Alpha

Lombard $BARD Sale on Buidlpad

Lombard is launching its token sale on Buidlpad, raising $6.75M at a $450M FDV. With no vesting, a strong investor base, and integrations across DeFi, this sale could be one of the year’s most closely watched.

Quick Overview

- $6.75M raise for 1.5% of supply ($450M FDV).

- Oversubscription format, 100% unlocked at TGE.

- Limits: $50–$5,000 (USD1, BNB, LBTC); Lombard Lux holders get higher caps.

- KYC mandatory.

- Timeline: registration Aug 26–29, payment Sept 1–2, allocation by Sept 4.

How the Sale Works

Lombard is holding a community sale on Buidlpad. The process is simple: people first sign up between August 26 and 29. After that, from September 1 to 2, they can put in money. Final allocations are split based on how much each person committed — this often helps smaller buyers when demand is high.

All $BARD tokens will unlock right away at TGE. This means buyers can sell immediately, but it also brings risk of big price swings. The minimum buy is $50, the maximum is $5,000. Holders of Lombard Lux, a reward token for stakers, can put in more.

Other projects are testing similar no-vesting models — Falcon Finance, for example, is preparing a $4M community sale with dual FDV tiers and USD1-only contributions.

Payments can be made in USD1 (ERC20 or BEP20), BNB, or LBTC. KYC is required, and addresses from banned countries cannot join.

Lombard and Its Core Token LBTC

Lombard’s main product is LBTC, a liquid staking token for Bitcoin. It lets users earn staking rewards while keeping their BTC liquid. In just 92 days LBTC passed $1 billion in TVL. It’s also been added to major DeFi platforms like Aave, Spark, and EigenLayer.

