Crypto

Ripple Is Expanding Its Product to Custody and Stablecoins

Ripple is moving beyond payments. With Ripple Custody and the RLUSD stablecoin, the company is building a regulated infrastructure for banks and fintechs, driving adoption, liquidity, and new momentum for XRP in 2025.

Quick Overview

- Ripple Custody launched in Oct 2024 with 250% YoY client growth

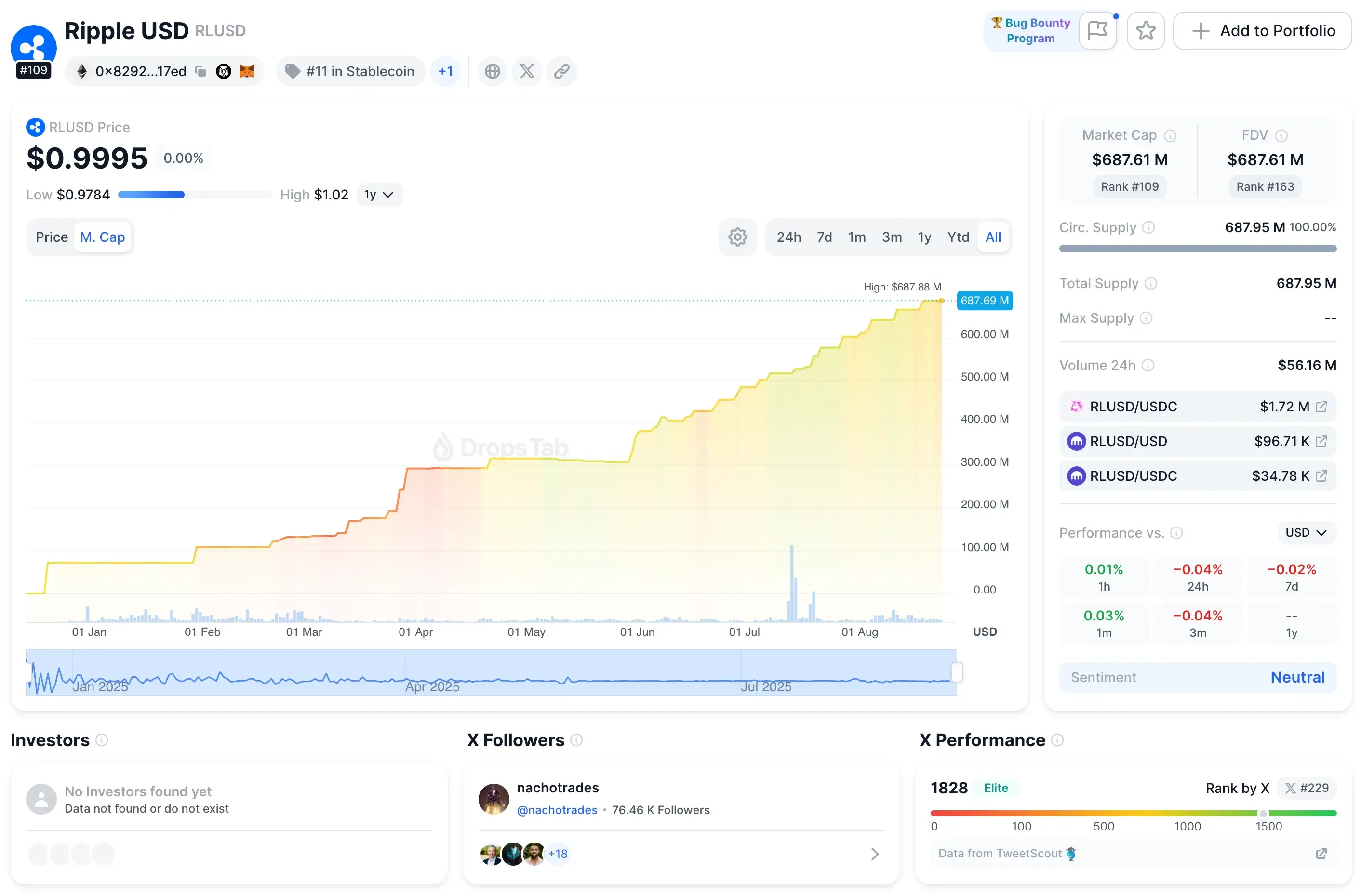

- RLUSD stablecoin reached $687.9M market cap within eight months

- BNY Mellon appointed as RLUSD reserve custodian in July 2025

- SEC lawsuit closed in Aug 2025 with $125M settlement

- Ripple applied for OCC banking charter, decision expected Oct 2025

Ripple Custody Product

Ripple Custody, launched in October 2024, was built for banks, asset managers, and fintechs that need digital asset storage without cutting corners on compliance. The setup leans on hardware security modules, fine-grained access controls, and Elliptic-powered transaction screening. It’s not just about safekeeping though. Because it plugs directly into the XRP Ledger (XRPL), clients can issue or move tokenized assets and trade them across the ledger’s native DEX. The network itself clears about 2.14 million transactions a day, with three-quarters of them finalizing in under five seconds. That speed matters when you’re moving institutional-sized money.

Growth has been sharp. Ripple says customer sign-ups jumped 250% year over year since launch. Today, institutions in more than 15 jurisdictions — from Switzerland and Germany to Singapore and Hong Kong — are already using the service. The roster includes names like BBVA Switzerland, Societe Generale – FORGE, DBS, and trading platforms such as RULEMATCH, Archax, and Futureverse.

Asia is becoming a proving ground. In February 2025, Ripple inked a deal with BDACS Korea, a regulated custodian, which opened the door for compliant XRP custody and distribution in South Korea.

That link ties directly into the country’s dominant exchanges — Upbit, Coinone, Korbit — effectively bringing XRP and tokenized assets into local institutional pipelines.

Put together, the picture is clear: Ripple Custody isn’t just another wallet vault. It’s positioning itself as a cross-border institutional bridge, meeting compliance standards while riding on XRPL’s liquidity rails.

Ripple Stablecoin RLUSD

