral (Q4 2025 – Q1 2026)

To understand the magnitude of the collapse, we must look at the timeline. It is not a story of a single bad trade, but a systematic refusal to accept market reality.

- The Catalyst (Oct 2025): The spiral began with a single event—a liquidation that wiped out a $79 million ETH long position. This was the tipping point, inverting his PnL status from a comfortable $44.5 million profit to a deep net deficit.

- The January Massacre (Jan 2026): Amidst high volatility, Huang faced 262 individual liquidations in a single month. The frequency—nearly 9 per day—suggests an automated or high-frequency attempt to catch a falling knife.

- The Martingale Loop (Jan 28, 2026): On-chain logs provide a granular view of the "gambler's ruin." Logs show a deposit of 144,000 USDC, which was fully liquidated that same day. Rather than de-risking, Huang immediately deposited an additional 249,000 USDC to "defend" the same long thesis.

- Cumulative Impact: Aggregated data confirms a total realized loss of $71 million on the platform over the four-month period ending February 2026.

This video provides the necessary educational context to understand why Jeffrey Huang's strategy failed. It explains the mathematical flaws of the "Martingale" system (doubling down on losers) that turned a manageable drawdown into a $71M catastrophe.

Reflexivity Risk: The "Whale Dividend"

Why did an experienced trader fail so spectacularly? The answer lies in Reflexivity Risk. On a transparent ledger like Hyperliquid, a whale’s liquidation price is public data.

Huang consistently utilized 25x leverage on ETH and 10x leverage on HYPE. In a volatile market, 25x leverage leaves a margin for error of less than 4%. When a whale opens such a position, they paint a target on their back. Algorithmic traders and the protocol’s own liquidation engines know exactly where the price needs to go to force a sell-off.

Crucially, Huang’s losses became the ecosystem's gains. The Hyperliquid Liquidity Provider (HLP) vault, which acts as the counterparty to traders, captures these liquidation fees. In early February 2026, HLP yields spiked, driven largely by the liquidations of whales like Machi and the "1011 Insider Whale." In this sense, Machi Big Brother is inadvertently subsidizing the protocol—a wealth transfer from the individual speculator to the collective decentralized entity.

Dashboard screenshot and analysis explicitly link elevated HLP returns (118% APR past month) to asymmetric gains when traders incur losses, providing direct evidence of the "whale dividend" mechanism where liquidation events transfer value to the protocol's liquidity vault. Data-centric and mechanistic focus adds forensic credibility to the reflexivity risk section.

returns are not smooth. These pools can have flat periods and then big jumps when market conditions favor LPs and traders as a group lose.

Historical Controversies: The Pattern of Extraction

While current losses are driven by market mechanics, Jeffrey Huang’s career is punctuated by allegations of capital extraction that provide critical context to his risk profile. The degradation of his reputation is rooted in on-chain evidence linking him to the mismanagement of investor funds.

The Formosa Financial Treasury (2018)

The ghost of Formosa Financial remains the most significant stain on the ledger. In 2018, the project raised 44,000 ETH via ICO. However, forensic analysis by investigators like ZachXBT revealed a critical outflow of 22,000 ETH from the treasury just three weeks after the raise.

Traceable Beneficiaries of the Outflow:

- Binance Deposits: 10,500 ETH sent to unverified accounts.

- Bun Hsu (littlebang.eth): 4,980 ETH.

- Czhang Lin (czhang.eth): 2,000 ETH.

- Harrison Huang: 1,997 ETH.

The implications are profound. This capital flight precipitated the project's collapse. Although Huang filed a defamation lawsuit against ZachXBT in 2022, he withdrew it in August 2023. Legally, this is significant; the withdrawal prevented the discovery process, leaving the blockchain evidence unchallenged and permanently etched into the public record.

Cream Finance: "Ship, Pump, Abandon"

Between 2020 and 2021, Cream Finance—a protocol championed by Huang—suffered three major exploits totaling over $180 million in lost user funds. Critics argue these breaches were not accidents but the result of a "ship, pump, abandon" philosophy: forking code (from Compound) without the rigorous auditing required to adapt it to new, riskier asset parameters. This history establishes a pattern where speed and hype consistently take precedence over security and sustainability.

Strategic Verdict: The End of the Whale Era

The liquidity crisis of Machi Big Brother is a microcosm of a larger structural shift in the 2026 crypto market. The era of the "Omnipotent Whale"—the individual who could move markets by sheer force of capital—is fading. It is being replaced by an era of institutional liquidity and algorithmic efficiency.

