Crypto

Ethereum Validator Exit Queue Hits ATH Amid Price Surge

Lido’s stETH lost value against ETH after Justin Sun pulled $518M from Aave. This caused borrowing costs to spike, forcing users to exit positions and pushing Ethereum’s withdrawal queue to a record 625k ETH.

Quick Overview

- stETH traded 0.3–0.6% below ETH as liquid staking unwinds surged

- HTX (Justin Sun) withdrew $518M ETH from Aave, spiking ETH borrow rates to ~10%

- Leveraged stETH loops flipped unprofitable, triggering mass exits

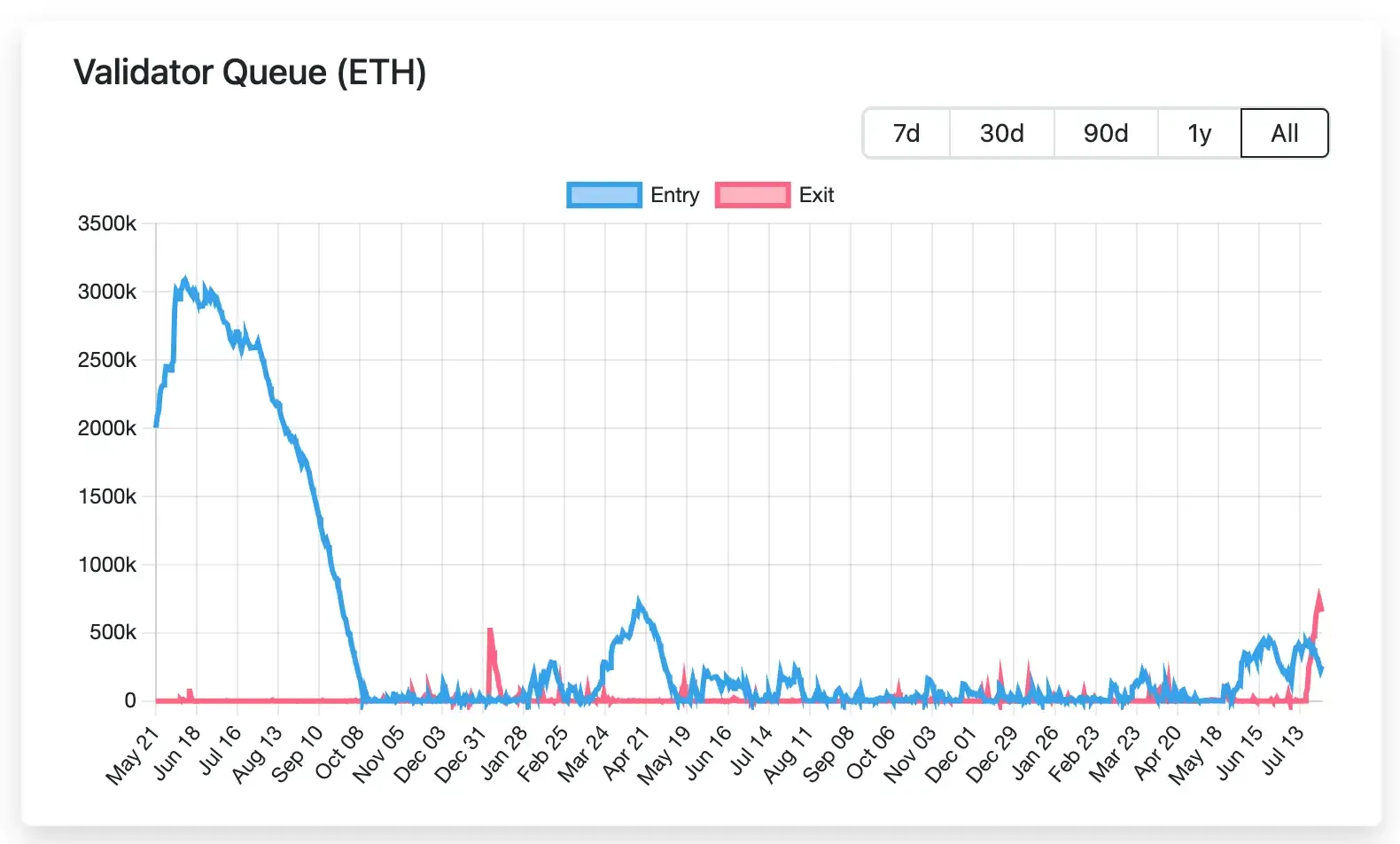

