Crypto

Ethereum Ecosystem Growth and Market Outlook

Ethereum in 2025 is faster, greener, and scaling through Layer-2 networks, driving billions in DeFi, NFTs, and real-world assets—while facing competition, regulation, and market risks.

Quick Overview

- Ethereum dominates DeFi, NFTs, and Web3 in 2025 with major scalability gains

- ETH trades near all-time highs, backed by institutional adoption

- Layer-2 networks surpass mainnet in transactions and lower fees

- Key risks include competition, security, and regulation

What Is Ethereum?

Ethereum is a blockchain you can program, not just use for sending money like Bitcoin. It was created to run smart contracts — programs stored on the blockchain that follow rules automatically. Vitalik Buterin came up with the idea in 2013, and the network launched on July 30, 2015, after a public fundraising. Since 2022, it has run on Proof of Stake, with over a million validators keeping it secure.

Ethereum uses a programming language called Solidity and the Ethereum Virtual Machine (EVM), which runs on every node. This setup can handle almost any kind of app. Standards like ERC‑20 for regular tokens and ERC‑721 for NFTs helped start the ICO craze, DeFi boom, and NFT market. Because it doesn’t rely on central servers, anyone can build and launch apps freely, with the rules enforced by code and community agreement. In short, Ethereum is the main infrastructure for Web3 — a global computer owned and run by its users.

Core Use Cases in Mid-2025

Decentralized Finance (DeFi)

Ethereum runs most top DeFi apps, like MakerDAO, Aave, Compound, Uniswap, and Lido Finance. These let people lend, borrow, trade, and earn interest without banks. By mid-2025, Ethereum holds about 60% of all DeFi value ($166B), and Lido alone has over $41B in staked ETH.

Non-Fungible Tokens (NFTs)

Ethereum created the ERC-721 standard for NFTs and is still the top network for them. After a slowdown, NFT trading on Ethereum jumped over 100% in July 2025. Platforms like OpenSea and Blur host collections such as CryptoPunks and Bored Apes, plus gaming and metaverse items.

Gaming and Web3 Social

Ethereum and its Layer-2 networks host blockchain games and social apps where users truly own their assets. Games like Gods Unchained, Axie Infinity, and Illuvium use Ethereum for secure transactions. Platforms like Mirror and Lens Protocol support publishing and social networking.

Stablecoins and Payments

Ethereum is home to major stablecoins like USDT, USDC, and DAI, plus over half of the $25B real-world asset token market. These tokens include bonds and real estate. Layer-2 networks make payments faster and cheaper, though other blockchains compete here.