Top-tier analyst (@WClementeIII) provides volume data showing Hyperliquid capturing significant traditional asset flow (e.g., 1.5% of CME silver futures), positioning it as an emerging institutional liquidity hub less tied to crypto speculation cycles. Directly substantiates the broader structural inversion from individual whale dominance to protocol/algorithmic efficiency. High engagement reflects authority.

HL could increasingly become viewed as a liquidity hub/trading venue, that just happens to be on crypto rails; especially as tooling for institutions to trade on HL improve.

The Transparency Trap

Huang’s failure highlights the double-edged sword of transparency. The same on-chain data that allowed him to build a reputation as a "top trader" now allows the market to dissect his failures in real-time.

When the market knows that a $34 million ETH long has a liquidation price of $3,059, predatory bots have an incentive to drive price action to that level. Huang’s persistence in reopening large, transparent positions suggests a failure to adapt to this adversarial environment. He is playing poker with his cards face up, while the rest of the table—automated, ruthless, and efficient—bets against him.

The HYPE Thesis: A Final Stand?

Currently, Huang’s solvency appears to hinge on the success of Hyperliquid’s HIP-4 upgrade (Outcome Trading) and the subsequent performance of the $HYPE token. He has effectively levered his remaining liquidity on this single ecosystem. While $HYPE has shown strength—surging over 20% on the HIP-4 announcement—Huang’s leveraged exposure introduces massive reflexivity. A sharp correction in HYPE could trigger a final cascade of liquidations, potentially wiping out the last of his liquid reserves.

The Verdict: Machi Big Brother’s net worth contraction to the $50M–$80M range forces a re-evaluation of his status. No longer a "smart money" signal, his wallet addresses (0x021...382) should now be monitored as volatility indicators—signals of potential forced selling rather than informed accumulation. In 2026, the ledger shows a whale beached by the receding tide of his own risk management.

How to Track Machi Big Brother’s Transactions (via Drops Bot)

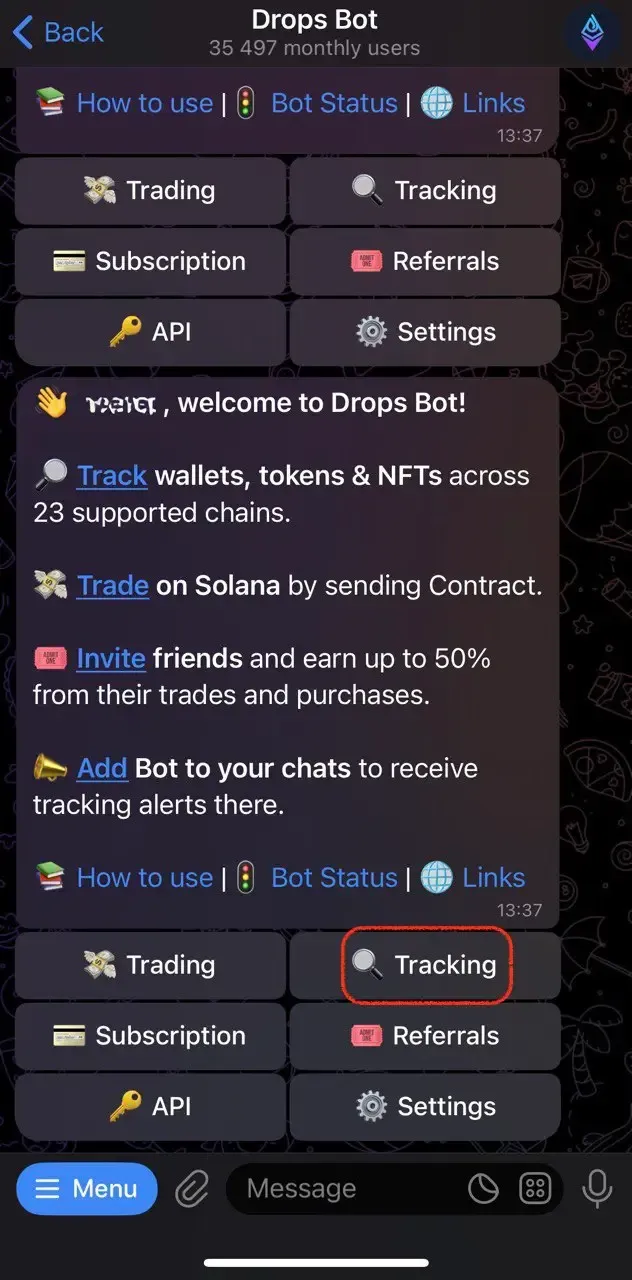

If you want to monitor the activity of well-known crypto traders like Machi Big Brother, the most convenient tool is the Drops Bot on Telegram. Below is a step-by-step guide to setting up tracking.