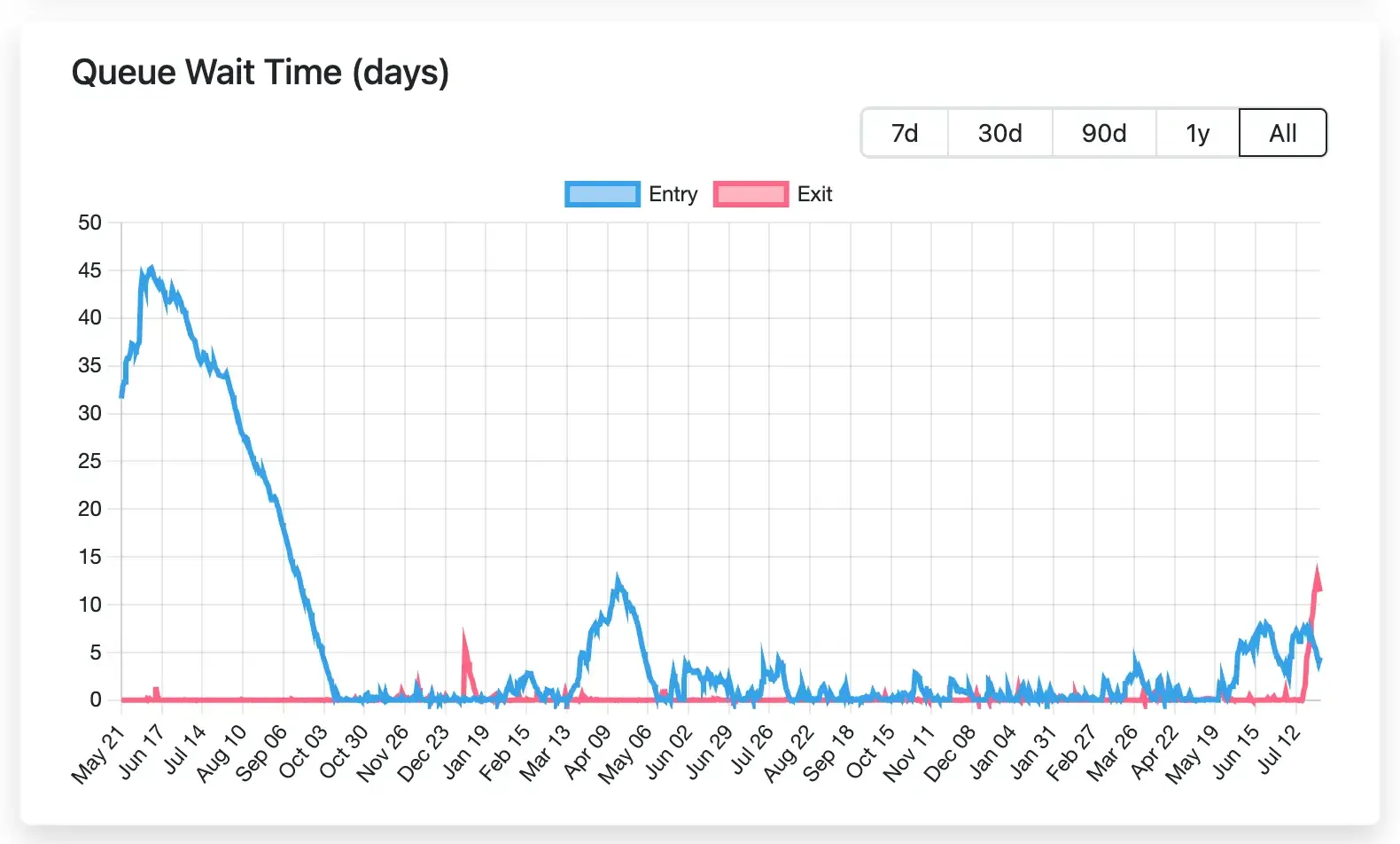

- Ethereum’s validator queue ballooned to 625k ETH (~8–10 days wait)

- stETH depeg reflects how leverage and liquidity crunches ripple across DeFi

- Peg is expected to normalize as queue clears and arbitrage kicks in

How stETH’s Peg Is Supposed to Work

stETH is Lido’s liquid staking token: each stETH ≈1 ETH staked on Ethereum, earning ~2.8% APRi. Traders arbitrage any discount by buying stETH and redeeming it on-chain for ETH (once withdrawals are processed), so the peg normally stays tight.