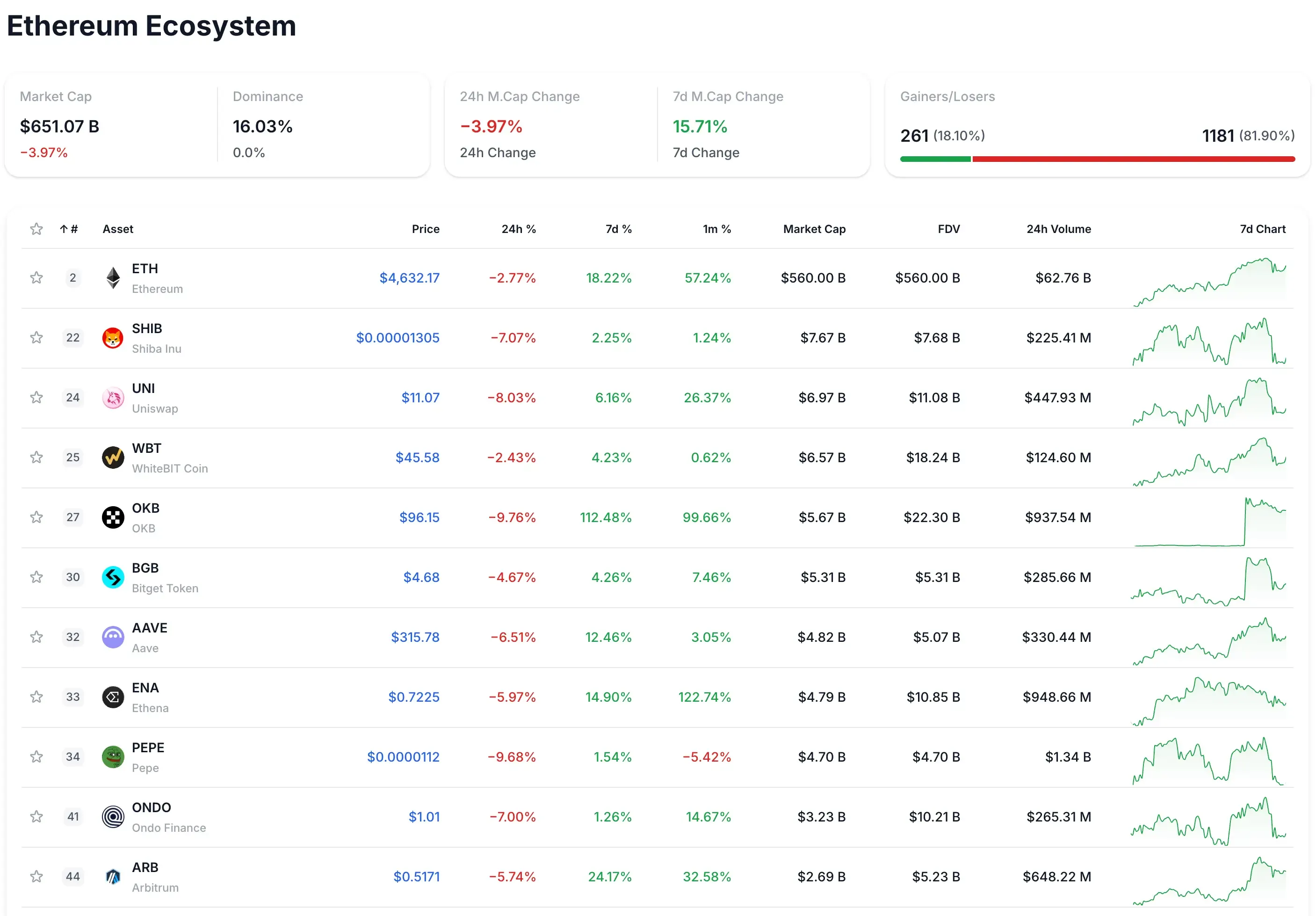

For a deeper dive into live data, market leaders, and trending projects, explore the full Ethereum ecosystem: https://dropstab.com/categories/ethereum-ecosystem

Ecosystem Snapshot (August 2025)

ETH Price

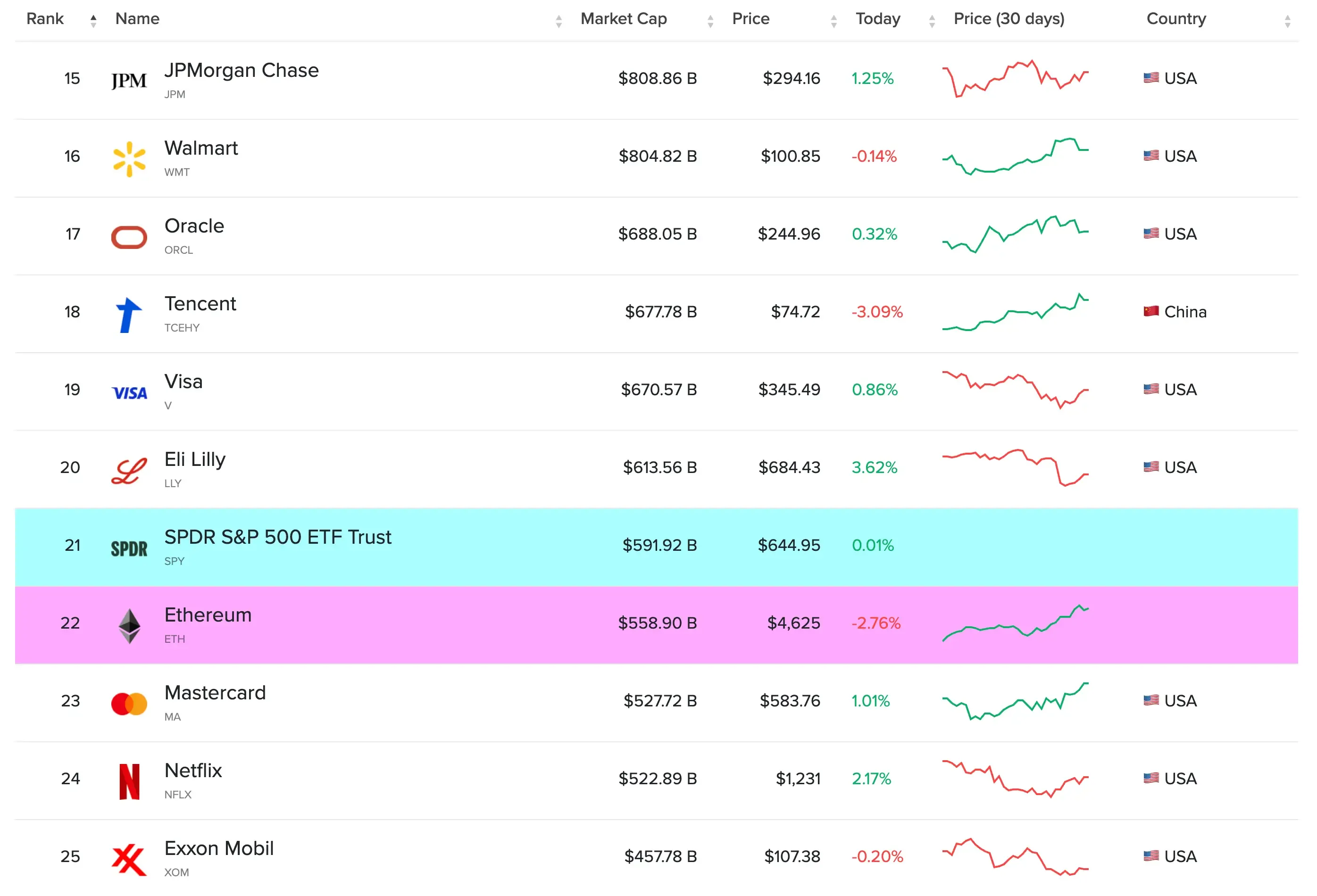

In Aug 2025, ETH was $4,744, up 76% from a year ago.