RLUSD (Ripple USD) is Ripple’s U.S. dollar–backed stablecoin, issued through its trust subsidiary under a NYDFS limited-purpose trust charter. It went live on December 17, 2024, designed to be fully collateralized with U.S. dollar deposits, Treasuries, and cash equivalents. To strengthen confidence, Ripple publishes monthly third-party attestations of reserves. The choice of NYDFS oversight wasn’t random — it’s considered the gold standard for stablecoin regulation, and Ripple leaned on it to win institutional trust.

Like all stablecoins, RLUSD combines crypto-native speed with fiat stability, but also inherits the broader sector’s benefits and risks — from efficient payments to regulatory scrutiny — which we’ve broken down further in our analysis of the pros and cons of stablecoins.

Adoption came quickly. Within eight months, RLUSD’s market cap climbed to roughly $687.9 million with daily trading volume around $67 million. The token spread fast across major platforms: starting with Uphold, Bitso, MoonPay, Archax, and CoinMENA, later expanding to Bullish, Bitstamp, Mercado Bitcoin, Independent Reserve, and Zero Hash.

A major milestone followed in July 2025 when BNY Mellon, the world’s largest asset custodian with more than $53 trillion under custody, was named reserve manager for RLUSD. The bank now handles reserve movement and conversion between RLUSD and USD — a strong endorsement for the coin’s credibility.

At the same time, adoption is spreading outside traditional markets: Singapore-based Trident Digital Tech Holdings announced plans to secure stablecoin licenses across several African countries and raise $500 million for XRP treasury purchases, aiming to accelerate RLUSD integration into African payment rails.

Utility is already visible. By mid-2025, Ripple’s On-Demand Liquidity network was processing over $1.3 trillion in quarterly remittances, with RLUSD playing a core role alongside XRP. The stablecoin is also becoming the backbone for tokenized assets:

Ondo Finance launched its flagship short-term U.S. Treasuries fund (OUSG) directly on XRPL, with seamless minting and redemption flows powered by RLUSD.

This positions Ripple’s dollar token as both a payments rail and a settlement layer for real-world asset tokenization.

Institutional Drivers

Regulatory clarity has been the real unlock. In August 2025, the SEC finally ended its long-running case against Ripple, dismissing remaining appeals and leaving a $125 million penalty as the closing chapter. That decision marked the end of years of courtroom uncertainty. Just as important, U.S. rulings from 2023 through 2025 confirmed that XRP is not a security when traded on public exchanges — a point that eased institutional hesitation around using both XRP and Ripple’s broader suite of products.