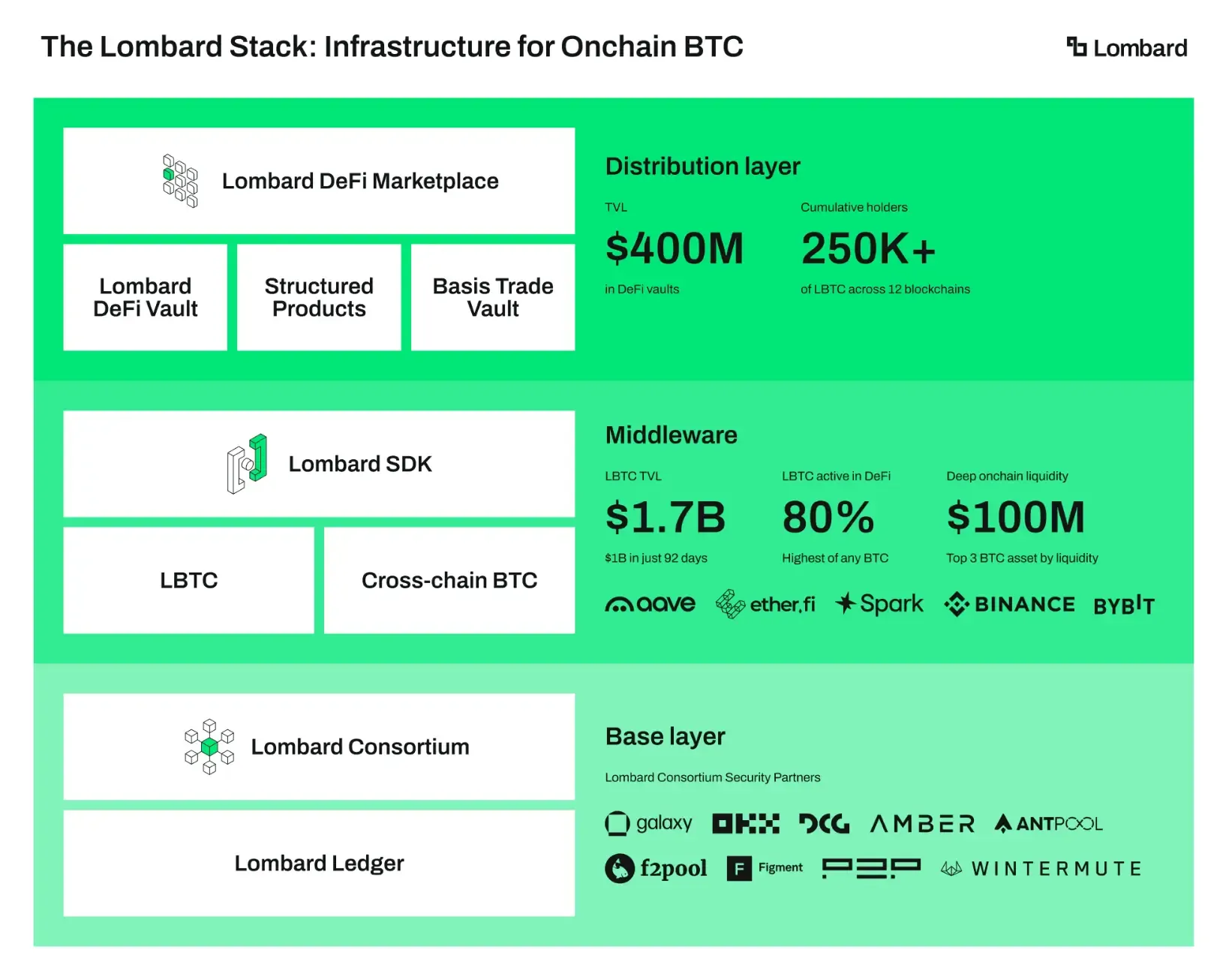

Alongside these metrics, Lombard outlines its full infrastructure stack — from the base consortium and ledger up to DeFi vaults and structured products. The official infographic highlights LBTC’s rapid $1.7B TVL, deep onchain liquidity, and integrations with Aave, Spark, and Binance, positioning it as one of the top Bitcoin assets in DeFi.

Right now, over 18,000 BTC are locked in LBTC, which is about 35% of all BTC staked through Babylon. The network is run by 14 large validators such as Figment, Galaxy, Kiln, and P2P.

Lombard also uses Chainlink tools: CCIP for cross-chain transfers, Proof-of-Reserve to track backing, and Price Feed oracles for price data. This makes LBTC more transparent and safer to use.

Jacob Phillips expanded on this vision in an Epicenter Podcast episode — “Lombard: Unlocking Bitcoin DeFi Through Liquid, Yield-Bearing LBTC” (Ep. 603) — where he described how LBTC could reshape Bitcoin’s role in DeFi.