Its market cap is about $558B — placing it ahead of Mastercard and making it the 22nd most valuable asset globally — a big jump from ~$1,600 in June, driven by more buyers and big investors.

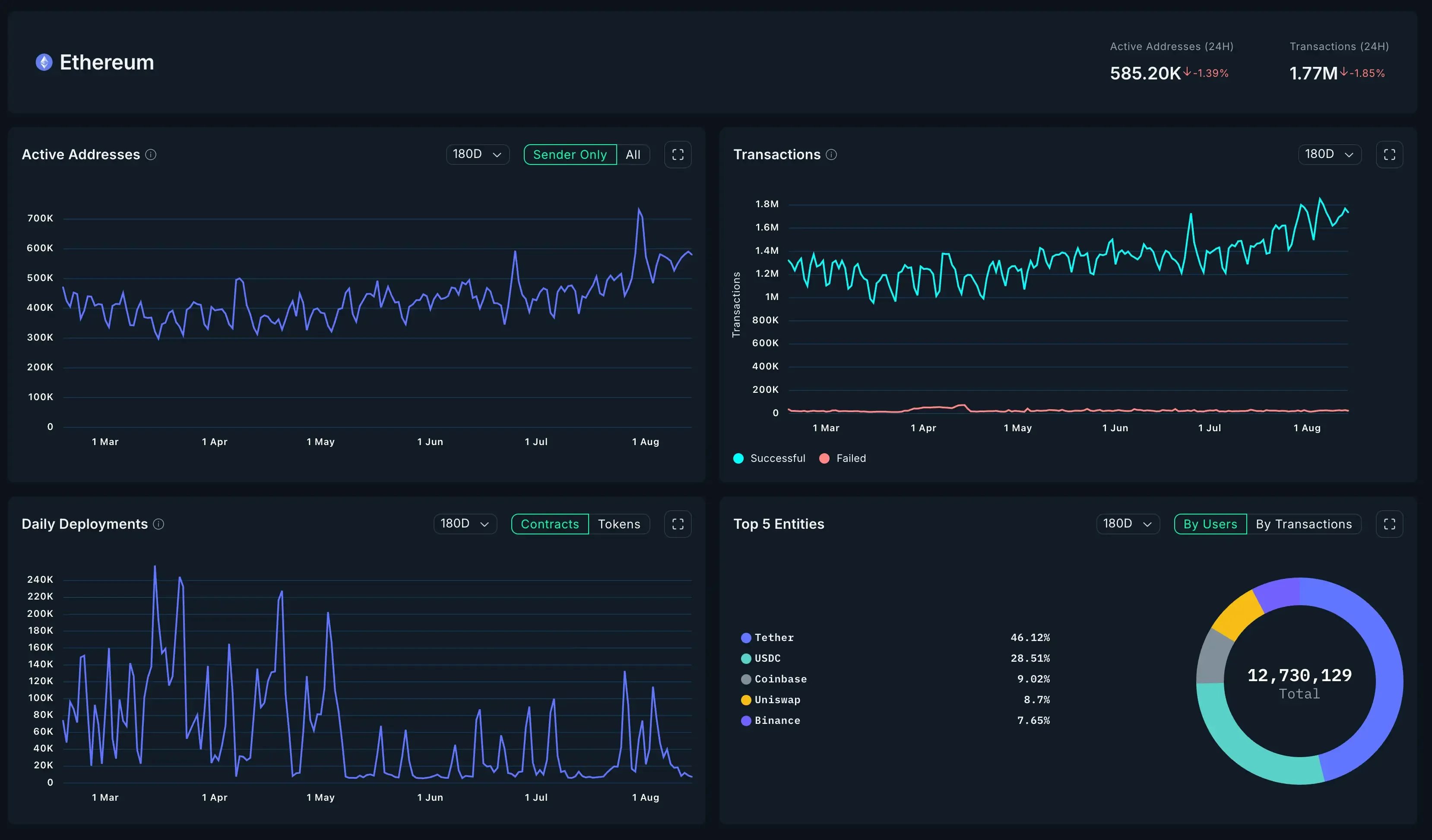

Network Activity

Ethereum handles 1.7–1.8M transactions a day, close to its highest levels. Active addresses are usually 500k–600k, sometimes over 1M. Gas use stays high, showing strong demand even with more activity moving to Layer-2s.