Step-by-Step Guide

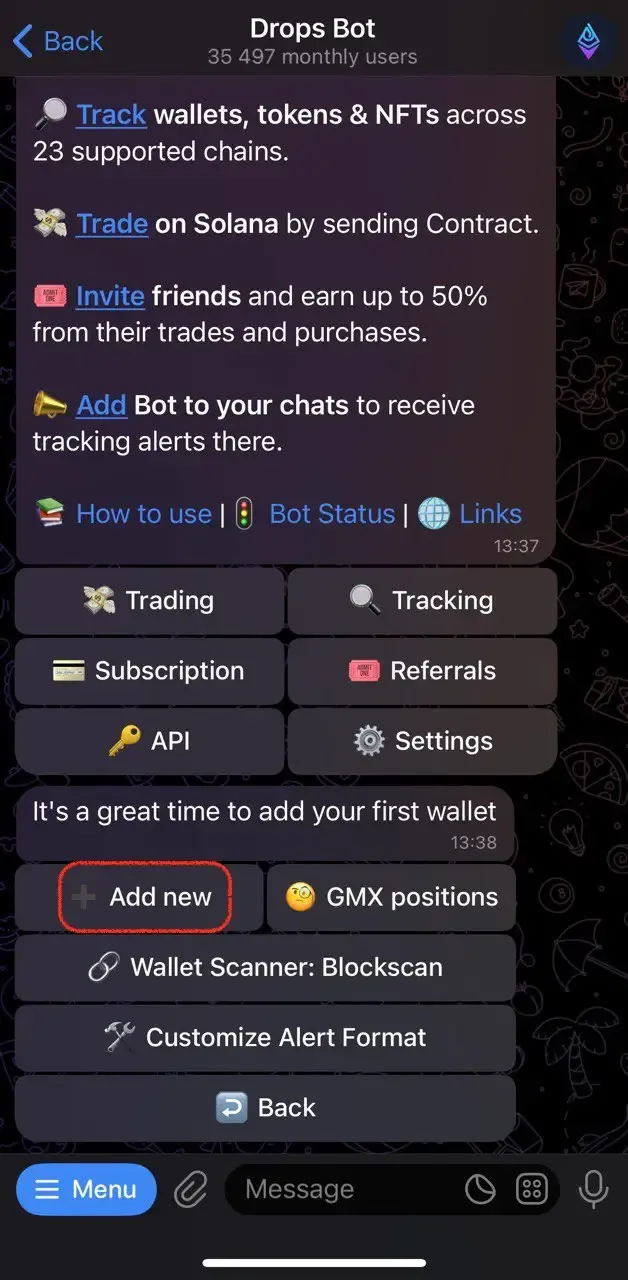

Launch Drops Bot on Telegram

Go to the link @drops_bot and click Start.

Select the “Tracking” Section

In the main menu, select Tracking — this is the section for monitoring wallet activity.