Investor Backing and the Role of $BARD

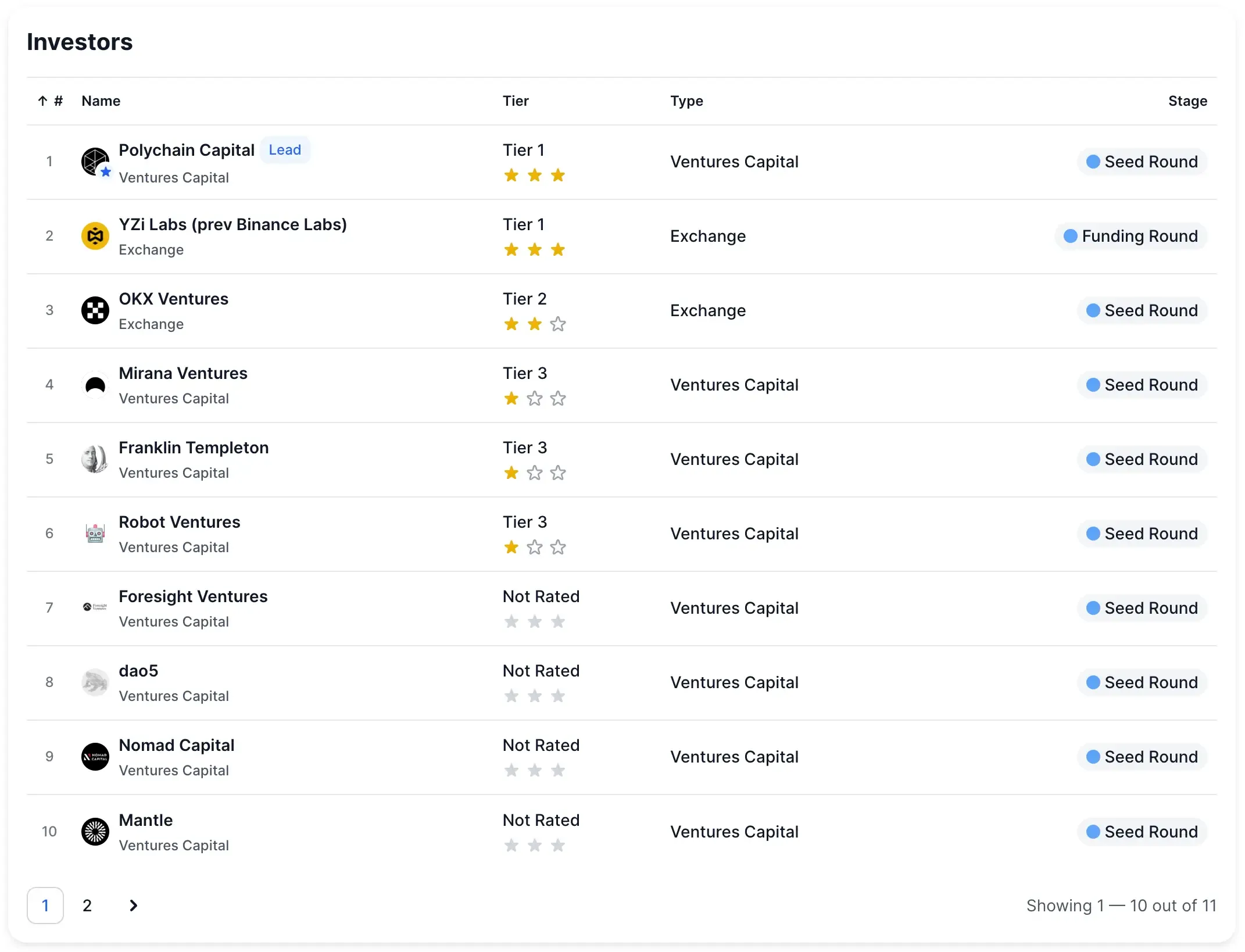

In 2024 Lombard raised $17M from major investors. Backers include Polychain Capital, Franklin Templeton, Bybit, YZi Labs (formerly Binance Labs), and Nomad Capital.

The $BARD token is more than just for trading. It supports security of the network, gives holders voting power on things like fees and project direction, and offers discounts. The Liquid Bitcoin Foundation will manage budgets and grants to grow the ecosystem around LBTC.

Why Buidlpad?

Buidlpad was chosen for the community sale. The platform has run other popular sales like Solayer and Sahara AI, which were heavily oversubscribed and performed well after launch.

Buidlpad’s own announcement — “Lombard’s $BARD Community Sale on Buidlpad: Your Gateway to Bitcoin Capital Markets” — highlights how the team wants to frame this sale as more than just another token launch.

Buidlpad’s model spreads tokens among many buyers, though average allocations can be small. For example, Solayer’s average was about $350 per wallet.

Important dates:

- KYC/Registration: Aug 26–29

- Payments: Sept 1–2

- Settlement: By Sept 4

Buidlpad takes a 2% fee from the tokens distributed.