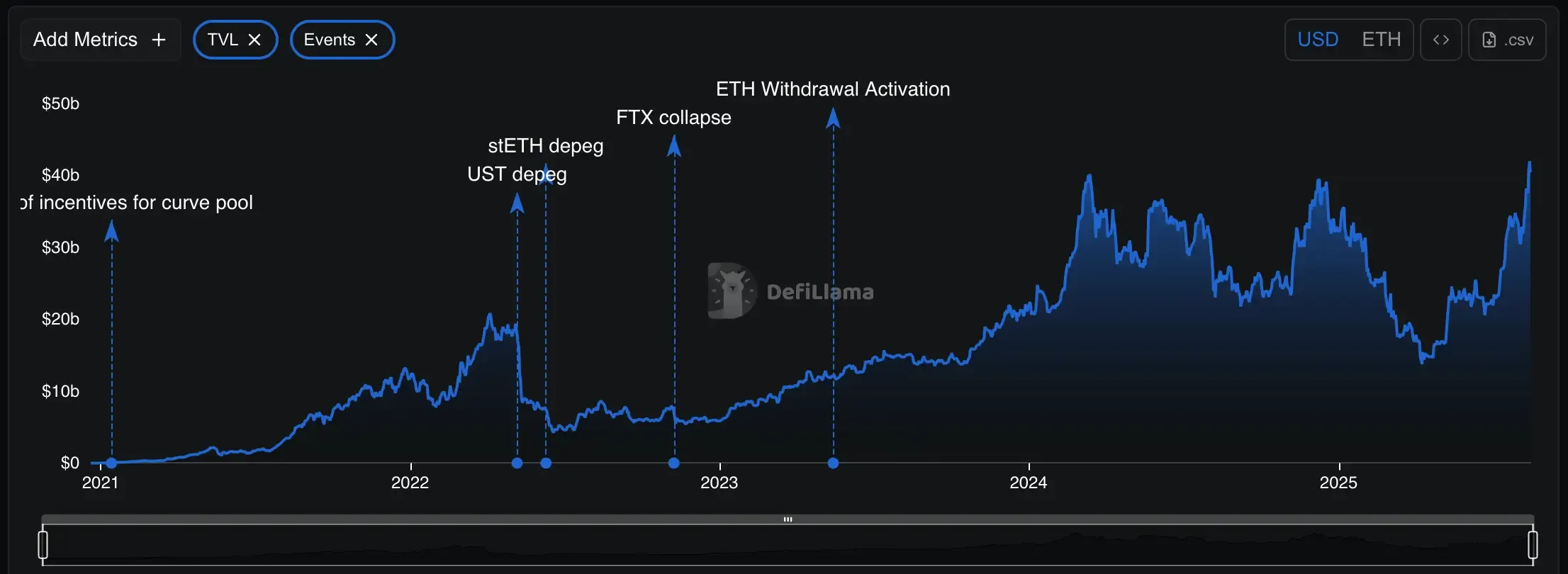

Total Value Locked (TVL)

Around $166B is locked in Ethereum DeFi, and $265B in the whole ecosystem. Lido leads with $41B in staked ETH, followed by Aave ($15B), Uniswap, and Curve. Most value is in staking and lending.