Lido’s site notes $32.8B staked ETH and a ~2.8% staking APR. In normal conditions, unlimited throughput is capped only by the validator exit rate: Ethereum limits how fast ETH can exit (currently ~8 ETH/block), so if too many redeem requests queue up, withdrawals slow down.

In practice, most stETH peg-support comes from the Curve pool (incentivized liquidity) and the built-in redemption mechanism. Curve’s stETH–ETH pool (the largest on Curve) has on the order of $1–3B liquidity (stETH and ETH).

Still, on-the-markets you can only swap about $100–200M+ before moving the price. The rest of the peg depends on time arbitrage: if stETH trades at X% below 1:1, arbitrageurs can lock up capital to wait for the on-chain unstake, capturing that spread. This arbitrage yield is essentially the “stETH discount to peg” factored against the exit queue delay.

For example, a 30 basis-point discount (0.3%) roughly equals ~3% annualized return if the queue is 2 days – plenty to attract buyers.

Liquidity Strains & Rising Exit Queue

In mid-July 2025, the Ethereum staking exit queue exploded. On July 16–22, over 600,000 ETH flooded into the queue (adding ~$2.1B of withdrawals in just 6 days). By July 25, 625k ETH ($2.3B) was queued, pushing the wait time to 8–10 days – the longest since late 2023.

Such a bottleneck directly pressures stETH. The longer withdrawals take, the lower its effective redeem price. With a 10–12 day lockup, the implied interest rate arbitrage becomes ~3% per 10 days (or ~110% annualized), so the peg can break easily until the queue shrinks. In practice, once stETH started trading a few tenths below ETH, sellers piled in, worsening the gap.

These sudden outflows also reflect a broader trend in how Ethereum responds to shifting capital — particularly in the ETF era. As seen in recent ETF-driven fund flow cycles, ETH’s 2025 rally was fueled by billions in inflows, and any reversal could become a key risk trigger for similar liquidity crunches across DeFi.