Ripple isn’t stopping there. On July 2, 2025, the company filed for a national trust bank charter with the Office of the Comptroller of the Currency. The OCC has 120 days to respond, which sets a decision window around October. If the charter is approved, Ripple would be positioned to offer fiat services, custody, and stablecoin issuance under federal oversight — effectively blending crypto infrastructure with traditional banking standards.

For now, Ripple operates through its U.S. trust unit and issues RLUSD under NYDFS supervision, giving it a compliance-first foundation. That regulatory framework signals to institutions that Ripple’s services aren’t experimental add-ons but bank-grade infrastructure ready to plug into global finance.

Competitive Landscape — Ripple vs Coinbase, Circle, BitGo, Anchorage

Ripple’s custody and stablecoin bets don’t exist in a vacuum. They land right in the middle of a market already dominated by names like Coinbase, BitGo, Anchorage, Tether, and Circle. The differences show where Ripple is trying to carve its lane.

Custody providers to watch

- Ripple Custody — launched in 2024. Too new for meaningful AUM stats, but already counts BBVA Switzerland, SocGen-FORGE, and DBS as clients. Operates under a NYDFS trust and leans on XRPL integration.

- Coinbase Custody — active since 2018, overseeing around $193 billion in assets by late 2023. Serves giants like BlackRock and Fidelity. It’s also the backbone custodian for most U.S. spot Bitcoin ETFs.

- BitGo — founded in 2013, one of the first to push multi-signature security. Provides custody for exchanges and funds, positioning itself as a qualified custodian.

- Anchorage Digital — federally chartered as a crypto bank, launched 2017. Safeguards tens of billions and has relationships with Visa, Samsung, and BlackRock. Its OCC license gives it a regulatory edge few others have.

On the stablecoin side, Ripple’s RLUSD has to compete against the entrenched giants while trying to win over institutional users that care about compliance.

Stablecoins side by side

- RLUSD (Ripple) — launched in 2024. Roughly $687.9 million market cap by Aug 2025. Fully backed by USD deposits and Treasuries, chartered under NYDFS, and publishes monthly third-party attestations.

- USDT (Tether) — the heavyweight at around $140 billion. In circulation since 2014, backed by USD and equivalents, but still criticized for its lack of full audits.

- USDC (Circle) — around $42 billion in market cap. Launched in 2018, backed by USD deposits, publishes monthly attestations, and also regulated by NYDFS.

- DAI (MakerDAO) — decentralized by design, with a ~$5.3 billion cap. Backed by crypto collateral like ETH, over-collateralized, and fully transparent on-chain.

Ripple’s strategy looks like a hybrid. On custody, it echoes Coinbase’s push for institutional trust but adds XRPL-native tokenization. On stablecoins, RLUSD leans closer to Circle’s USDC model — fully backed, attested, and regulator-approved — while distancing itself from Tether’s audit concerns and DAI’s decentralized unpredictability.

