Crypto

Pump.fun’s GFF Injects $1.7M Into Meme Tokens

Pump.fun’s Glass Full Foundation has poured $1.7M into 10 Solana meme tokens, using five public wallets for full transparency—giving the ecosystem a liquidity boost and a clear signal of long-term backing.

Quick Overview

- Pump.fun launched the Glass Full Foundation on August 7, 2025

- Deployed 2,022 SOL (~$1.7M) into 10 meme tokens on August 9

- Used five public wallets for full on-chain transparency

- Largest stakes went to Tokabu and House (~20% each)

- Boosted prices and liquidity across the Solana meme market

What Is Pump.fun’s Glass Full Foundation (GFF)?

The Glass Full Foundation (GFF) is a program started by Pump.fun on August 7, 2025, to give financial support to the most active and promising communities in its memecoin network. It puts money into certain meme tokens that already have strong support from their users, helping keep trading smooth and prices more stable.

By adding extra funds, GFF works to keep token prices from dropping too fast, make markets less risky, and build trust among investors. Pump.fun hasn’t said where the money comes from or how it picks which tokens to support. The program began at a time when Pump.fun’s daily income had dropped by about 97%—from over $7 million in January to around $200,000 in early August—because of a slowdown in the memecoin craze and more competition. GFF is meant to bring new energy to the platform and show Pump.fun’s long-term commitment to Solana’s meme token scene.

Liquidity Injection Details – August 9, 2025 Deployment

On August 9, 2025, shortly after launch, the Glass Full Foundation (GFF) put 2,022 SOL (about $1.7 M USD) into ten meme tokens on Pump.fun. The buys were made through five GFF wallets that were clearly labeled, so anyone could see and track the trades on the blockchain. Using several wallets helped spread the purchases and avoid pushing prices too much.

As trader @SalvinoArmati observed, “So what do you do when the market stops creating runners and you’re sitting on $1.7B in cash? Well, you just run them up yourself… plant runners, farm volume, harvest fees.”

This perspective captures the strategic intent: stimulate token activity, generate trading volume, and recycle fees back into the ecosystem.

Records show these wallets spent around $1.69 M, leaving about $350K for future use. Pump.fun shared the wallet addresses to keep things transparent and prove its promise to add “significant liquidity” to key ecosystem tokens. The leftover funds mean GFF can make more buys later if needed.