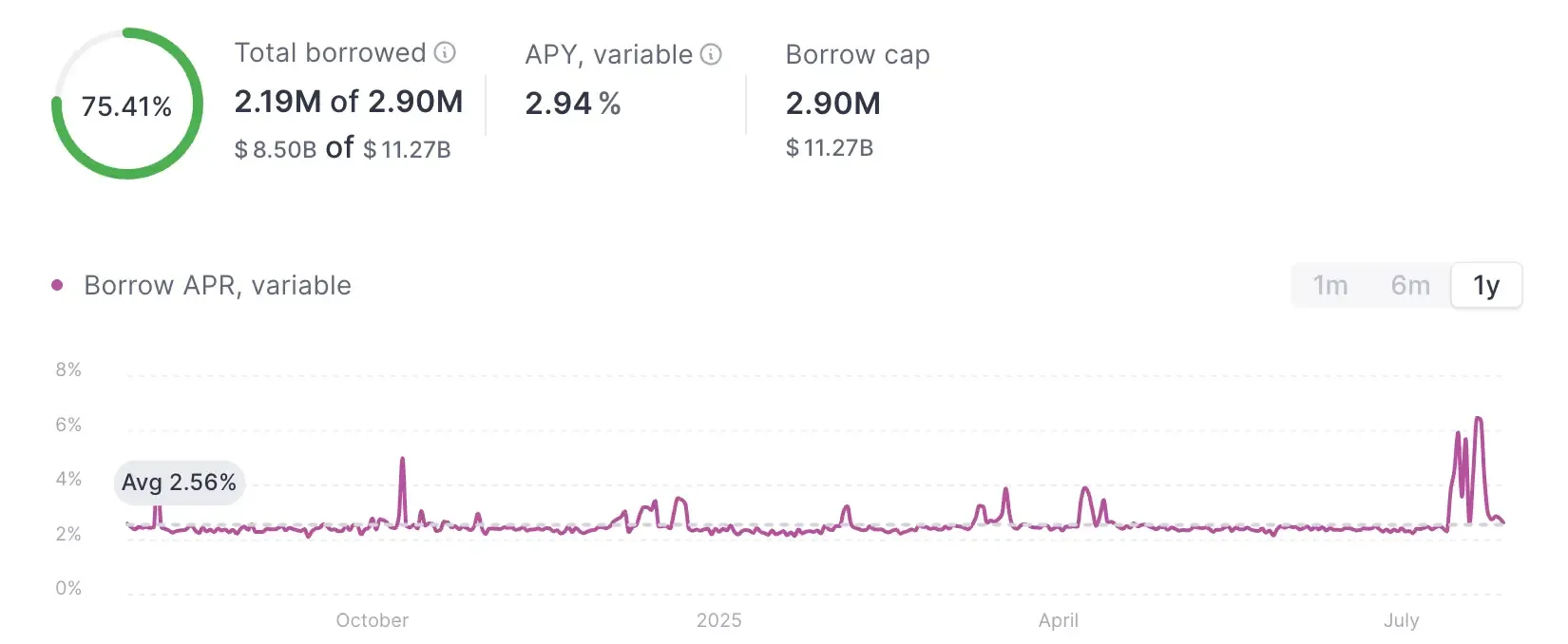

Aave Borrow Rate Spike & the Unwind

The trigger was an Aave liquidity shock. On-chain sleuths linked the queue surge to a huge ETH outflow from Aave – traced to HTX (Justin Sun’s exchange) withdrawing ETH via Aave. One report noted that HTX (labeled a “whale”) pulled 50,600 ETH (~$181M) in one day, and 160,600 ETH ($518M) over the week. This withdrawal cut Aave’s ETH supply, sending utilization and borrow APR sharply higher. At one point ETH borrow APR neared 10%.

Higher borrow costs destroyed the classic stETH leverage trade. Loopers were depositing stETH on Aave to borrow ETH (at ~8–10% APR) and redepositing, pocketing the ~3% staking yield. With borrow rates spiking above the staking yield, these loops flipped to negative yield.

As Bitget reported, once ETH borrowing rates hit ~10% and stETH yield was ~3%, loopers were losing ~50% of their principal monthly. They “were compelled to redeem stETH to deleverage”. In short, once the math broke (3% vs 10% APR), loopers scrambled to unwind positions.

