Crypto

From Biotech to HYPE: Sonnet SPAC Forms Hyperliquid Strategies Inc.

Sonnet BioTherapeutics pivots from biotech to crypto, merging into Hyperliquid Strategies—a Nasdaq‑listed SPAC treasury play holding 12.6 M HYPE (≈ $583 M at signing) plus $305 M cash, backed by Paradigm, Galaxy, Pantera, and more.

TL;DR

- SPAC merger forms Hyperliquid Strategies Inc. (HSI)

- Reserve: 12.6 M HYPE tokens (≈ $583 M) + $305 M cash → $888 M total

- Strategic backers: Paradigm, Galaxy Digital, Pantera, D1, Republic Digital, 683 Capital

- New leadership: Bob Diamond (chair), David Schamis (CEO); board adds Eric Rosengren

- Sonnet’s oncology R&D becomes an HSI subsidiary; shareholders get CVRs

- Sonnet shares jumped ~300% pre‑market; echoes Lion Group’s $600 M HYPE move

Deal Overview

A SPAC vehicle sponsored by Atlas Merchant Capital LLC (“Atlas”), Paradigm Operations LP (“Paradigm”), and additional investors (“Sponsors”) is set to combine with Nasdaq‑listed Sonnet BioTherapeutics. The merged company—renamed Hyperliquid Strategies Inc. (HSI)—will pivot from oncology R&D to public‑company crypto treasury management.

Token Reserve: 12.6 million HYPE tokens (≈ $583 million based on spot price just before signing)

Cash War Chest: At least $305 million invested by sponsors

Total Pro Forma Value: $888 million

Listing: Continues on Nasdaq Capital Market under a new ticker as the first pure‑play public crypto treasury firm

Strategic Investors & Rationale

Key backers include Paradigm, Galaxy Digital, Pantera Capital, D1 Capital, Republic Digital, and 683 Capital. Paradigm co‑founder Matt Huang explains:

“We hear lots of institutional demand for exposure to Hyperliquid, yet the native token HYPE is difficult to access in the United States. We are excited about this treasury strategy, which we believe will contribute to the Hyperliquid ecosystem in many ways over time.”

This consortium underscores a convergence of DeFi protocol growth with regulated public‑market capital.