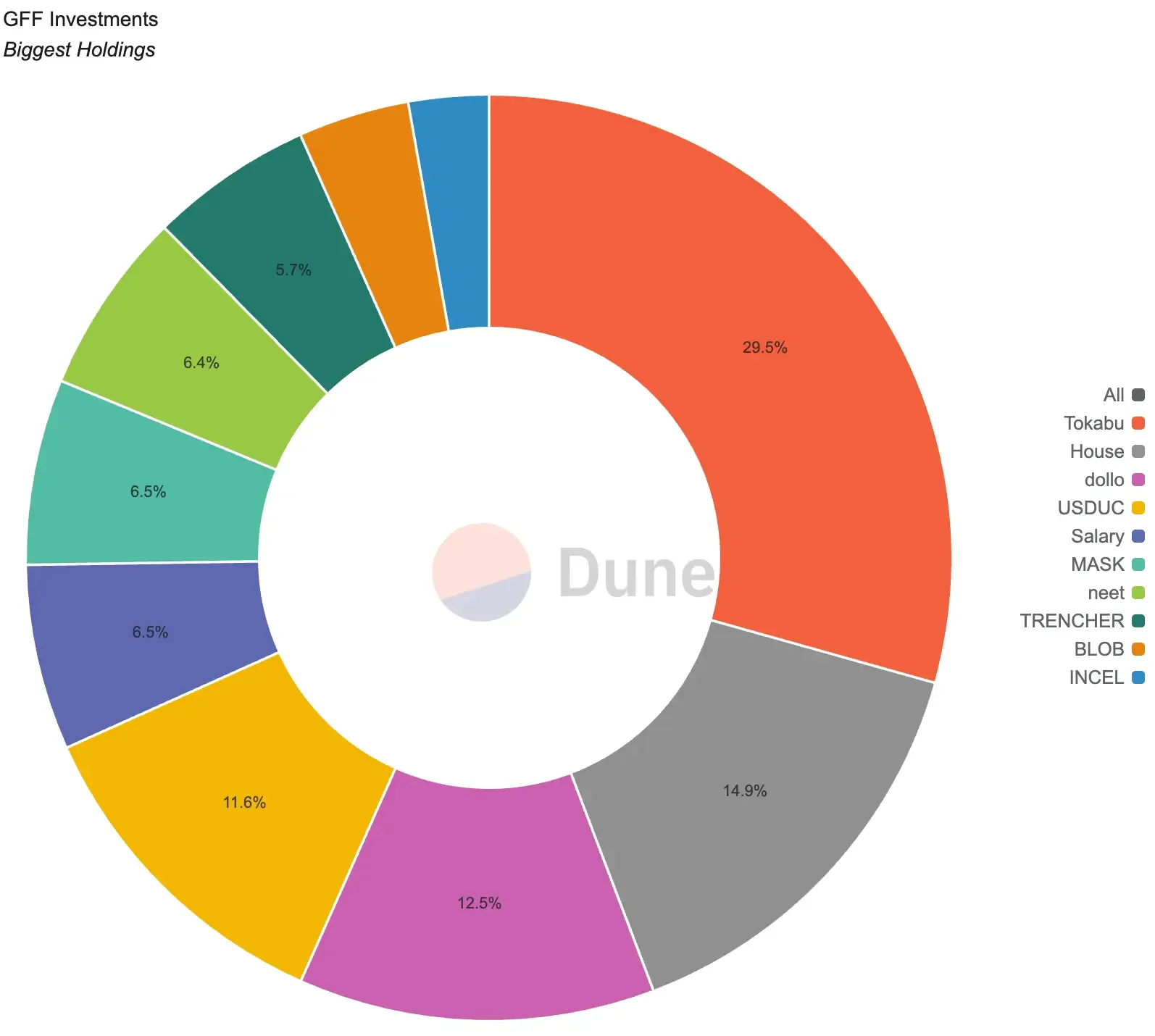

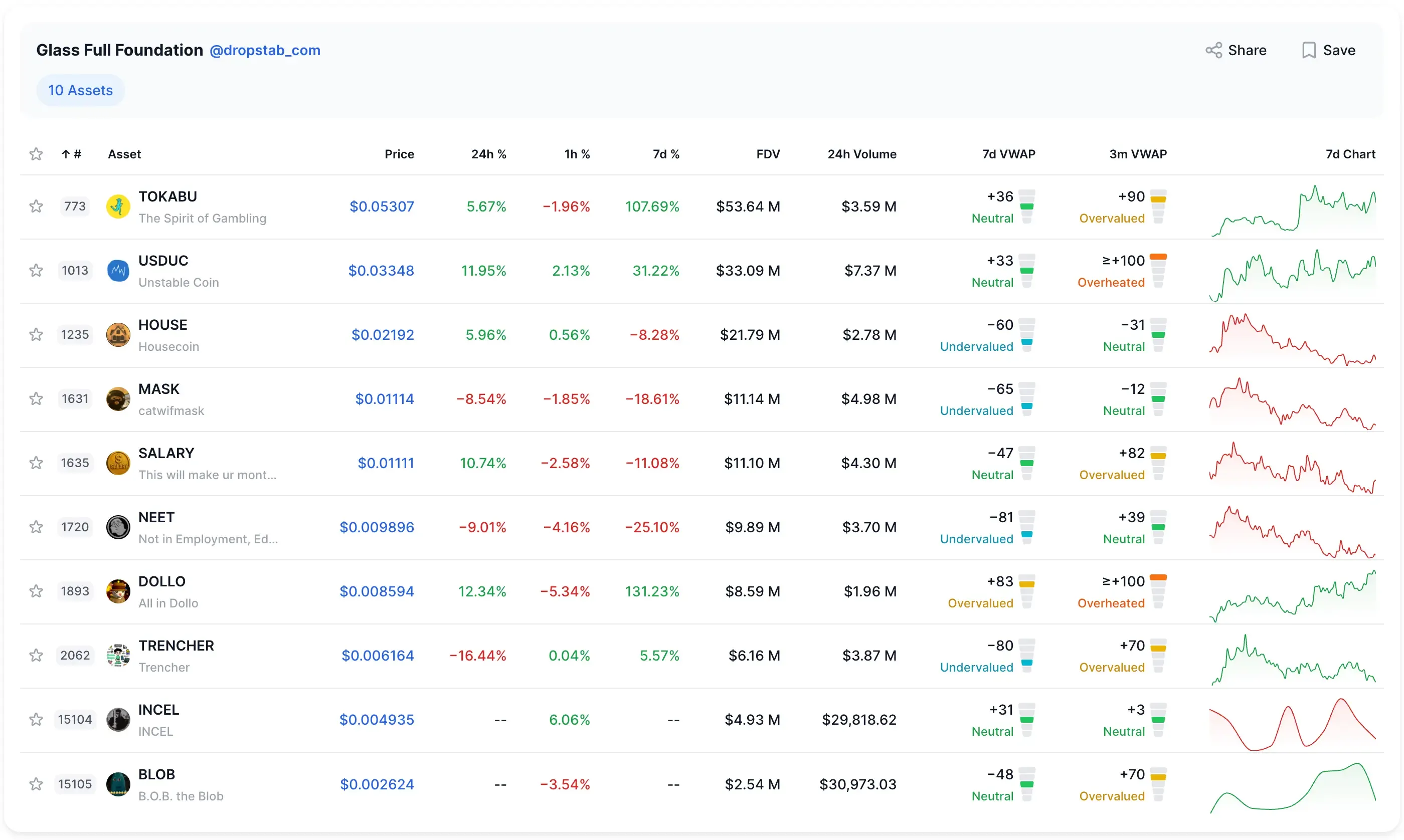

Portfolio & Wallet Transparency

On August 8, 2025, the Glass Full Foundation’s portfolio covered ten meme tokens launched on Pump.fun. Tokabu made up 21.3% and House 20.6% of the invested amount, each worth around $350K–$360K. The other eight tokens — USDUC, NEET, MASK, Salary, Trencher, d0lo, BLOB, and INCEL — each held between 3% and 10%.