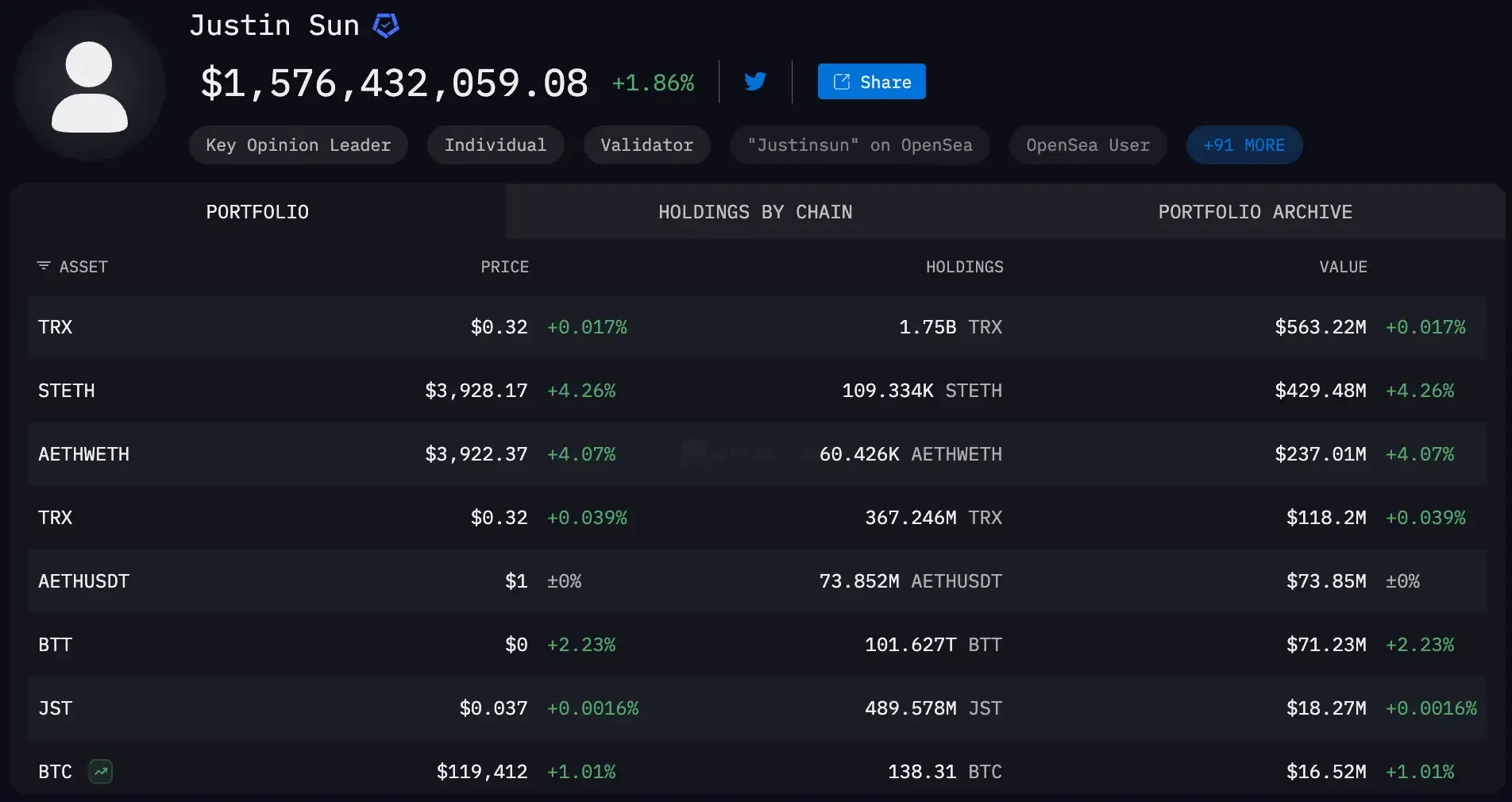

Justin Sun’s Role

The on-chain data implicates Justin Sun’s HTX operations. Justin Sun controls wallets that have been accumulating and shifting massive ETH and stETH positions (as Protos and others documented). The mid-July transfers from HTX to Binance suggest an internal rebalance or risk move. Crypto commentators (including Binance’s BlockBeats and others) explicitly named these “giant whales” as the likely cause of the ETH crunch. Whether Sun was taking profit, shoring up liquidity, or reallocating assets, the effect was to drain Aave’s ETH.

While Sun himself hasn’t commented publicly on stETH, his footprint is clear: HTX’s redemptions drove Aave’s metrics. Notably, Arkham Intelligence data shows Sun-linked wallets still hold ~$0.5B in stETH as of mid-2025, so unwinds can dramatically sway the peg.

In any case, this episode underscores how a single entity’s on-chain moves can jolt DeFi peg dynamics — even as Ethereum itself builds toward longer-term strength. In fact, between validator reforms, new scaling tech, and renewed institutional interest, many are now seriously considering whether Ethereum could reach $10K.

The Loopers’ Dilemma & Aftermath

Once loop positions started liquidating, a cascade ensued. Many holders chose to exit via the validator queue (accepting the 9–10 day wait) and hope for 1:1 value. Others sold immediately on open markets to avoid the queue delays. Both choices affected the peg: selling on-market directly added selling pressure, widening the discount, while routing stETH into the queue reduced on-chain liquidity support. In practice, stETH traded ~0.3–0.6% below ETH in late July.

“We might be in the early stages of a stETH liquidity crunch,” noted @DeFi_Hanzo on X. “Big whales like Justin Sun and Abraxas pulled ETH from Aave, spiking borrow rates. That killed leveraged stETH loops. Sellers flooded out, Curve softened the blow — but with validator queues over $2.2B and oracle mispricing, things could snap fast.”

Note: 30–60bps roughly matches a quarter of the ~2.8% staking yield.

That discount is the arbitrage profit for anyone willing to buy stETH and wait. We observe that the market has effectively repriced stETH to account for the now-extended 8–10 day unlock.

For the remaining leveraged holders, the choices are stark. Selling stETH on the spot market at 0.3–0.6% discount means locking in a loss of ~3–6% on a 10× position. Alternatively, they can hold through the queue, suffering ~8–10% APR on their ETH borrow (netting roughly –5% on principal over 10 days), and pray the queue clears. Neither option is pleasant.

As Bitget noted, this was “a roughly 50% negative APY” on a 14-day basis for 10× loopers. In effect, loopers are baking in another potential depeg if they stay stuck.

Key Insights & Outlook

stETH’s peg can break quickly when liquidity dries up. Even with Lido’s deep TVL and Curve support, large leverage positions mean limited real-time flexibility. When too many stakers exit or whales shift assets, the peg slips until conditions stabilize.

Recursive staking loops only work when ETH borrow rates stay below staking yields. Once rates spike, these loops flip to negative carry. Aave’s risk team and Lido have warned participants to reduce exposure:

“stETH loopers are now unprofitable, so start de-leveraging”

By July 24, signs of recovery were already visible.

“stETH depeg already down to 0.17%. Thank you for the free markets & arbitrage,” posted @Jrag0x. “This should slow down the exit queue growth. Next time, think a bit before panicking over ‘Staking Withdrawal Death Loop’ threads.”