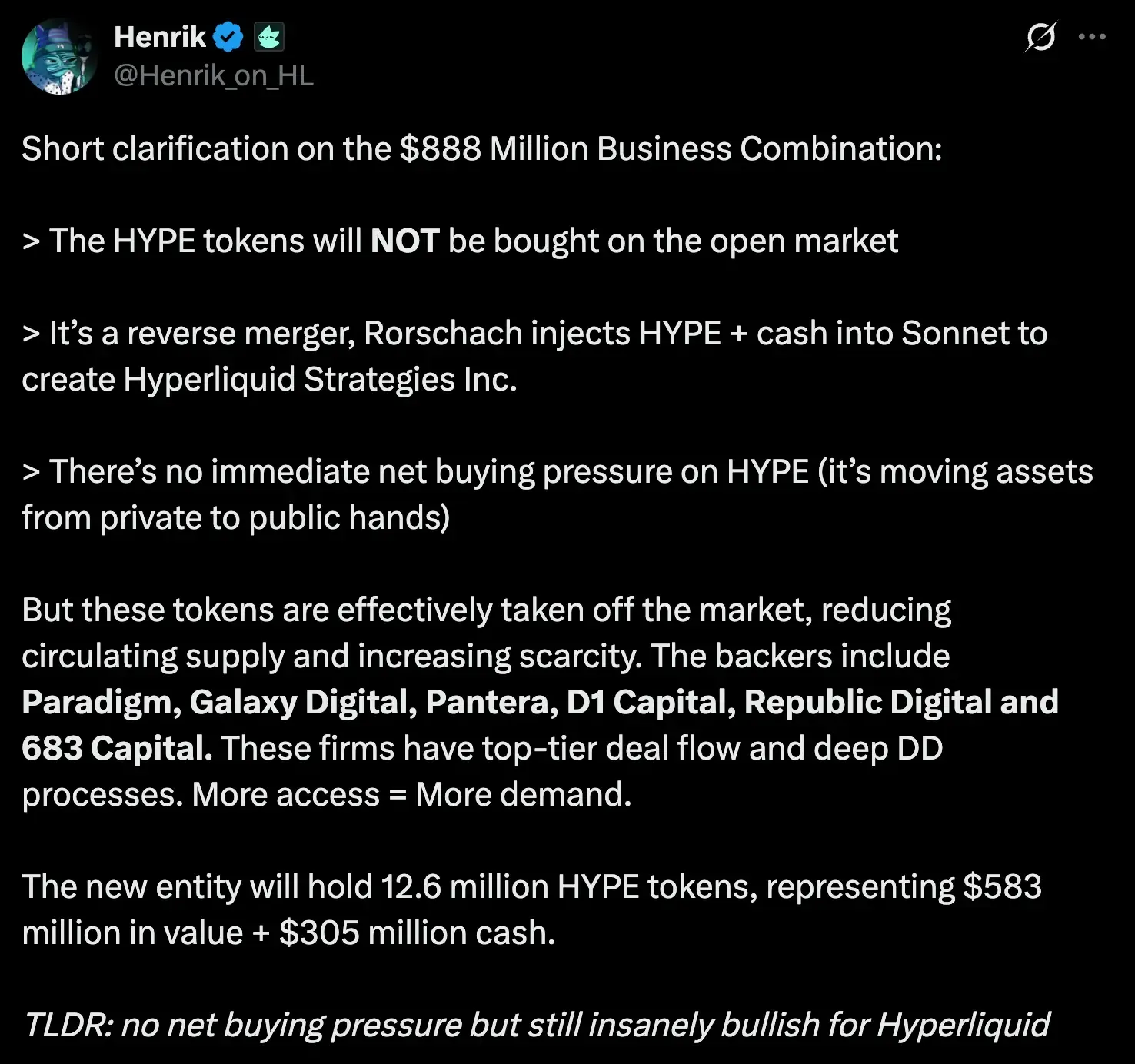

While the merger doesn't create immediate net buying pressure on HYPE (since the tokens are transferred, not bought on-market), they are effectively removed from circulation — tightening supply. As noted by @Henrik_on_HL, this structure remains bullish for Hyperliquid due to scarcity and the quality of institutional backers.

“TLDR: no net buying pressure but still insanely bullish for Hyperliquid”

Market Context: Hyperliquid’s Momentum

Built on the Hyperliquid Layer‑1 blockchain, the Hyperliquid decentralized exchange has:

- Processed $1.5 trillion in perpetuals volume over the past year

- Reached an all‑time high open interest of $11.3 billion

These metrics cement HYPE’s status as a top‑tier derivatives token and justify a large on‑chain reserve — all powered by Hyperliquid’s high-speed, decentralized perpetuals exchange, which blends CEX-grade performance with DeFi transparency. Learn more about how Hyperliquid works.

Leadership & Governance

At closing:

- Bob Diamond (Atlas co‑founder, ex‑Barclays CEO) → Chairman of HSI

- David Schamis (Atlas co‑founder, CIO) → CEO of HSI

- Board additions: Former Boston Fed president Eric Rosengren plus two of Sonnet’s independent directors

Their combined crypto, financial‑services, and public‑company expertise aims to ensure rigorous treasury oversight.

Sonnet’s Biotech Legacy & CVR Upside

Post‑closing, Sonnet’s oncology platform becomes a wholly‑owned subsidiary of HSI. Existing Sonnet shareholders will receive Contingent Value Rights (CVRs) entitling them to future biotech milestone payments—balancing immediate crypto exposure with long‑term drug‑development optionality.

Pre‑Market Reaction & SPAC Trend

On merger news, Sonnet shares surged ~300% in pre‑market trading, lifting its market cap to just over $16 million. This mirrors Lion Group’s June SPAC deal—a $600 million facility to back its own HYPE treasury—which highlights a growing trend of SPACs “flipping” into digital‑asset treasuries.

What’s Next?

Ticker Reveal & Nasdaq Filings: Expect updates in coming weeks.

Deployment of $305 M: Additional HYPE acquisitions should bolster liquidity and price support.

Ecosystem Initiatives: Potential liquidity mining programs, on‑chain governance participation, and strategic partnerships to drive protocol adoption.

Hyperliquid Strategies’ SPAC‑driven metamorphosis sets a new benchmark for institutional crypto exposure. By marrying robust token‑economics with public‑company governance, HSI offers investors regulated access to DeFi upside—while keeping one foot in biotech optionality via Sonnet’s CVRs.