What Ripple’s Expansion Means for Institutions

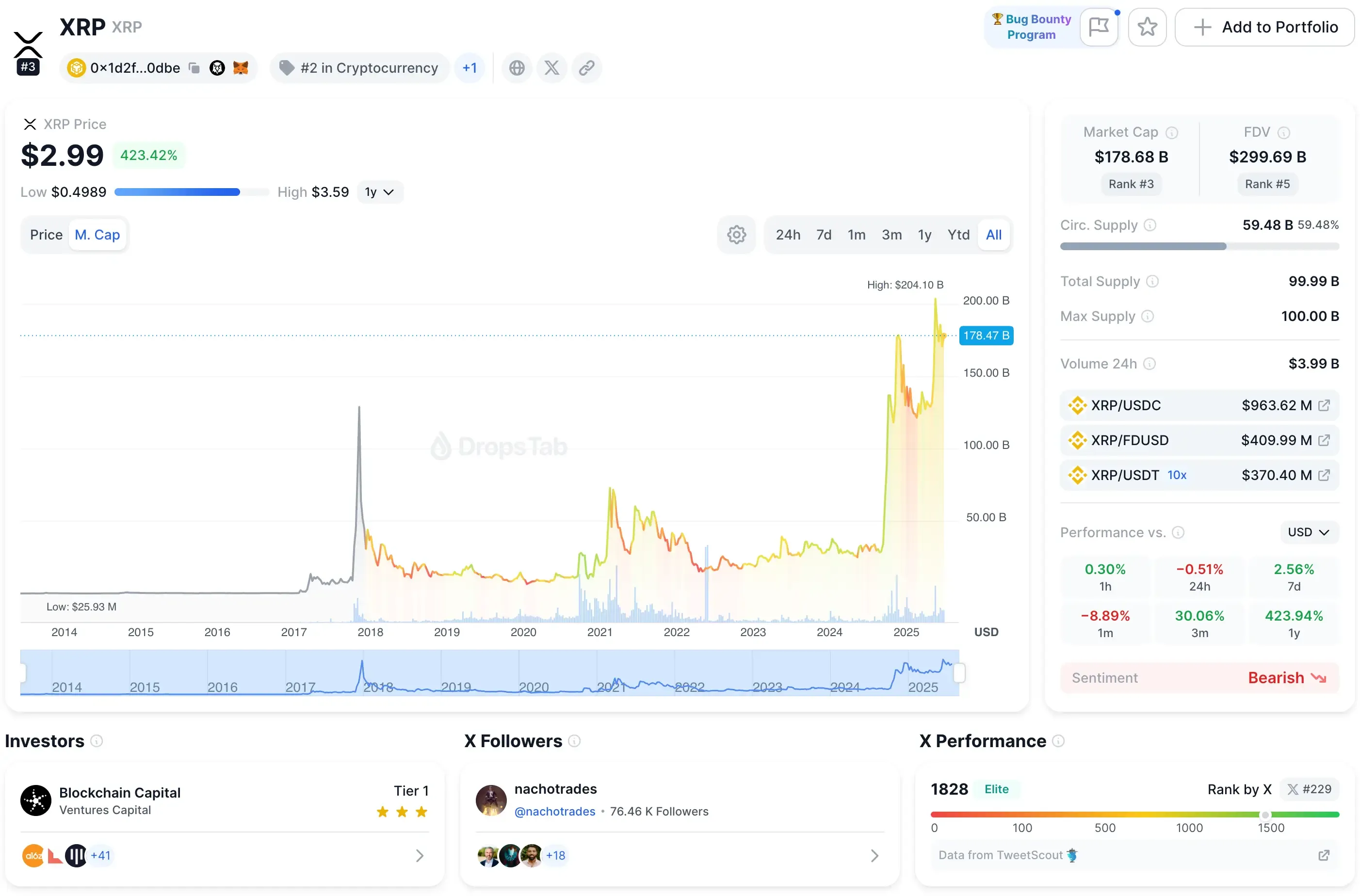

Ripple’s push into custody and stablecoins rounds out its product stack. For banks and fintechs, the value is obvious: custody, payments, and settlement rails all stitched together. Assets can be tokenized on XRPL, reserves parked in a regulated USD stablecoin, and cross-border transfers executed with near-instant finality. It’s an ecosystem loop — Ripple Custody, RLUSD, XRPL — where every RLUSD transaction feeds back into XRP fees and liquidity. No surprise then that XRP has surged in 2025, up about 176% year-to-date.

Still, not everyone is convinced. Critics argue that Ripple’s model extracts value in layers — selling to institutions, who then offload to retail — and point to investors like SBI, which holds roughly 9% of Ripple’s equity, as evidence of the blurred line between corporate backing and token utility.

At the same time, whale behavior shows capital rotation: around $56 million in XRP positions recently shifted into Chainlink, with traders betting on its $11 trillion derivatives oracle market dominance.

Moves like this highlight how even as Ripple builds regulated rails, parts of the market hedge into competing infrastructure.

Regulatory clarity is the backbone here. The SEC case is closed, and Ripple’s bank charter application is in play. NYDFS already supervises its trust arm, giving RLUSD credibility in the same league as Circle’s USDC. If the OCC approves Ripple’s charter this fall, the company effectively becomes a crypto-native bank — not unlike Coinbase or even BNY Mellon, but with its own stablecoin rails attached.

For traders, this means more options: RLUSD sitting alongside USDC and USDT in cross-border FX, tighter spreads, deeper liquidity. For institutional investors, the pitch is sharper: a full-stack, regulated infrastructure that’s already in use. OTC desks are shifting dollar transfers into RLUSD, and some banks are trialing Ripple Custody to store digital assets. The barriers to entry keep dropping — which is exactly what Ripple has been chasing for a decade.