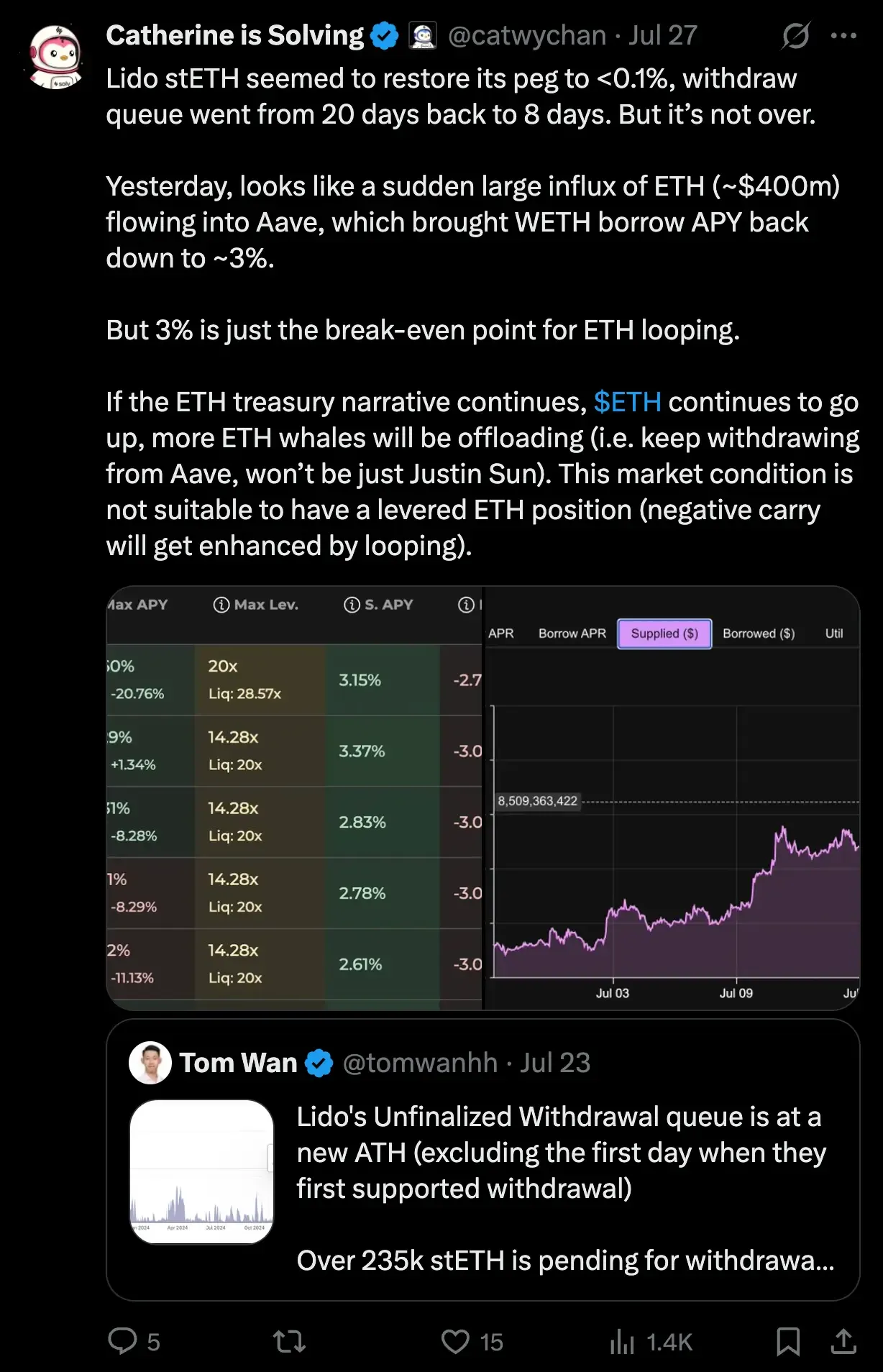

But optimism was short-lived. By July 27, new concerns emerged about incoming volatility:

“Lido stETH seemed to restore its peg to <0.1%, and the validator queue dropped from 20 days back to 8,” noted @catwychan. “But it’s not over... more Aave withdrawals are coming — not just from Justin Sun. This isn’t a safe time for levered ETH positions.”

stETH’s fundamentals remain sound, but this episode highlights how fragile leveraged staking structures can become. Expect more scrutiny on loop risks and validator exits going forward.