Crypto

SharpLink Gaming’s Ethereum Bet Makes It the Top Public ETH Holder

SharpLink Gaming (NASDAQ: SBET) has acquired 198,167 ETH (~$500M), becoming the top public company in Ethereum holdings. All ETH is staked, reflecting a bold crypto strategy backed by Ethereum co-founder Joseph Lubin.

TL;DR

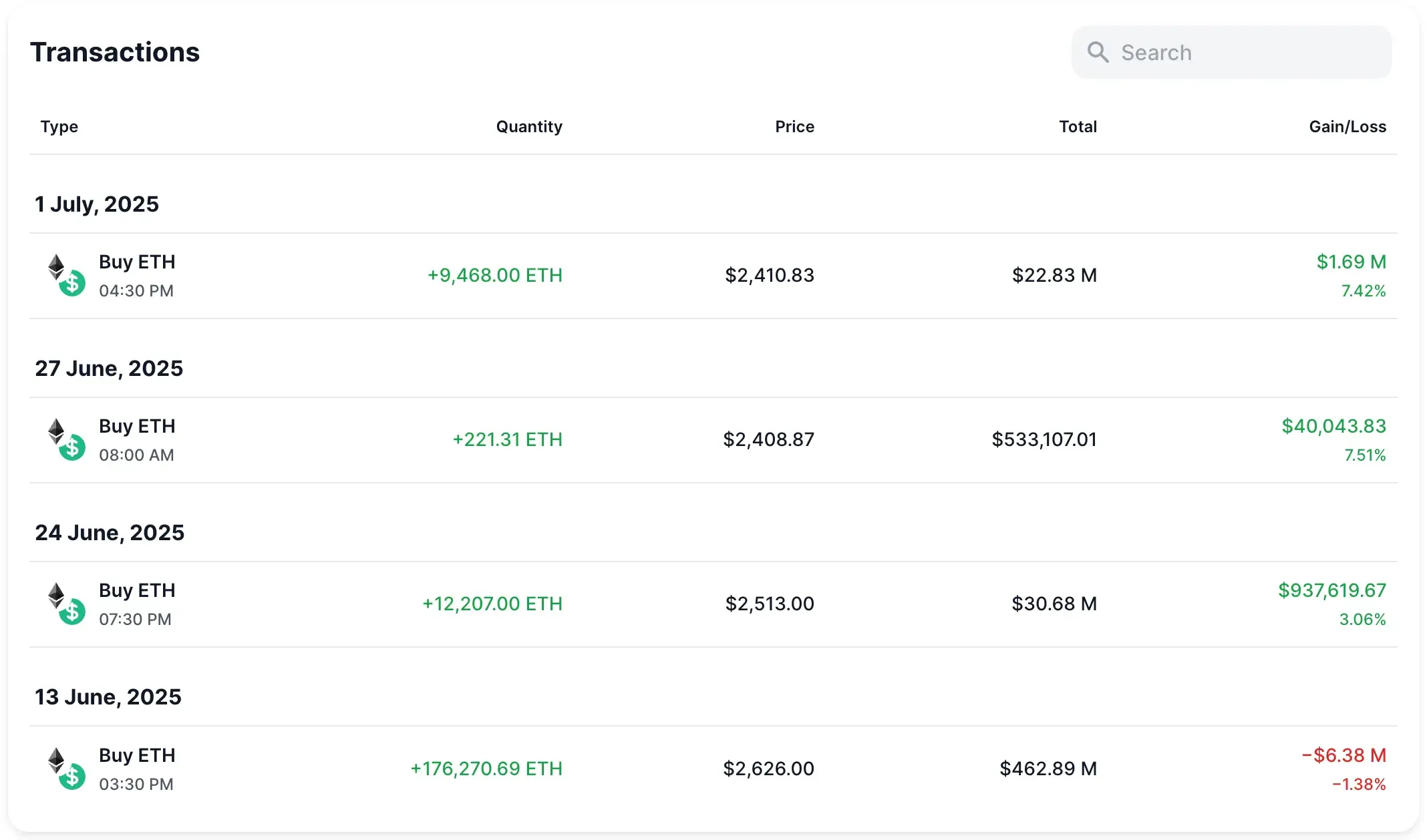

- SharpLink purchased 198,167 ETH (~$485 M total) within a month, at an average price around $2,600 per ETH. This makes it the largest public Ether holder globally, surpassing all other publicly traded companies.