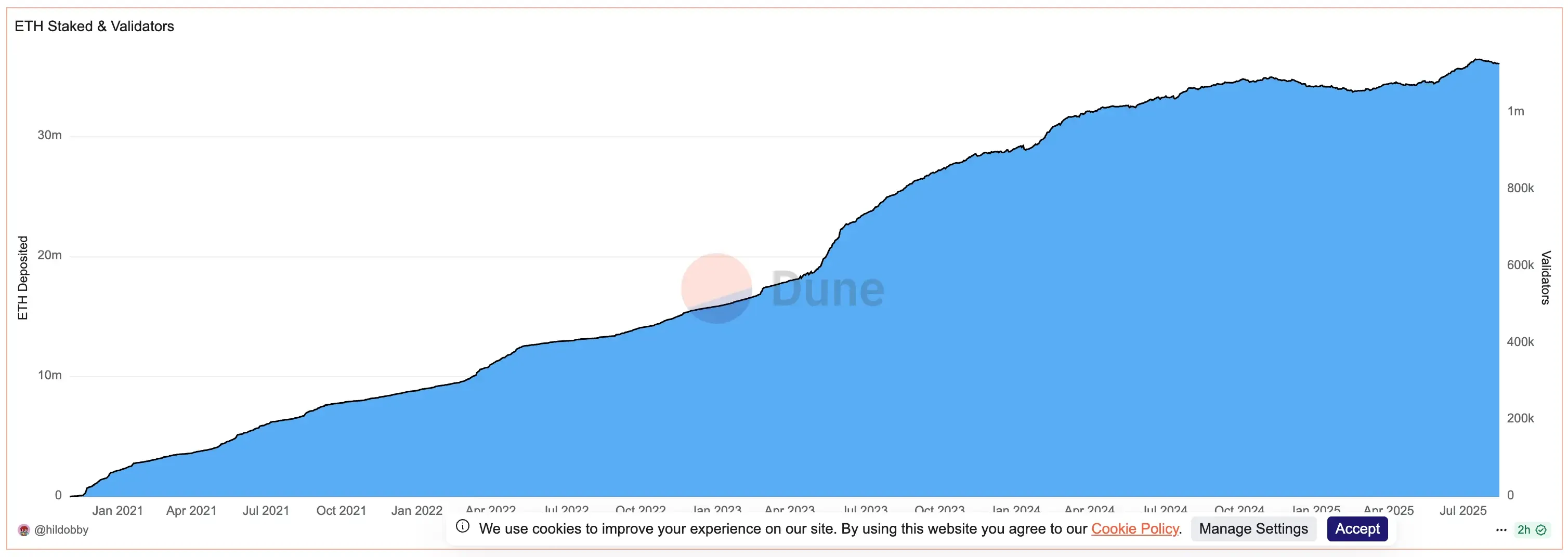

Staking and Supply

35.7M ETH is staked (~29.8% of all ETH), earning ~3–4% yearly. Lido controls ~27–28% of this (~9.4M ETH). Since 2022, ETH’s supply is down about 350,000 due to fee burning, making it slightly deflationary.