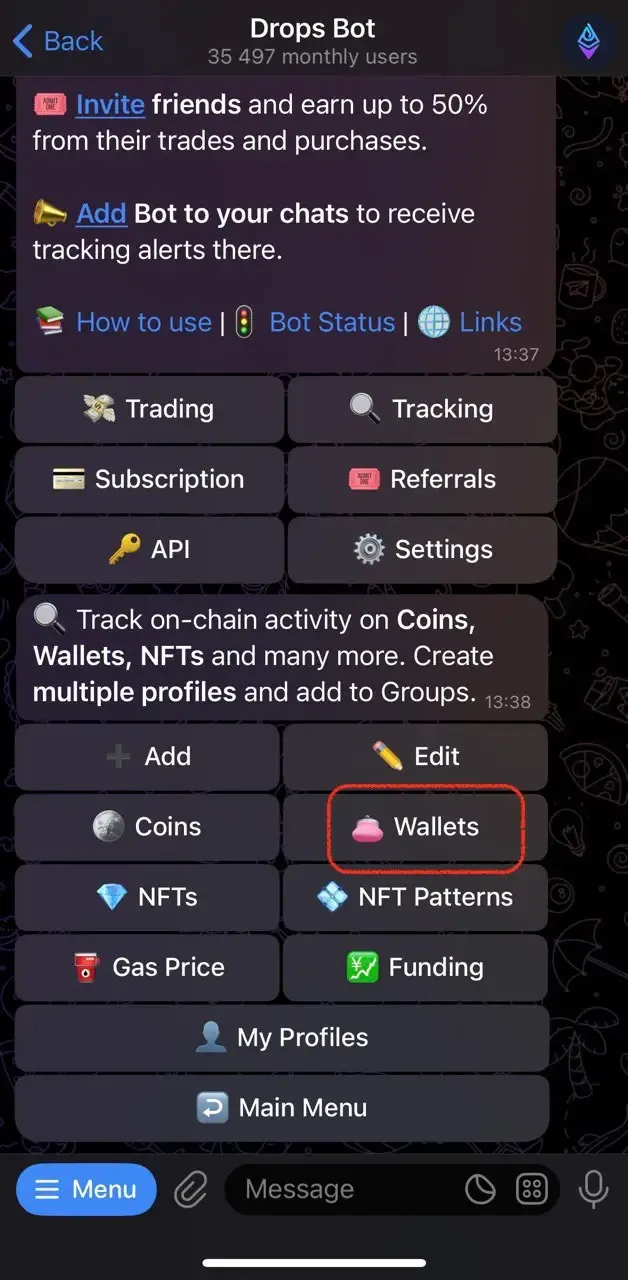

Go to “Wallets”

Next, choose Wallets to manage the addresses you’re tracking.

Click “Add new”

The bot will offer to add a new wallet — click the Add new button.

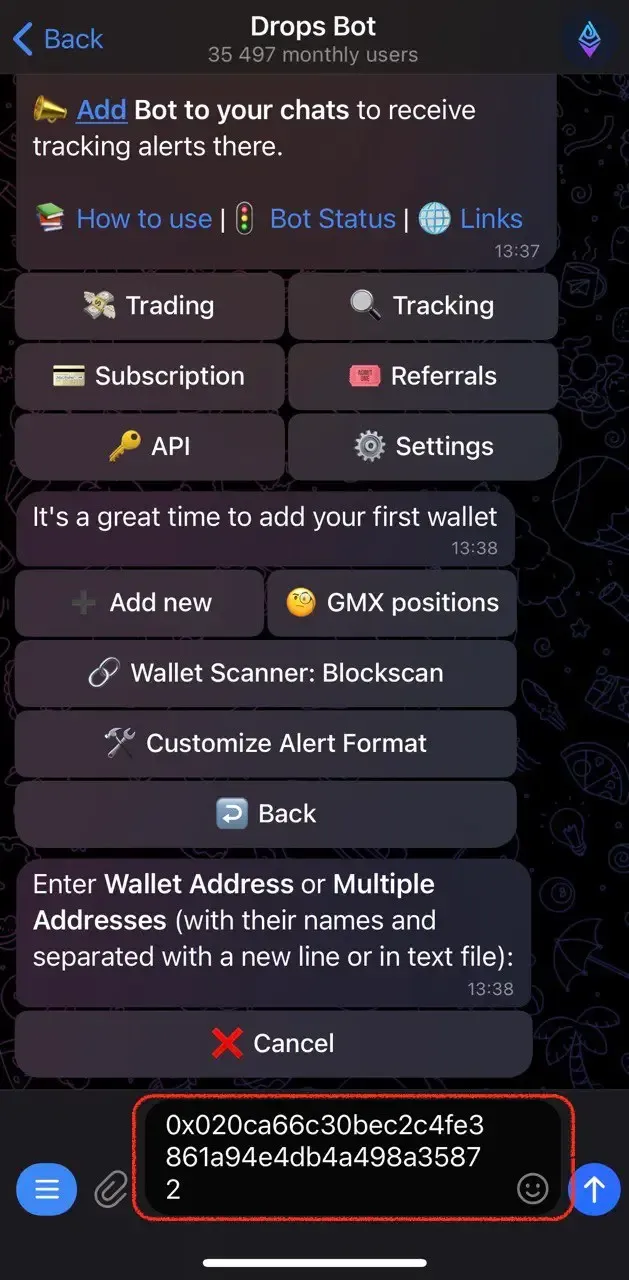

Enter the Wallet Address

Paste Machi Big Brother’s wallet address into the input field:

0x020ca66c30bec2c4fe3861a94e4db4a498a35872

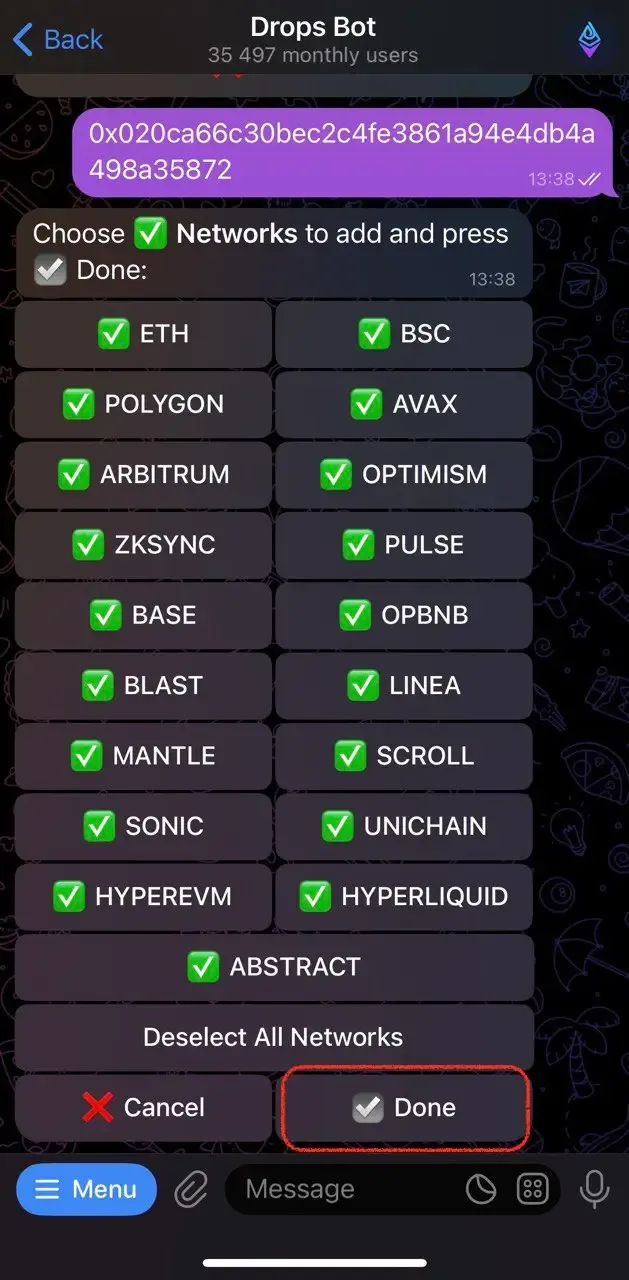

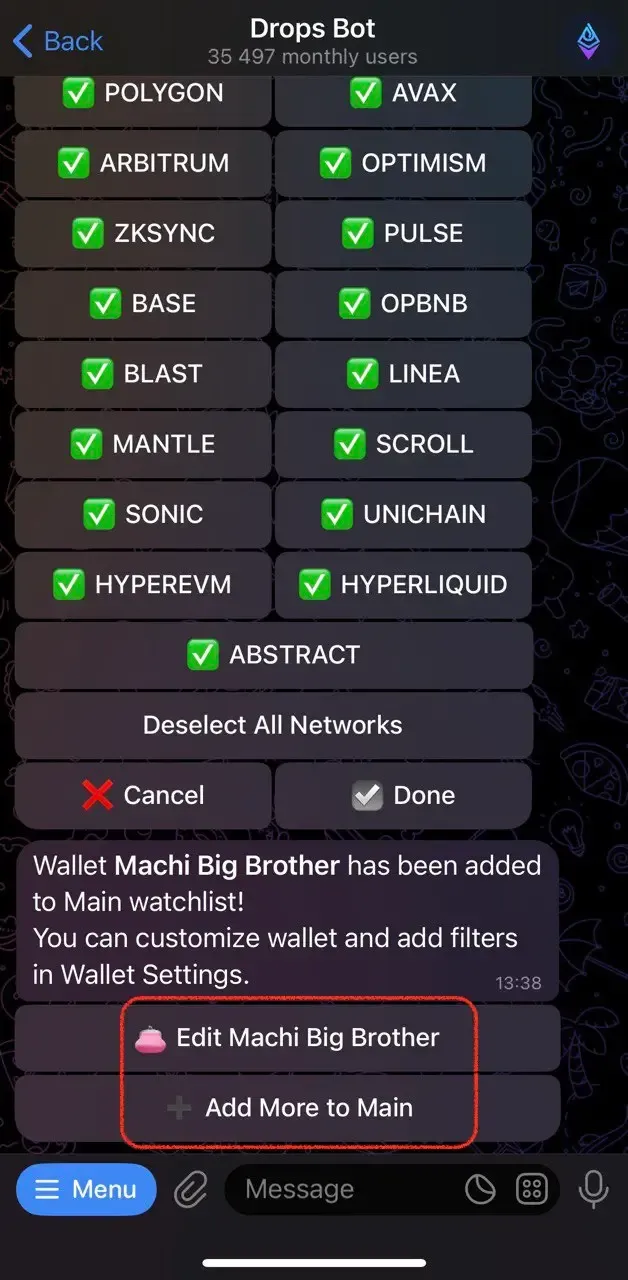

Choose Networks to Track

The bot will show a list of networks — you can leave the default settings and press Done.

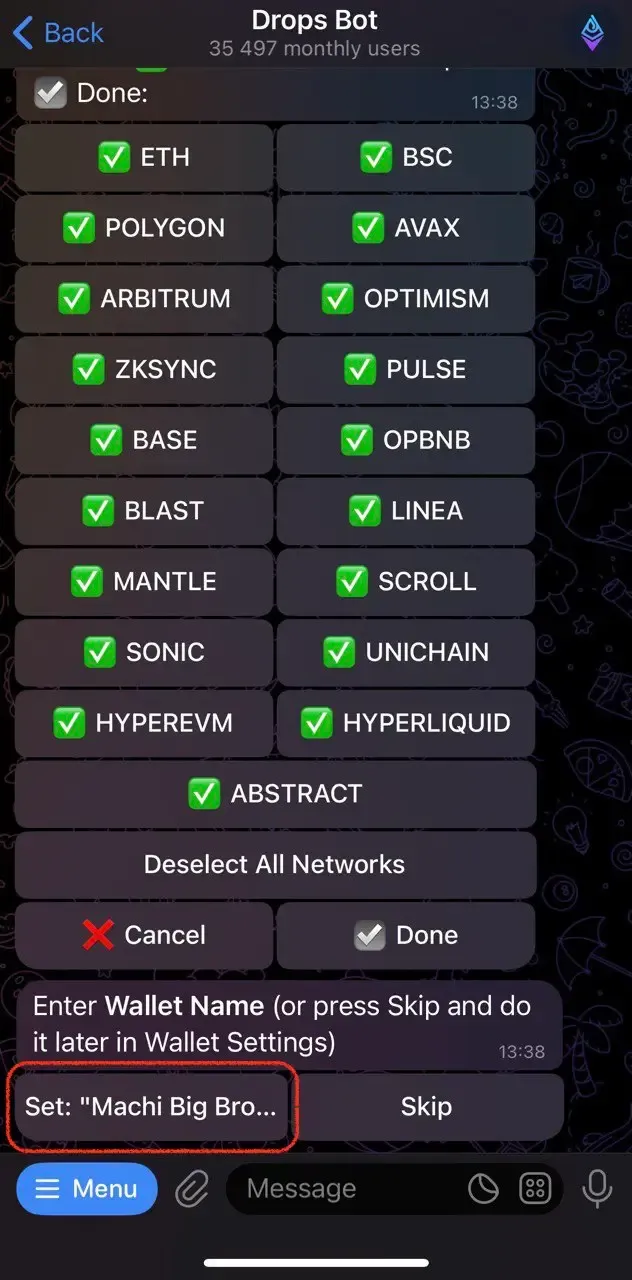

Assign a Wallet Name

Since Machi’s wallet is already known to the system, the bot will suggest the name Machi Big Brother. You can use it or assign your own — the name can be changed anytime in the settings.

Done!

The bot will confirm that the wallet has been successfully added. You will now receive notifications about all activities from this address: purchases, sales, transfers, and DeFi interactions.

If needed, you can add other wallets, adjust notification settings, or disable tracking anytime through the bot’s menu.