- The firm adopted Ethereum as its primary treasury reserve asset, mirroring a MicroStrategy-like approach but with ETH. Leadership (including Ethereum’s Lubin) cites Ethereum’s “foundational” role in digital finance as motivation.

- 100% Staked for Yield: All of SharpLink’s ETH holdings are staked in Ethereum’s network to earn passive income. The company has already accrued ~222 ETH in staking rewards, boosting its holdings while contributing to network security.

- SharpLink raised $425 M in a private placement (led by ConsenSys) and sold shares via an ATM program to fund the purchases. Over $100 M in additional equity was issued, increasing shares outstanding but fueling the ETH buy.

Table of Contents

The Largest Public ETH Holder

By reaching nearly 200,000 ETH, SharpLink has leapfrogged every other public company in ETH holdings. For context, the Ethereum Foundation (a non-profit entity, not publicly traded) holds about 214,000 ETH in its treasury – only slightly more than SharpLink – and regularly sells small portions to fund development.

However, among stock-listed firms, SharpLink is now #1 by a wide margin. Previously, publicly traded Ethereum treasuries were virtually unheard of or much smaller.

For example, Chinese app maker Meitu garnered attention in 2021 for buying 31,000 ETH, but it eventually sold all 31K ETH by late 2024. Crypto mining companies have held some Ethereum – U.S.-based miner Bit Digital reported about 24,400 ETH as of Q1 2025 – but that is only ~12% of SharpLink’s current stash.

Even major crypto-native firms haven’t hoarded ETH at SharpLink’s scale on their balance sheet. Coinbase, for instance, holds a substantial amount of crypto including Ethereum for operational and investment purposes, but exact figures aren’t publicly disclosed.

And while investment vehicles like BlackRock’s iShares Ethereum Trust ETF custody large quantities of ETH (about 1.7 million ETH on behalf of fund shareholders, equivalent to ~$4.5 billion), those assets belong to investors in the fund, not to the company itself.

SharpLink’s Ethereum, on the other hand, is owned outright by the company as a treasury reserve. This makes SharpLink an outlier – no other public corporation has ever put this level of conviction (and capital) into ETH.

It’s worth noting that SharpLink’s ETH trove even surpasses the holdings of some national treasuries (though a few governments and ETFs hold more, as noted). In essence, SharpLink has made itself the closest equivalent to a “MicroStrategy of ETH.” MicroStrategy became famous for accumulating Bitcoin; SharpLink is now doing the same with ETH.

Why Ethereum? SharpLink’s Strategy and Rationale

SharpLink’s bold move to adopt Ethereum as its primary treasury reserve asset is a deliberate strategic pivot. The company – traditionally a provider of sports betting and iGaming technology solutions – announced that aligning with ETH gives it “direct exposure to the world’s leading smart-contract platform and second largest digital asset.”

In the words of SharpLink CEO Rob Phythian, “We believe Ethereum is foundational infrastructure for the future of digital commerce and decentralized applications. Our decision to make ETH our primary treasury reserve asset reflects deep conviction in its role as programmable, yield-bearing digital capital.”

This aligns with broader views that Ethereum is no longer playing catch-up — with upgrades, leadership shifts, and innovations like MegaETH, a breakout toward $10K ETH may not be as far-fetched as it sounds (explore analysis).

Company leadership draws parallels to broader trends in crypto adoption. Joseph Lubin, Ethereum’s co-founder who joined SharpLink as Chairman, heralded SharpLink’s ETH treasury as a “pivotal milestone” for institutional Ethereum adoption. He noted that digital assets like ETH are fast becoming the strategic currency of the modern digital economy. By embedding Ethereum into its corporate strategy, SharpLink is positioning itself at the forefront of what it sees as the future of finance.

Lubin also highlighted that by allocating significant capital to staking, SharpLink is “contributing to Ethereum’s long-term security and trust properties while earning additional ETH for that work.”

In other words, the company isn’t just passively holding ETH; it’s actively participating in the Ethereum ecosystem as a validator (via stake) and being rewarded for it.

Essentially, buying SBET stock now gives investors indirect ownership of ~0.002 ETH per share (a metric SharpLink calls “ETH Concentration,” now at 2.35 ETH per 1,000 diluted shares). This is a novel value proposition: shareholders are investing in an operating business plus a sizeable crypto treasury.