Layer-2 Adoption

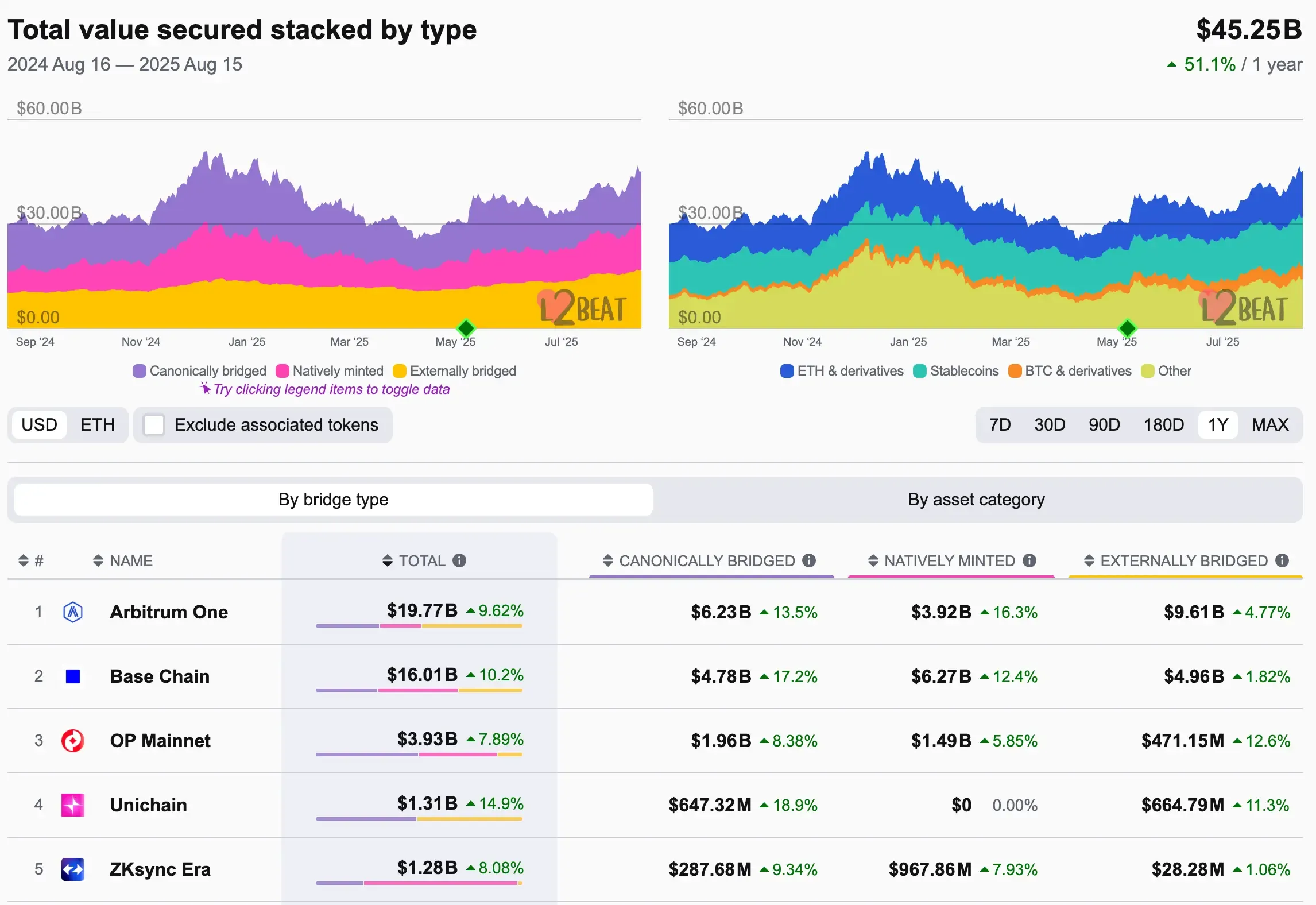

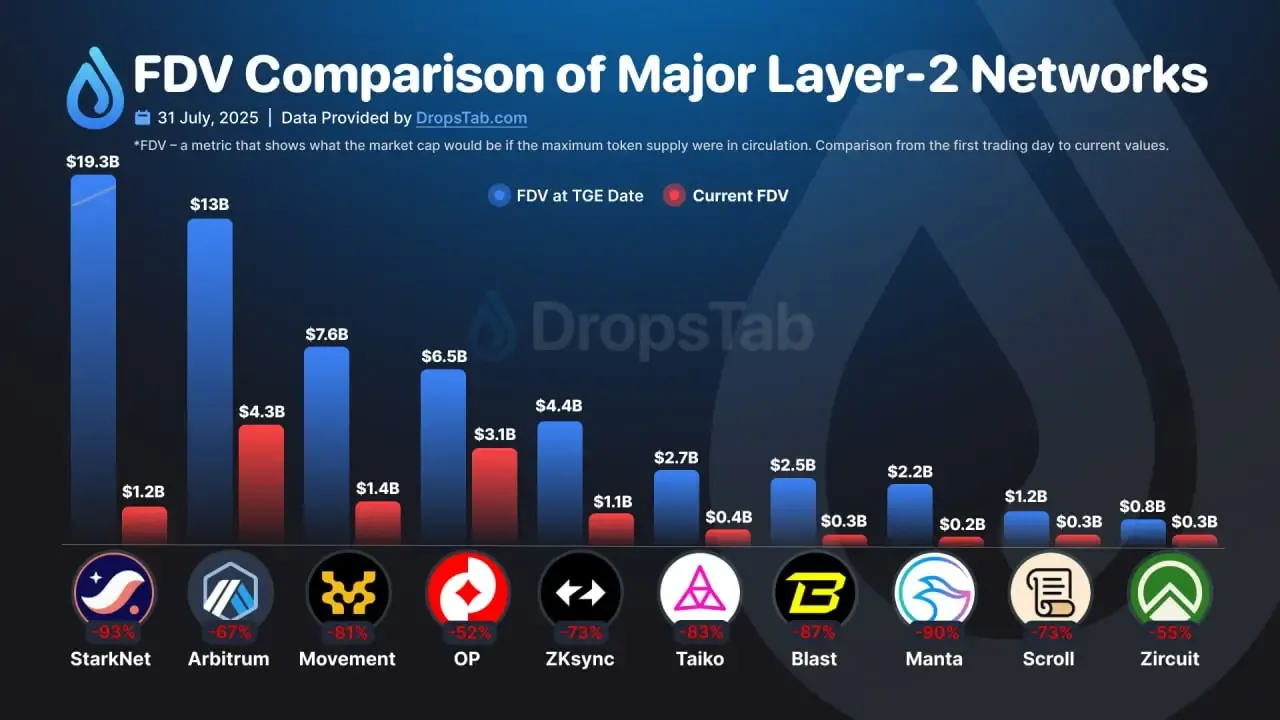

Layer-2 networks now process more transactions than Ethereum’s main chain. Base averages ~8.6M daily, Arbitrum ~3.4M, compared to L1’s ~1.7M. L2 TVL is about $45B, led by Arbitrum ($19.8B) and Base ($15.9B), with others like Optimism, zkSync Era, and StarkNet holding $1–4B.

Scaling and Upgrades

In 2025, Ethereum’s big steps forward come from key upgrades and Layer-2 scaling, which make the network faster and easier to use while staying decentralized.

Layer-2 Scaling

The main Ethereum chain can only handle about 15–30 transactions per second, so much of the activity happens on Layer-2 rollups like Arbitrum, Optimism, Base, and ZK-rollups. These process millions of transactions each day. Recent launches, such as Linea’s token generation event featuring an 85% community allocation and dual ETH-linked burn mechanics, highlight how Ethereum’s L2 ecosystem continues to innovate and attract users.

In March 2024, the “Dencun” upgrade (Cancun + Deneb) introduced EIP-4844, which added data blobs that cut L2 fees by up to 90%. By mid-2025, transactions on L2 cost only $0.01–$0.10, bringing in more DeFi projects and consumer apps. Ethereum’s plan focuses on rollups, with future updates aiming for full danksharding.

Dencun Upgrade

Launched on March 13, 2024, Dencun’s proto-danksharding lets rollups store batch data cheaply, reducing costs about tenfold. Other changes improved security and validator tools, reinforcing Ethereum’s L2-first approach.

Account Abstraction (ERC-4337)

Released in 2023, ERC-4337 allows smart wallets with features like custom permissions, grouped transactions, account recovery, and gas fee sponsorship. It’s now widely used in wallets and apps. By the end of 2024, there were over 19 million smart accounts, with expectations of 200 million+ by the end of 2025. This makes starting and using Ethereum apps easier.

EigenLayer and Restaking

Running since 2023, EigenLayer lets ETH stakers also secure other services for extra rewards. By 2025, it holds about 68% of the $26B restaking market (~3.5–4M ETH). This helps new projects use Ethereum’s security, though it comes with risks if those services fail.

August 2025 Price Outlook for the Rest of the Year

After falling under $2,000 in Q2 2025, ETH has climbed to about $4,700 in August, close to its record high of $4,891. A strong Bitcoin rally and several ETH spot ETF filings have boosted optimism, but price swings are still likely.