Positioning in the Bitcoin DeFi Landscape

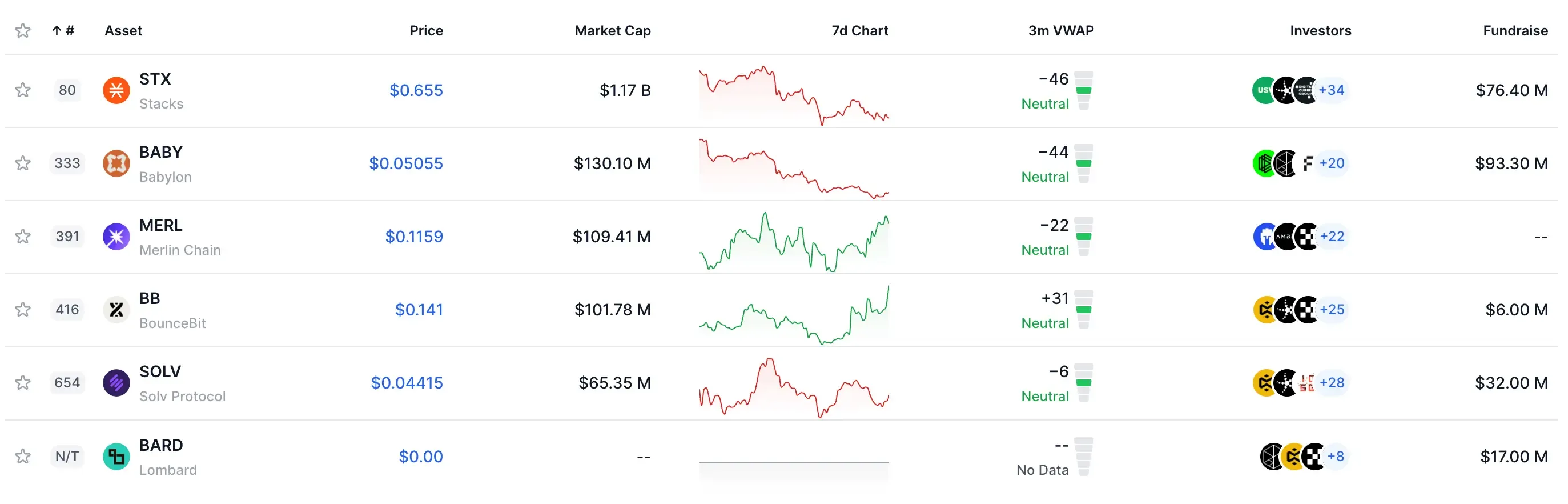

Lombard’s $450M FDV puts it between Babylon ($528M) and Solv ($374M). Stacks is much higher at $1.2B. In terms of design, Lombard is most like Babylon, but the higher valuation shows that people expect stronger growth.

Bitcoin DeFi is still new. Projects like Lombard are interesting because they let holders earn yield without giving up their BTC. Lombard already controls 35% of the BTC staked in Babylon, which shows strong adoption.

Because tokens unlock all at once, the price could swing sharply at listing. But past Buidlpad sales — Solayer (3–4x ROI) and Sahara AI (~2.3x ROI) — suggest demand can still drive early gains. The excitement around Lombard’s sale mirrors a broader revival in token fundraising — 2025 has seen ICO-style launches return with strong demand and revamped models, a trend already reshaping how projects approach distribution explored in detail here.

Comparison with past sales:

- FDV: Solayer $350M; Sahara AI $600M; Lombard $450M.

- Tokens sold: Solayer 3%; Sahara AI 1.42%; Lombard 1.5%.

- Oversubscription: Solayer ~6x; Sahara AI ~8.7x; Lombard TBD.

- Max allocation per wallet: Solayer $2,000; Sahara AI $3,000; Lombard $5,000.

- Average allocation: Solayer ~$350; Sahara AI ~$282; Lombard est. ~$470.

- Listing ROI: Solayer 3–4x; Sahara AI ~2.3x; Lombard TBD.

Takeaway

Lombard looks like one of the stronger projects in BTC-DeFi. It has a skilled team, backing from big funds, and integrations with top DeFi protocols. The sale is easy to access with low minimums, no vesting, and full unlock. But that also means the token may be very volatile at launch.

If demand is like past Buidlpad sales, $BARD could rally early. Unlike hype-driven meme launches, Lombard is trying to become core Bitcoin infrastructure — a role that could attract more serious, long-term capital.