The timing of SharpLink’s bet also aligns with a hopeful regulatory outlook. U.S. lawmakers have been advancing legislation on stablecoins and crypto market structure, which Lubin and Phythian have suggested could catalyze broader adoption of Ethereum technology if passed. By moving early, SharpLink aims to get ahead of the curve and establish itself as a forward-thinking leader at the intersection of crypto and the online gaming industry.

Staking 100% of ETH – Earning Yield and Securing the Network

One distinctive aspect of SharpLink’s treasury strategy is that it hasn’t left its Ether idle. The company deployed 100% of its ETH reserves into staking and liquid-staking protocols as of the end of June. By doing so, SharpLink helps validate Ethereum’s proof-of-stake blockchain – effectively contributing to network security – and in return earns staking rewards paid in ETH. This turns their treasury into an income-producing asset.

It also removes nearly 200K ETH from liquid circulation — a move that adds to Ethereum’s broader supply crunch, where tens of thousands of ETH are withdrawn from centralized exchanges daily and cold storage, ETFs, and corporate treasuries are tightening available supply across the board. This growing pressure is detailed in our analysis of the Ethereum CEX withdrawals trend.

According to SharpLink’s disclosures, the firm generated 120 ETH in staking rewards by June 20, and then accumulated a total of ~222 ETH in rewards since the strategy began (through early July). For example, in just one week (June 21–27), after the latest purchases, SharpLink earned 102 ETH from its staking activities. At current prices, that’s over $250,000 worth of Ether earned in a week simply by participating in Ethereum’s consensus mechanism. Annualized, this implies a staking yield on the order of 5%–6%, which aligns with typical Ethereum network staking APYs.

To achieve this, SharpLink likely split its holdings between running its own validation nodes and using liquid staking platforms. Liquid staking solutions (such as Lido or Rocket Pool) provide tokenized staked ETH (e.g. stETH), which SharpLink can hold or potentially use in DeFi, all while still earning rewards. In fact, blockchain data shows one of SharpLink’s wallets holds a substantial amount of liquid staked ETH tokens, indicating the use of such services. By combining direct staking and liquid staking, SharpLink ensures that essentially every Ether is productive – either locked in official validators or yielding via staking derivatives.

This comprehensive staking approach shows SharpLink’s commitment to Ethereum’s ecosystem. Lubin highlighted that this not only yields income, but also “contributes to Ethereum’s long-term security” by validating transactions. It’s a symbiotic strategy: as Ethereum succeeds and transitions fully into a proof-of-stake future, SharpLink benefits both as a stakeholder and as an investor. All staking rewards earned (hundreds of ETH so far) compound the company’s holdings – effectively increasing its treasury without additional cash outlay.

Key Takeaways and Future Outlook

For investors and industry observers, SharpLink’s ETH strategy offers several insights:

Proof of Concept for ETH Treasuries

SharpLink is essentially testing whether a public company can successfully adopt a crypto (ETH) as its primary reserve and be rewarded for it (through stock value or business growth). If it succeeds, it may pave the way for other companies to consider Ethereum for treasury diversification, especially those in tech or finance sectors.

Enhanced Transparency via Blockchain

By leveraging public blockchain addresses and reporting metrics like “ETH concentration” and staking rewards, SharpLink provides a level of transparency and verifiability uncommon in traditional finance. Stakeholders can literally monitor the company’s treasury in real-time on Etherscan. This could increase trust if managed well (but also exposes the company to constant public scrutiny of its moves).

Volatility and Risk Management

SharpLink’s journey also highlights the risks of marrying corporate finance with crypto. Stock volatility, dilution concerns, and regulatory questions (e.g., how to account for crypto on the balance sheet under GAAP, which the company flagged in its disclosures) are challenges it must navigate. The company will need prudent risk management – for instance, ensuring it has enough fiat liquidity for operations so it isn’t forced to sell ETH at a low point.

Strategic Alignment with Web3

With Lubin at the helm of the board, SharpLink is likely positioning to do more with Ethereum than just hold it. We might expect the company to explore integrating blockchain technology into its gaming platforms, perhaps enabling crypto-based betting, NFTs for sports fans, or other Web3 innovations in iGaming. Holding ETH could then also serve a strategic purpose if SharpLink builds on Ethereum’s network for its products.