Base Case

If Bitcoin stays around $120K and investor interest remains steady, ETH use could keep growing, helped by more staking after the Nov 2025 Fusaka upgrade. Price could reach $5,000–$6,000 in Q4 2025 with a gradual rise.

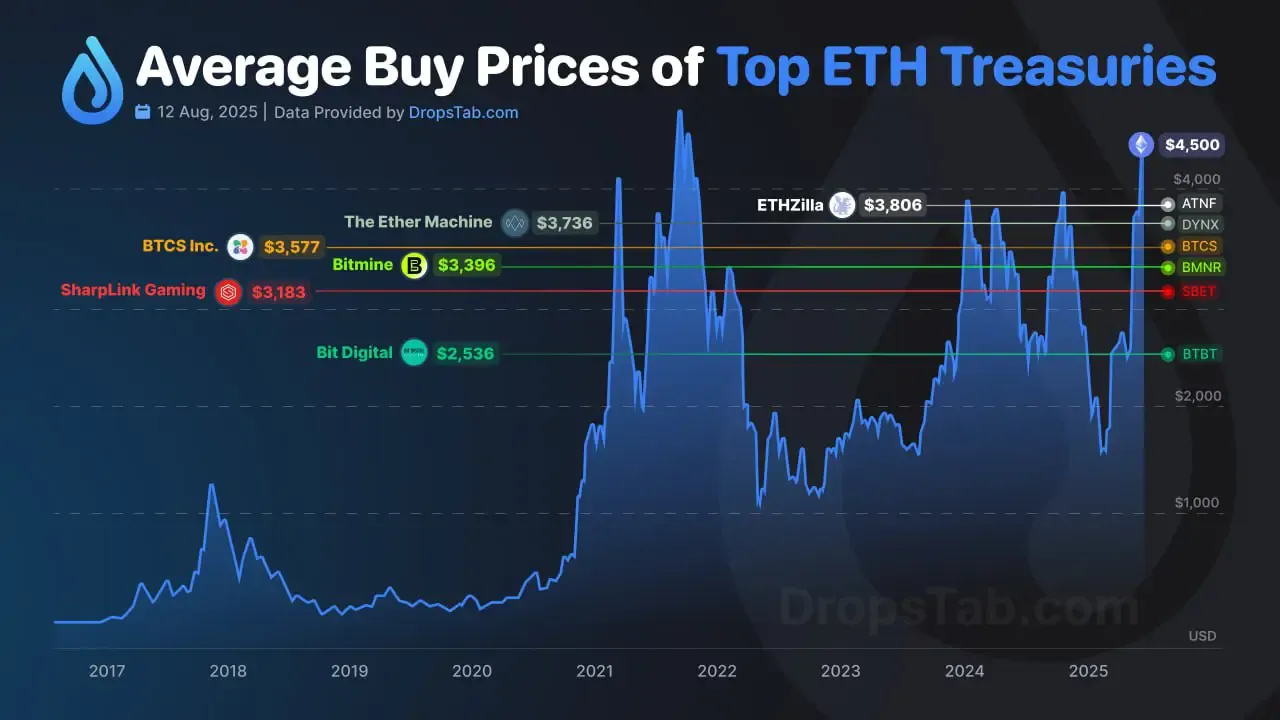

Analysts point out that institutional investors and company treasuries now hold over 1.2M ETH. Institutional treasuries are, on average, in profit at today’s price.

As of Aug 2025, ETH ≈ $4,500 vs. average buy levels: ETHZilla $3,806 (+18.2%), The Ether Machine $3,736 (+20.4%), BTCS $3,577 (+25.8%), Bitmine $3,396 (+32.5%), SharpLink $3,183 (+41.4%), Bit Digital $2,536 (+77.4%). This supports the thesis of ongoing accumulation and lowers near‑term sell pressure from treasuries.