The five GFF wallets are public and easy to track on the blockchain. Anyone can check token holdings, trades, and timestamps using Solana explorers or Glass Full Foundation tab, which updates balances and activity in real time. This openness helps build trust, keeps Pump.fun accountable, and lets the market quickly see if support changes.

Impact on the Solana Meme Ecosystem

On August 9, 2025, GFF added a large amount of liquidity to the market, and prices jumped fast. Tokabu went up about 40% to ~$0.039, Housecoin reached ~$0.035, and Fartcoin (FART) rose around 13% to $1.02. Aura, Troll, and Fwog also gained. Pump.fun’s own PUMP token climbed roughly 30% for the week. With more liquidity, trading became smoother, spreads got smaller, and prices were less likely to swing wildly.

In the medium term, GFF’s visible support shows both the community and competitors that Pump.fun is serious about backing certain tokens. This could lead to more people holding their tokens, new buyers joining in, and other launchpads creating similar programs. But there are risks: the market could depend too much on GFF, the criteria for picking tokens aren’t fully clear, and only about $350K remains for future use. Since memecoins are volatile and often lack real value, relying on GFF too much could be risky. Still, the short-term results have been clear — more liquidity, higher prices, and fresh energy in Solana’s meme scene.

This move also helped the platform regain ground against rival launchpads like LetsBonk, whose July surge quickly faded. As shown in recent market share analysis, Pump.fun reclaimed 73.6% share and $13.5M weekly revenue by August, while LetsBonk slid to 15.3% and under $30K daily.

As trader @LexaproTrader noted, “I’m in awe of Pumpfun’s curation, direction, and talents right now… these moves are absurdly S-tier and will likely change our space.” This sentiment echoed across the community, reinforcing the bullish response and optimism sparked by GFF’s launch.

High-profile traders often influence sentiment in similar ways. Figures like Machi Big Brother — NFT whale, DeFi pioneer, and controversy magnet — show how a single market player’s moves can ripple across prices and narratives.

Comparison & Precedents in Crypto

The Glass Full Foundation is new to Solana but has similarities to past projects in crypto. On BNB Chain, Four.meme gave top meme tokens grants and liquidity, much like GFF. These efforts can raise prices quickly, but long-term success depends on strong communities.

In DeFi, some projects have funds to protect important assets, while direct market support is closer to traditional finance’s “plunge protection” than typical crypto methods. Other blockchains, like Avalanche and Polygon, offer rewards and grants to keep users, but GFF is different because it buys existing community tokens, acting as a market maker for memecoins.

If GFF succeeds, it could set an example for organized liquidity support in the meme space. If it fails, it might show the limits of this approach. Regulators are paying attention, and similar programs could face new rules. GFF mixes traits of an ecosystem fund, market maker, and trust builder, making it a first for Solana’s meme market.

FAQs about GFF and Tracking Its Activity

Q: Why did Pump.fun use five labeled wallets?

A: The five wallets make it easy for anyone to see GFF’s trades on the blockchain and help spread purchases to avoid big price jumps or drops. On August 9, they spent about $1.69M, with $350K left for later use.

GFF Wallet 5

FmEFAFZdAB6TEHY3wLSGPYTPJHKruBEiG2f4vLccg8iKGFF Wallet 4

6Wm7huEr9XewD52ZK9zAiviExD15yaj54vtM8P3oxvaqGFF Wallet 3

HjQUxEdFcNMV2aSPRBkR9MbD86RL41ZNuZXEADLzetE9GFF Wallet 2

7LJJRqxH1U7b7XcfnAZZHkpAQUMje5vpRjvWyZpM8SYnGFF Wallet 1

EV3Jpro4c17nXXbnGaJ5wfhv5RJhHgKEYjN51aHYgGiHFollow Glass Full Foundation in Drops Bot with just a few clicks: https://dropstab.com/products/drops-bot

Q: How can you track GFF’s activity?

A: You can check Solana explorers like Solscan or use DropsTab to view GFF’s wallets, balances, and trade history in real time. DropsTab also shows token details, and you can set alerts for wallet activity. Dune Analytics dashboards share breakdowns of the $1.69M spent by token and date.

Q: What does 2,022 SOL mean for liquidity and slippage?

A: For smaller tokens with low liquidity, $1.7M across 10 tokens can make trading smoother and reduce price changes during buys or sells. Small-cap tokens benefit most, while bigger ones see more of a confidence boost. This support keeps prices steadier as long as the funds stay in place.