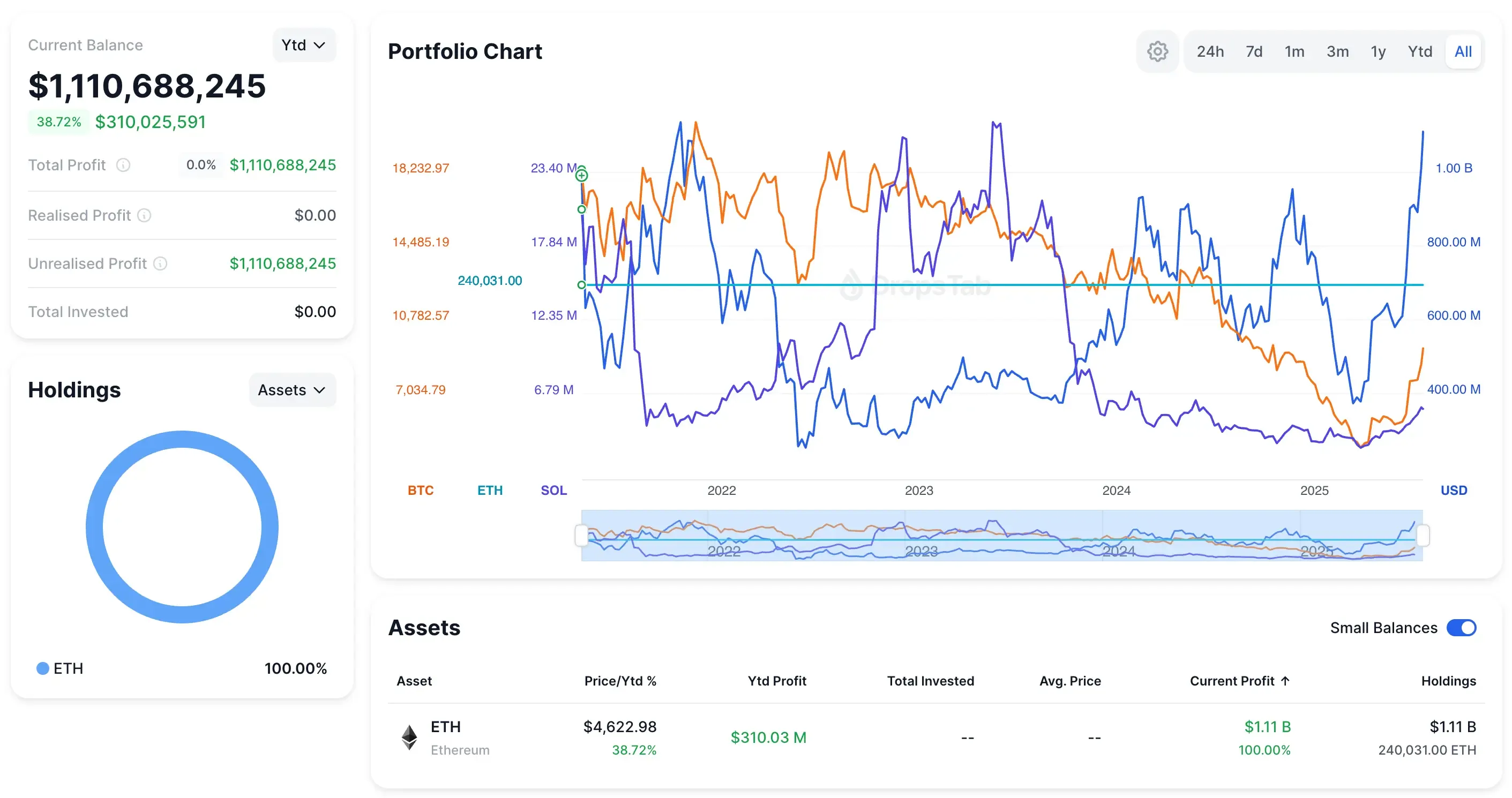

Ethereum’s co-founder Vitalik Buterin also holds over $1B worth of ETH on-chain (about 240,000 ETH), signaling strong personal commitment to the network.

Bull Case

Approval of ETH ETFs, Bitcoin hitting $150K+, major network upgrades, and a DeFi comeback could push ETH to $8,000–$12,000 by late Q4 2025, possibly in a rapid spike — and as some analysts argue in this research, Ethereum may be closer than ever to a $10K breakout, with bold leadership shifts, major upgrades, and the rise of MegaETH positioning it for a decisive move.

Recent ETF inflow data backs this scenario — on August 11, total ETH ETFs saw over $1B in net inflows, with BlackRock alone adding $639M in a single day, according to analyst Dan Gambardello.

Bear Case

A market drop, big DeFi hack or Layer-2 failure, or a large wave of ETH sales could pull prices down to $3,000–$3,500. Strong buying could soften the fall, but major shocks could still cause steep losses.

Security remains a concern—over $3.1B was lost to hacks in early 2025, mostly in DeFi. ETH also tends to rise faster than BTC in good markets and fall harder in downturns. If BTC reaches $150K, ETH might hit $7K–$10K; if BTC stalls, ETH could drop quickly.

Key Risks in 2025

Competition and L2 Shift

Other blockchains like Solana, Avalanche, and Sui compete for users and developers. Ethereum’s own Layer‑2s, like Base and Arbitrum, now handle more transactions than its main chain. This could make L1 feel less important unless it stays the top settlement layer.

Lower Fees, Lower Rewards

Upgrades like EIP‑1559 and Dencun cut L1 fees, which helps users but may reduce validator earnings. With more activity on L2s, low L1 fees could weaken staking incentives and long‑term security.

Security Risks

Hackers stole over $3B in the first half of 2025, including from Ethereum‑based projects. A big DeFi exploit or L2 outage could drop ETH’s price and hurt trust in the ecosystem.

Centralization Issues

Lido holds around 28% of staked ETH, and a few exchanges control many validators. MEV concentration and reliance on big cloud services add risks of censorship or outages.

Regulation

ETH isn’t a security in the U.S., but rules in other countries could limit DeFi use or reclassify some tokens. More ties to traditional finance mean more compliance pressure.

Market Conditions

Economic downturns or less investor interest could lower ETH demand. Failures in major apps like stablecoins or NFTs could also weaken demand. Rapid price spikes risk creating bubbles that may burst quickly — a cycle often fueled by public calls to “buy the dips,” like Eric Trump’s recent post urging investors to load up on BTC and ETH.